More Related Content

Similar to Equity lock products for mortgage lenders

Similar to Equity lock products for mortgage lenders (20)

Equity lock products for mortgage lenders

- 1. © 2013 EquityLock Solutions, Inc. All rights reserved.

EquityLock is a registered trademark of EquityLock Solutions, Inc.

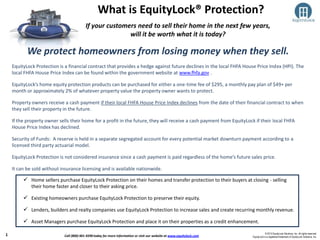

If your customers need to sell their home in the next few years,

will it be worth what it is today?

What is EquityLock® Protection?

Home sellers purchase EquityLock Protection on their homes and transfer protection to their buyers at closing - selling

their home faster and closer to their asking price.

Existing homeowners purchase EquityLock Protection to preserve their equity.

Lenders, builders and realty companies use EquityLock Protection to increase sales and create recurring monthly revenue.

Asset Managers purchase EquityLock Protection and place it on their properties as a credit enhancement.

1

•EquityLock Protection is a financial contract that provides a hedge against future declines in the local FHFA House Price Index (HPI). The

local FHFA House Price Index can be found within the government website at www.fhfa.gov .

•EquityLock’s home equity protection products can be purchased for either a one-time fee of $295, a monthly pay plan of $49+ per

month or approximately 2% of whatever property value the property owner wants to protect.

•Property owners receive a cash payment if their local FHFA House Price Index declines from the date of their financial contract to when

they sell their property in the future.

•If the property owner sells their home for a profit in the future, they will receive a cash payment from EquityLock if their local FHFA

House Price Index has declined.

•Security of Funds: A reserve is held in a separate segregated account for every potential market downturn payment according to a

licensed third party actuarial model.

•EquityLock Protection is not considered insurance since a cash payment is paid regardless of the home’s future sales price.

•It can be sold without insurance licensing and is available nationwide.

We protect homeowners from losing money when they sell.

Call (800) 401-9290 today for more information or visit our website at www.equitylock.com

- 2. TO

INCREASE

SALES

FOR

MONTHLY

REVENUE

TO

UPGRADE

Feature Description

EquityLock

FIRST

EquityLock

PROTECTOR

Home Price

Protection®

Protected Value

Amount

Fixed for FIRST and PROTECTOR. Consumer decides the property value

amount for their Home Price Protection® contract such as property value,

purchase price, mortgage amount, down payment, existing equity, etc.

$100,000 $50,000

Determined by

Consumer

Coverage Period Measured from the initial date of any EquityLock Protection contract. 5 Years

As long as monthly

payments are made

15 Years

Waiting Period No claims are eligible for payment within the first 24 months of the contract.

Market Downturn

Payment Terms

Property sales require an “arm’s-length” transaction to an unrelated party.

If a future short sale occurs, the lender always gets paid first.

Maximum Downturn

Payment

(Claim Amount)

The maximum downturn payment is capped at a percentage of the original

property protected value amount. NOTE: With EquityLock FIRST, the first 5%

of any FHFA House Price Index decline is not eligible for payment.

$10,000

(10% of $100,000)

$10,000

(20% of $50,000)

20% of

Protected

Value Amount

Property Types

Primary residences, second homes, non-owner occupied and multi-family up

to 49 units.

Single Family

Only

Pricing Factors

Home Price Protection® pricing depends on property location, homeowner

mobility, property type, occupancy (rent, lease to own, owner occupied), etc.

Portfolio pricing for Asset Managers & Mortgage Servicers is fixed at 1.90%.

Fixed Fixed Variable

Limitations

Protected properties that result in a future foreclosures are ineligible for

claim payments. Future short sales require lender disclosure and approval.

Pricing Terms

EquityLock PROTECTOR monthly retail price is determined by retailer.

Maximum price is $79.95 per month (see www.equitylock.com).

Home Price Protection® pricing for consumers vary from 1.75% to 3.00% of

their desired Protected Value Amount and is based on the Pricing Factors

listed above. Financing is available for up to 60 months.

Home Price Protection® pricing for institutions is fixed at 1.90%.

$295

for 5 years of

Home Value

Protection

Wholesale cost is

$41 per month.

Includes warranty

coverage for 6

existing home

appliances.

Retailer receives

markup amount

each month.

1.75% to 3.0%

Additional Information

Private labeling is available at no additional charge.

