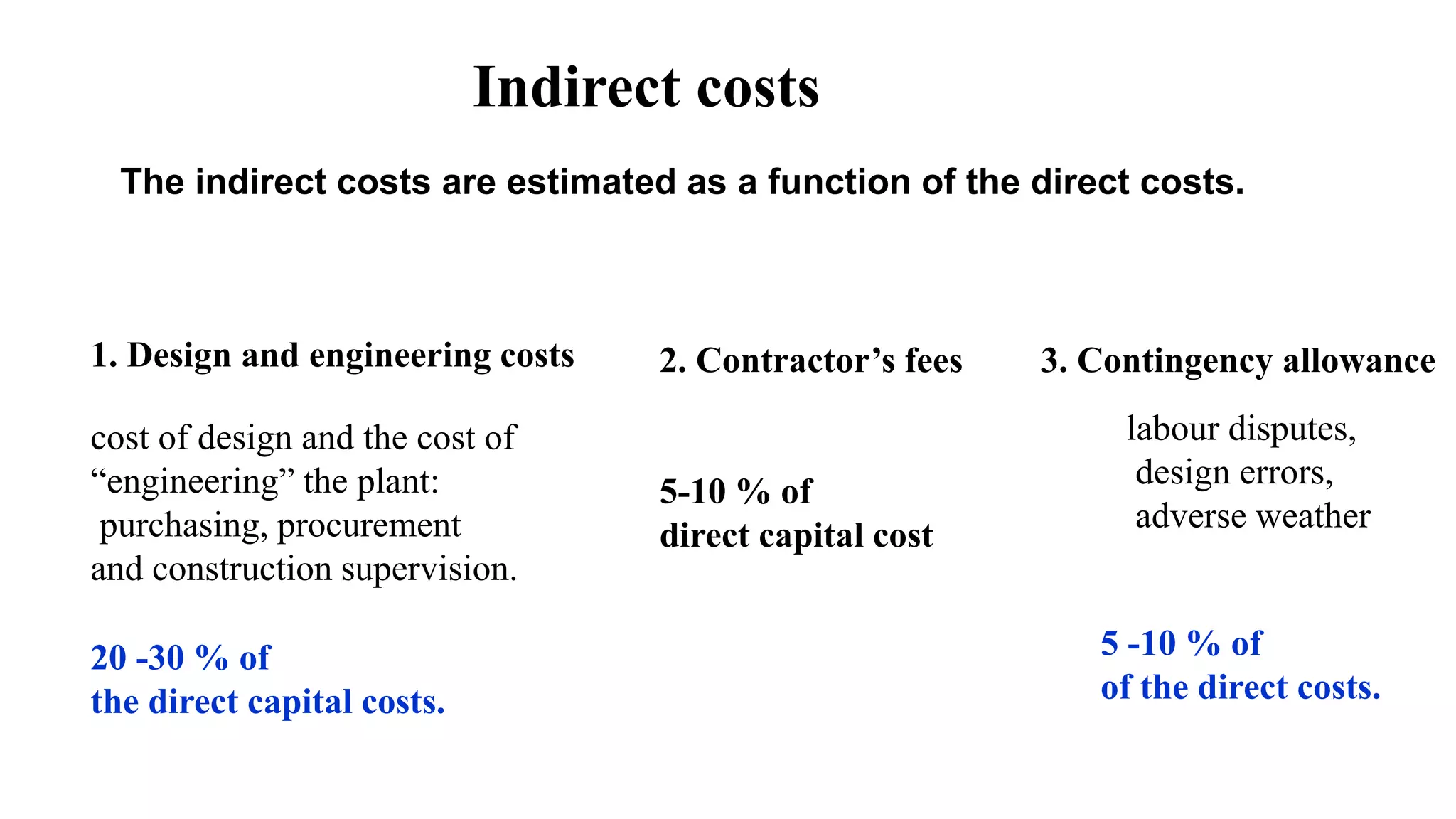

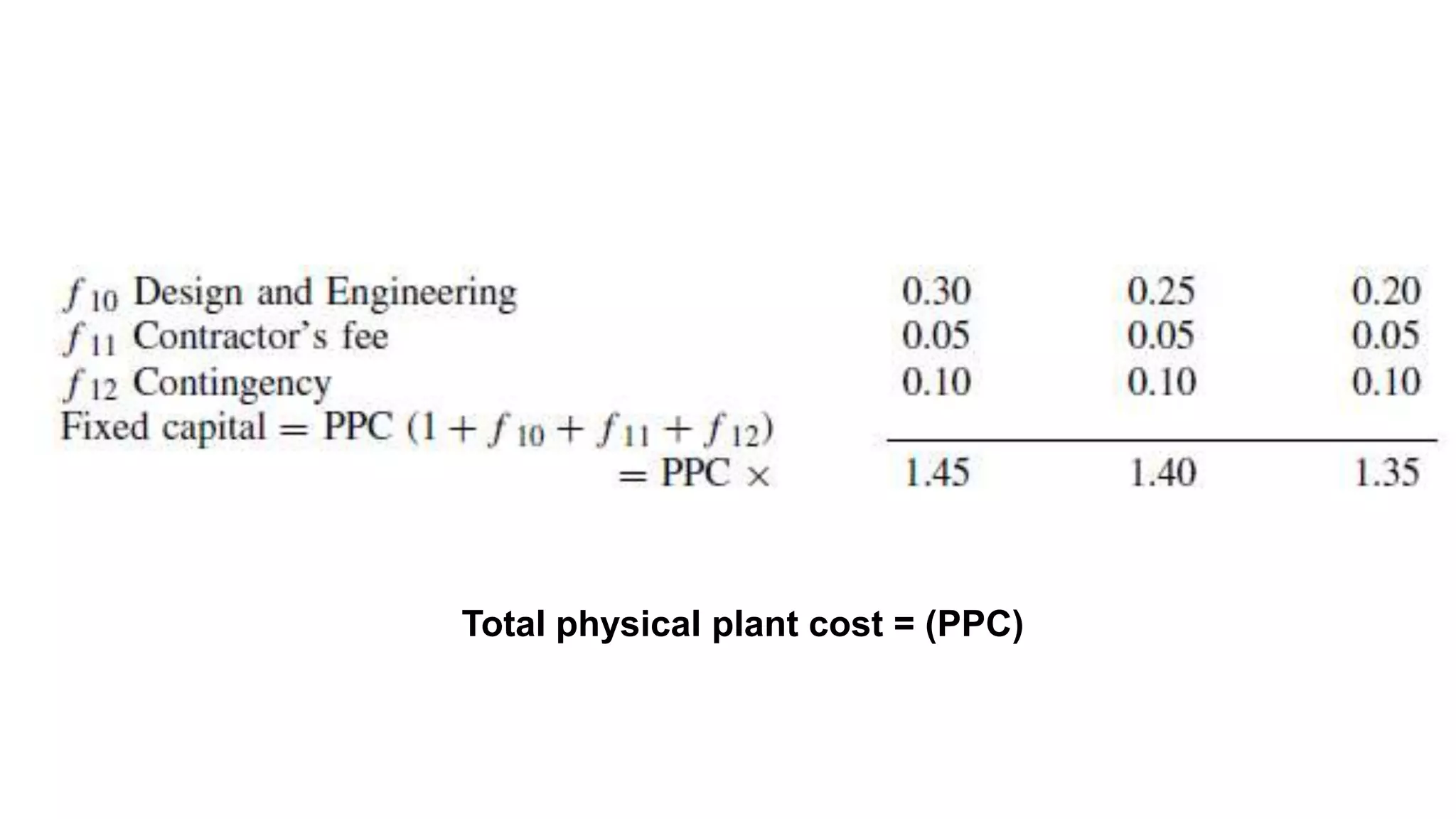

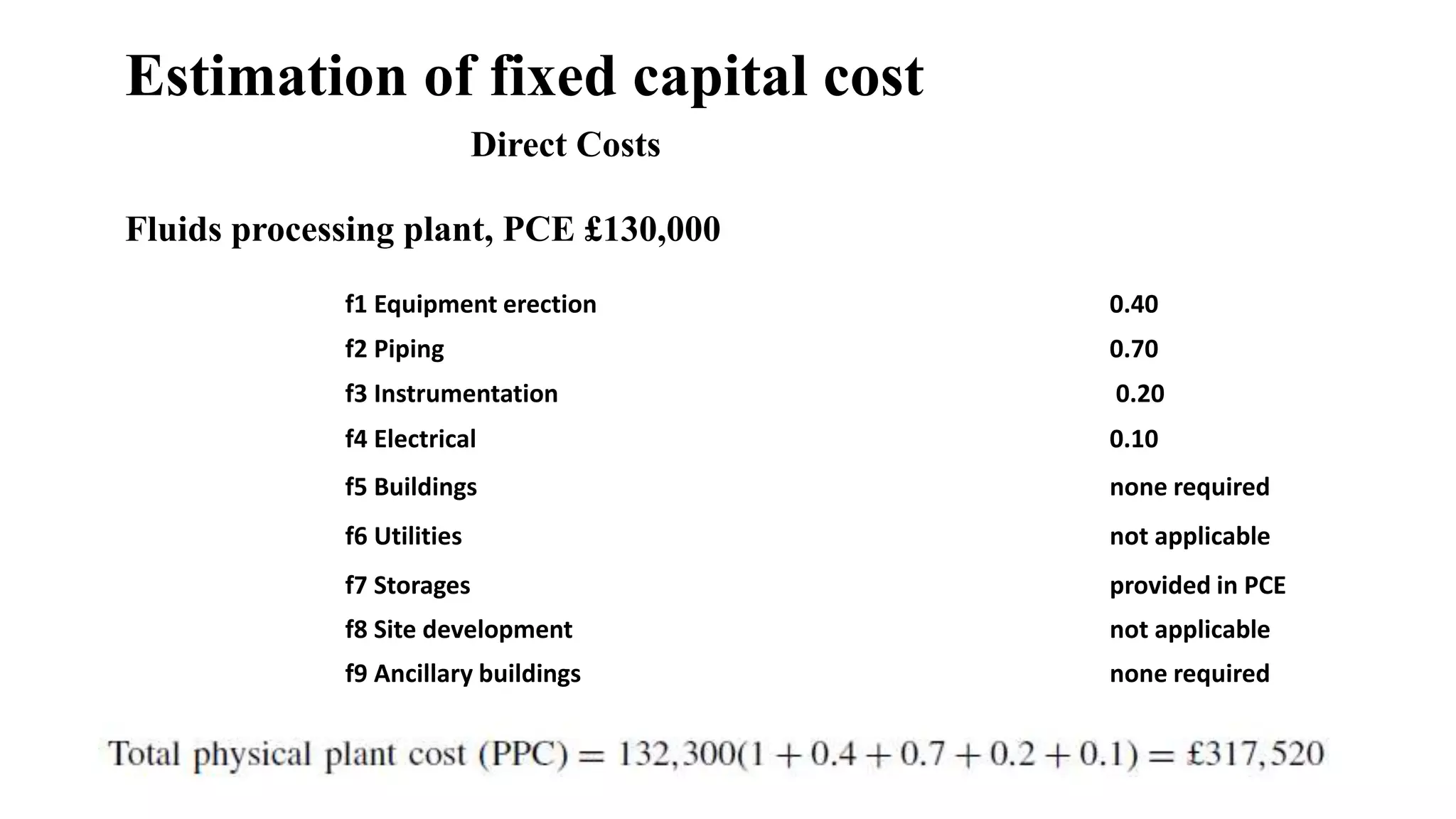