Sample contract and pricing plans are available upon request.

EquityLock Protection Product Summary

2 © 2013 EquityLock Solutions, Inc. All rights reserved.

EquityLock is a registered trademark of EquityLock Solutions, Inc.Call (800) 401-9290 today for more information or visit our website at www.equitylock.com

- 3. HPI = 181.9

Index decline

at time of sale

Market Downturn

Payment is

calculated based

on percentage

decline in HPI

from the time

contract was put

into place

regardless of

sales price

How EquityLock® FIRST Works

$100,000 of the Homeowner’s Property’s Value is Protected

with FHFA House Price Index (HPI)

as reported at www.fhfa.gov

Protected Value Amount

is Fixed at $100,000

HPI = 214

at the time contract is

put into place

Year 1 Year 2 Year 3 Year 6

24 month waiting period

Property

Sells in

Year 4

Year 5Year 4

EquityLock FIRST

Expires in Year 5

HPI = 226

Index Increased

No Market

Downturn

Payment

HPI = 214

No Index Change

No Market

Downturn

Payment

In the example above where there was a HPI decline, the local House Price Index values dropped 15% when

the home is sold in Year 4. (214 – 181.9) 214 = 15%.

This results in $10,000 PAID to the homeowner.

With EquityLock FIRST, the first 5% of Index decrease is not eligible for any market downturn payment and the

maximum payout cannot exceed 10%.

Market Downturn Payments are calculated by:

Multiplying the initial Protected Value Amount $100,000

By the Percentage Decrease in the HPI Index less 5% (15% decline - first 5% decline = 10%) x 10%

$10,000

3 © 2013 EquityLock Solutions, Inc. All rights reserved.

EquityLock is a registered trademark of EquityLock Solutions, Inc.Call (800) 401-9290 today for more information or visit our website at www.equitylock.com

- 4. • Coverage Period: 5 Years

• Waiting Period to File for Market Downturn Payment: 24 months (first 2 years)

• Eligible Properties: Primary residences, second homes, non-owner occupied

and multi-family up to 49 units

For only $295 for each closed loan, you will give your

customers $100,000 of home equity protection, increase your

loan volume and dominate your local marketplace.

House Price Index Decline in

Years 3 through 5

Maximum Payout When Property is Sold

(10% Maximum)

0.01% to 5.00% The first 5% index decrease is not eligible for any payment

5.01% to 15.0%

Example 1: Index drops 6.2%, payout would be 6.2% - 5.0% = 1.2%

Example 2: Index drops 12.3%, payout would be 12.3% - 5.0% = 7.3%

Example 3: Index drops 15.0%, payout would be 15.0% - 5.0% = 10.0%

15.01% and above Capped at 10%

Protected

Value Amount

Maximum Payout

(10%) in years 3 – 5

When Property is Sold

Protected Amount

for 5 Years =

Your Cost for FIRST

$100,000 $10,000 $295

Leading Question for Loan Rate Shoppers:

Are any of the other lenders you’re

considering offering to protect $100,000

of your home’s value?

We do.

Give Your Customers EquityLock FIRST and

Convert More Leads to Closed Loans

Increase Your Lead Conversions

and Purchase Business Today

Increases Your Fee

Revenue & Earnings

Differentiates You

From Other Lenders

Easy To Implement

Protects Your

Residential Portfolio

and REOs

In the future, EquityLock will contact FIRST customers to see if they wish

to purchase additional protection coverage and upgrade to Home Price

Protection®.If this occurs, you may be eligible to receive referral fees to

help offset your $295 FIRST marketing expense.

4 © 2013 EquityLock Solutions, Inc. All rights reserved.

EquityLock is a registered trademark of EquityLock Solutions, Inc.Call (800) 401-9290 today for more information or visit our website at www.equitylock.com

- 5. Process For EquityLock FIRST + Upgrading

New Mortgage

Application with

EquityLock FIRST

Included

Once property is identified,

EquityLock submits invoice to

provider for FIRST product,

payable 10 days after

escrow/closing

Escrow / Closing Occurs

If customers desire additional coverage after

escrow/closing, a second contract with

Home Price Protection® is provided

Homeowner receives

EquityLock FIRST Certificate of

Protection™ with NO

additional out-of-pocket cost.

EquityLock receives

payment within 10

days of closing

EquityLock

calls customer and goes

over all FIRST details

EquityLock sends FIRST

Certificate of Protection

directly to customer

© 2013 EquityLock Solutions, Inc. All rights reserved.

EquityLock is a registered trademark of EquityLock Solutions, Inc.

Home Price Protection®

UPGRADE OPTION

for FIRST

Lenders, Real Estate Agents,

Home Builders and Title/Escrow

Companies Purchase FIRST

TO INCREASE SALES

5 Call (800) 401-9290 today for more information or visit our website at www.equitylock.com

- 6. • Coverage Period: Month-to-month as payments are received

• Waiting Period to File for Market Downturn Payment: 24 months

• Maximum Payout When Property Is Sold: Up to $10,000

• Eligible Properties: Single Family Residences Only (Owner-Occupied & Investor)

Includes EquityLock Home Appliance Extended Warranty

• Will repair or replace a customer’s existing range/oven/cooktop,

dishwasher, built-in microwave, kitchen refrigeration, clothes washer

and clothes dryer

• Provides up to $1,500 each year for each appliance

• Coverage begins 30 days from first payment

• $50 deductible applies for each service call

Protected

Value

Amount

Maximum

Payout

Fixed Monthly

Wholesale Cost

Assumed

Retail Price*

Monthly

Amount Paid to

Retailer

$50,000 $10,000 $41 $49.95 $8.95

Offer EquityLock® PROTECTOR to all

employees and customers via email,

flyers, social media and statement

inserts. Retailer receives the retail

markup difference each month.

How Big Is Your Database?

Possible Recurring Revenue With

EquityLock PROTECTOR

Retailer

Database of

Customers

Response

Rate

Paying

Customers in

First Month

First Month

Revenue at

$8.95

Total

12 Month

Revenue**

5 Year Total

Revenue**

10,000 1% 100 $895 $56,002 $445,174

25,000 1% 250 $2,238 $140,003 $1,112,935

50,000 1.5% 750 $6,713 $420,008 $3,338,805

75,000 1.5% 1,125 $10,069 $630,011 $5,008,207

100,000 2.0% 2,000 $17,900 $1,120,020 $8,903,479

*Maximum Retail Price is $79.95 (see www.equitylock.com)

**Includes Persistency Assumptions

Up To

$9,000

Each

Year

Receive Recurring Monthly Revenue with EquityLock® PROTECTOR

Retailer determines

monthly retail markup

price

EquityLock processes and

collects monthly payments

for Retailer

Retailer offers PROTECTOR

to their entire

homeowner database

Retailer offers PROTECTOR

to employees in their

benefits package

6 © 2013 EquityLock Solutions, Inc. All rights reserved.

EquityLock is a registered trademark of EquityLock Solutions, Inc.Call (800) 401-9290 today for more information or visit our website at www.equitylock.com

- 7. EquityLock FIRST to increase sales

1. Purchase EquityLock FIRST for all your new mortgage applications. EquityLock will provide FIRST to your customers after closing.

2. Schedule time for EquityLock to train your origination and support staff.

3. Allow EquityLock to help create marketing materials, flyers, handouts, press releases, radio, social media, etc. to win more

customers and protect their home values.

4. Schedule FIRST meetings with real estate agents, builders, financial planners, referral partners, community leaders, local media, etc.

EquityLock PROTECTOR for monthly revenue from your database of existing homeowners

1. Sign our Standard Distributor Agreement to receive retail markup proceeds and referral fees.

2. Determine your retail monthly price for PROTECTOR (i.e., $49.95, $54.97, etc.) and create a Promotional Code for online purchases.

3. Determine if you want to provide an introductory offer to your existing homeowners, such as $19.95 for the first 3 months.

4. Schedule time for EquityLock to provide PROTECTOR orientation to your staff.

5. Allow EquityLock to help create marketing materials, flyers, handouts, press releases, inserts, social media, etc.

6. Marketing to your existing homeowner database via email is less expensive and produces higher response rates. Direct mail and

mortgage/bank statement insert templates are also available.

7. Distribute the PROTECTOR monthly offer. EquityLock handles all customer support, monthly payment processing and product

fulfillment with no added burden on your existing staff or cost.

8. Begin receiving monthly checks from EquityLock.

Your Next Steps with FIRST and PROTECTOR Plans

© 2013 EquityLock Solutions, Inc. All rights reserved.

EquityLock is a registered trademark of EquityLock Solutions, Inc.

You Receive All Income Collected Above Our $41 Wholesale Price for PROTECTOR

7 Call (800) 401-9290 today for more information or visit our website at www.equitylock.com