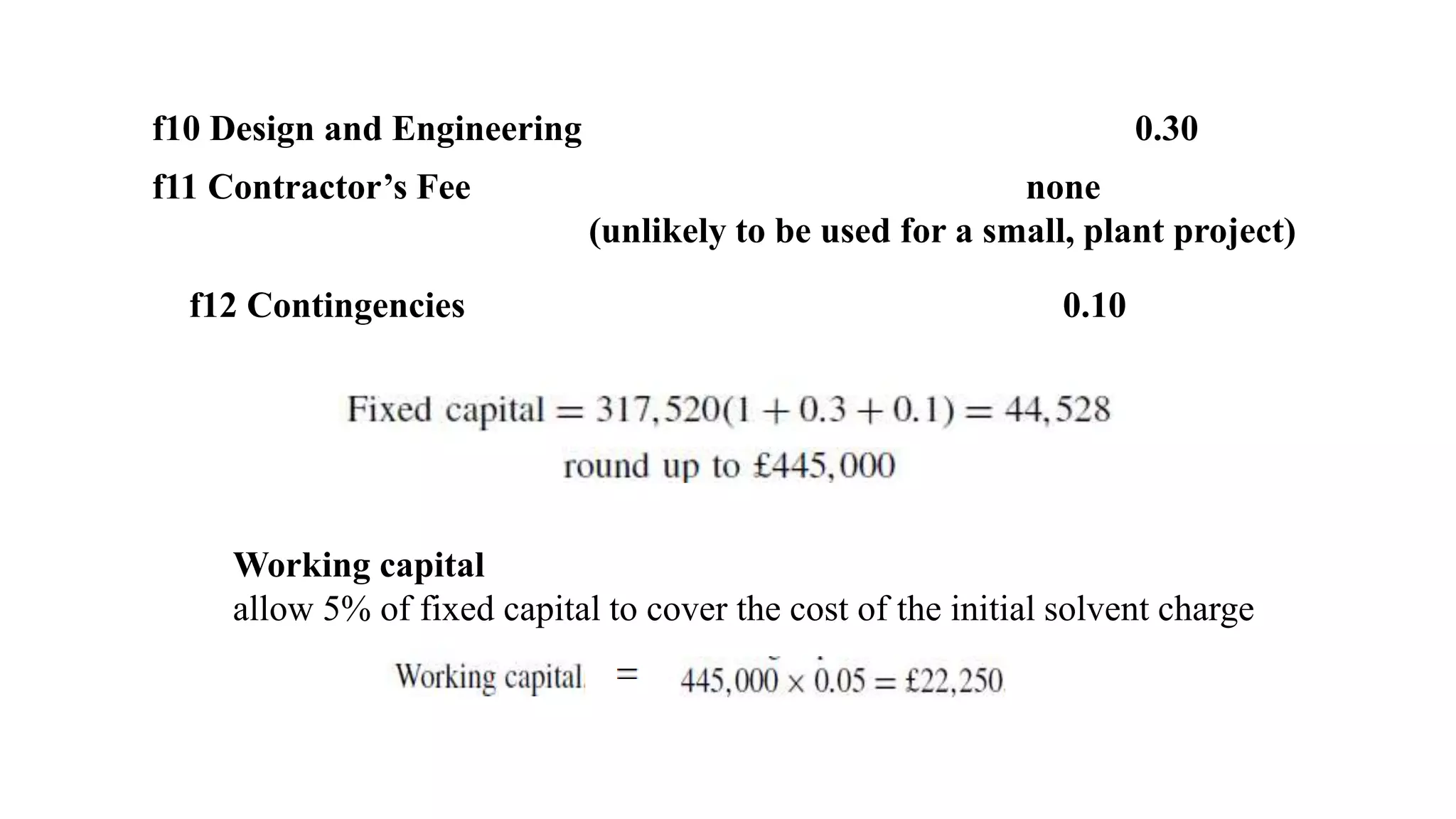

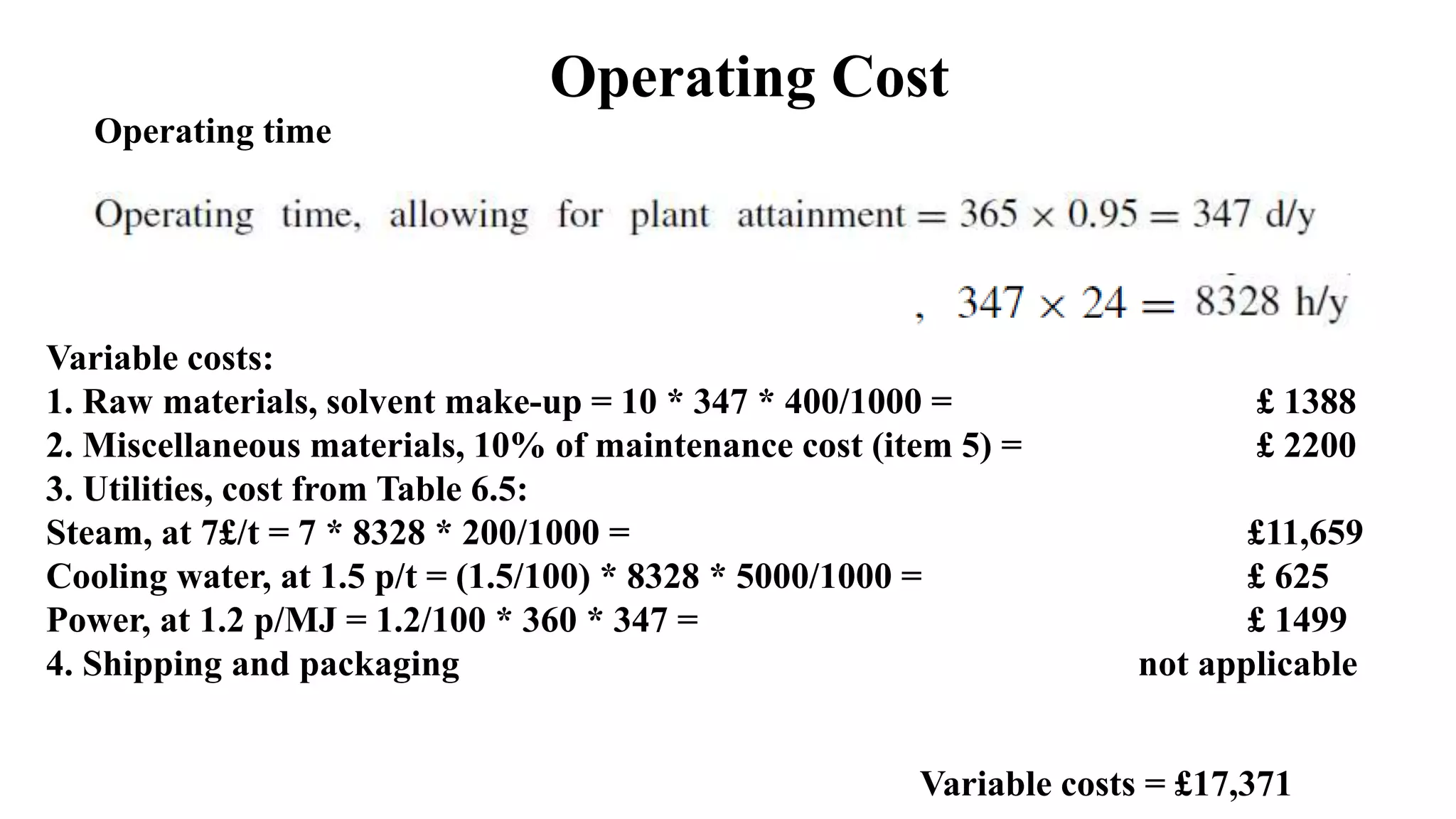

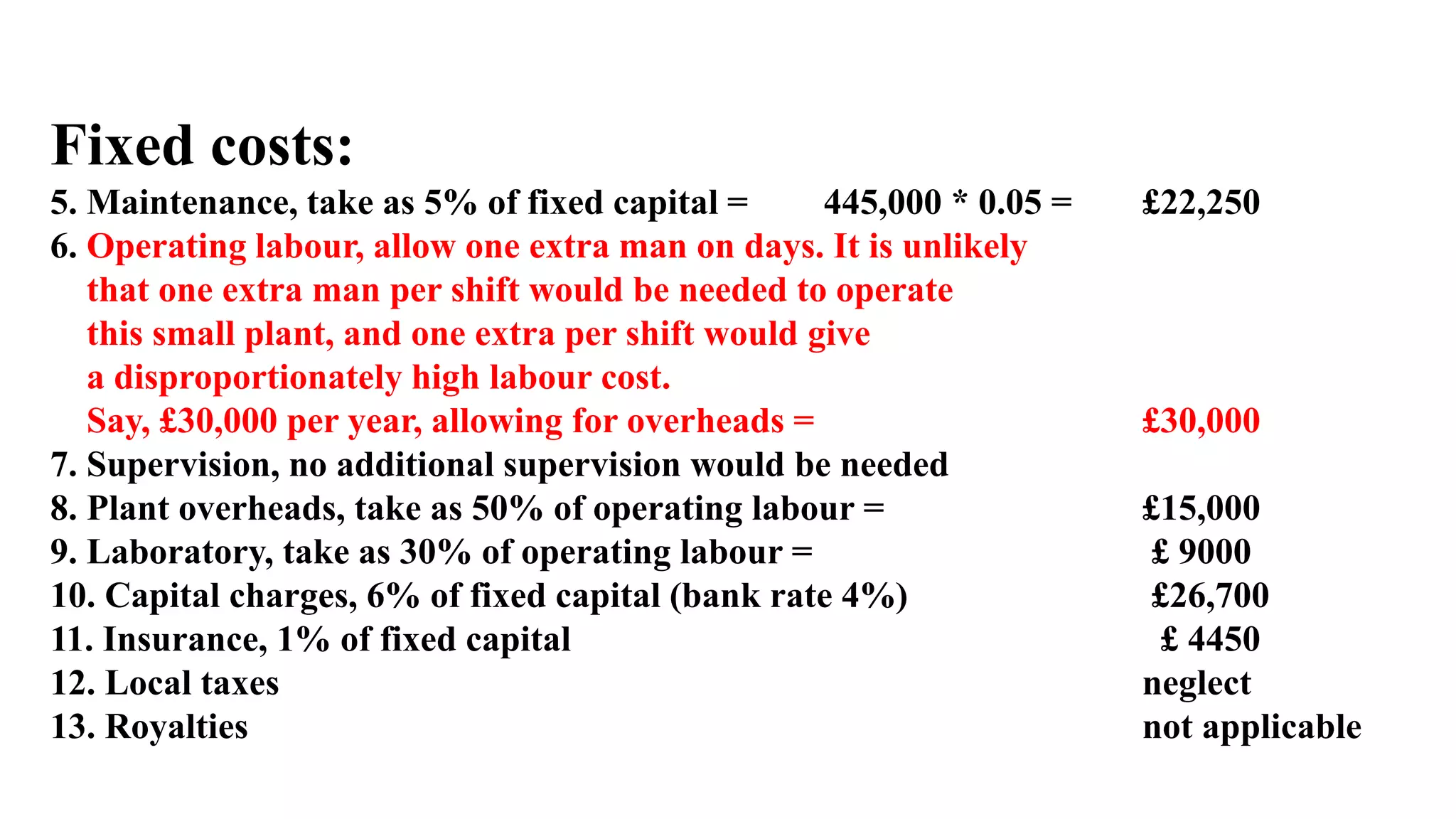

The document outlines the estimation of fixed capital costs for a fluid processing plant, detailing both direct and indirect costs including design, contractor fees, and various contingencies. Operating costs are broken down into variable and fixed costs, resulting in an annual operating cost estimate of £125,000. The calculations and analyses reference established engineering economy textbooks.