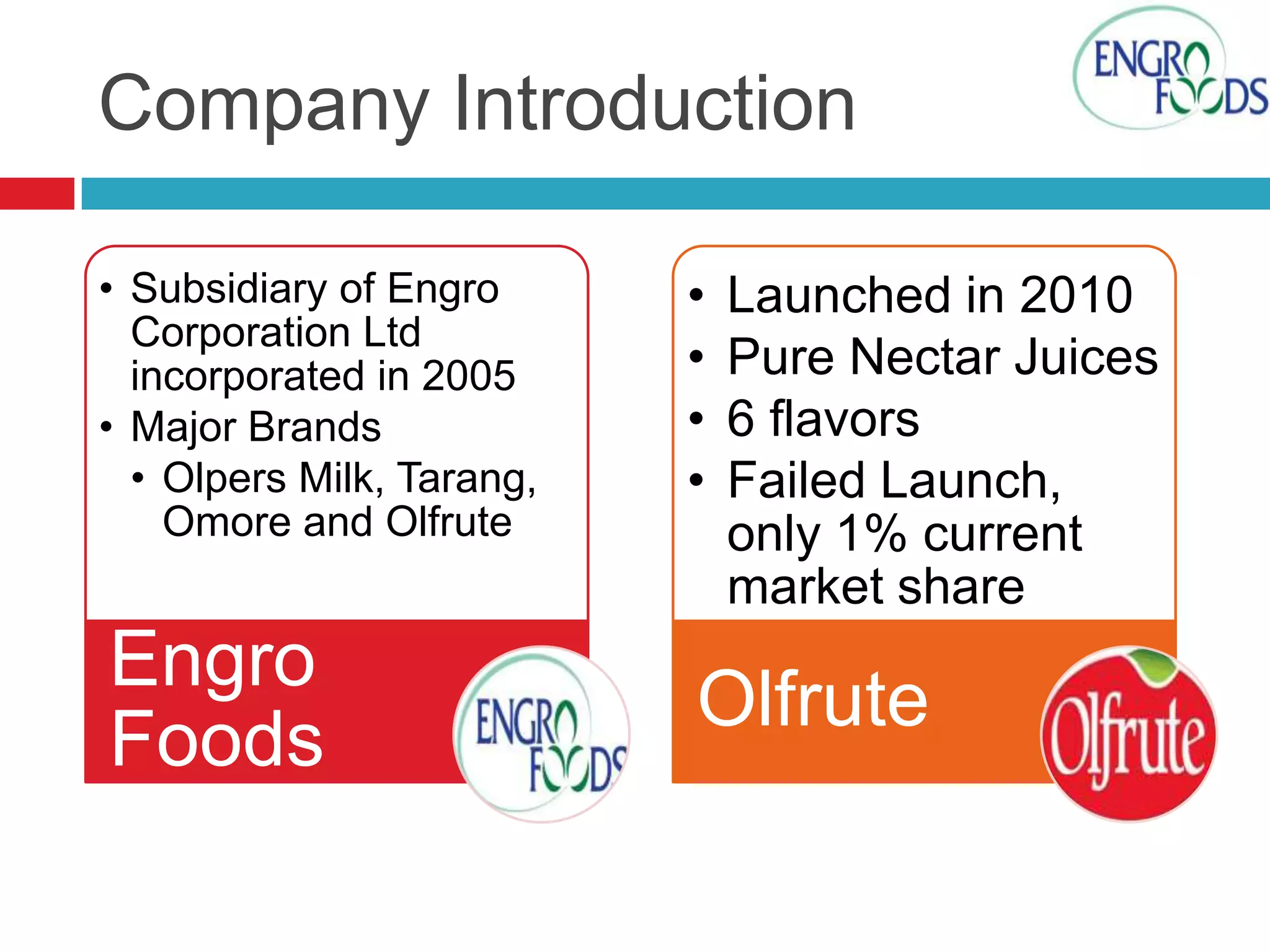

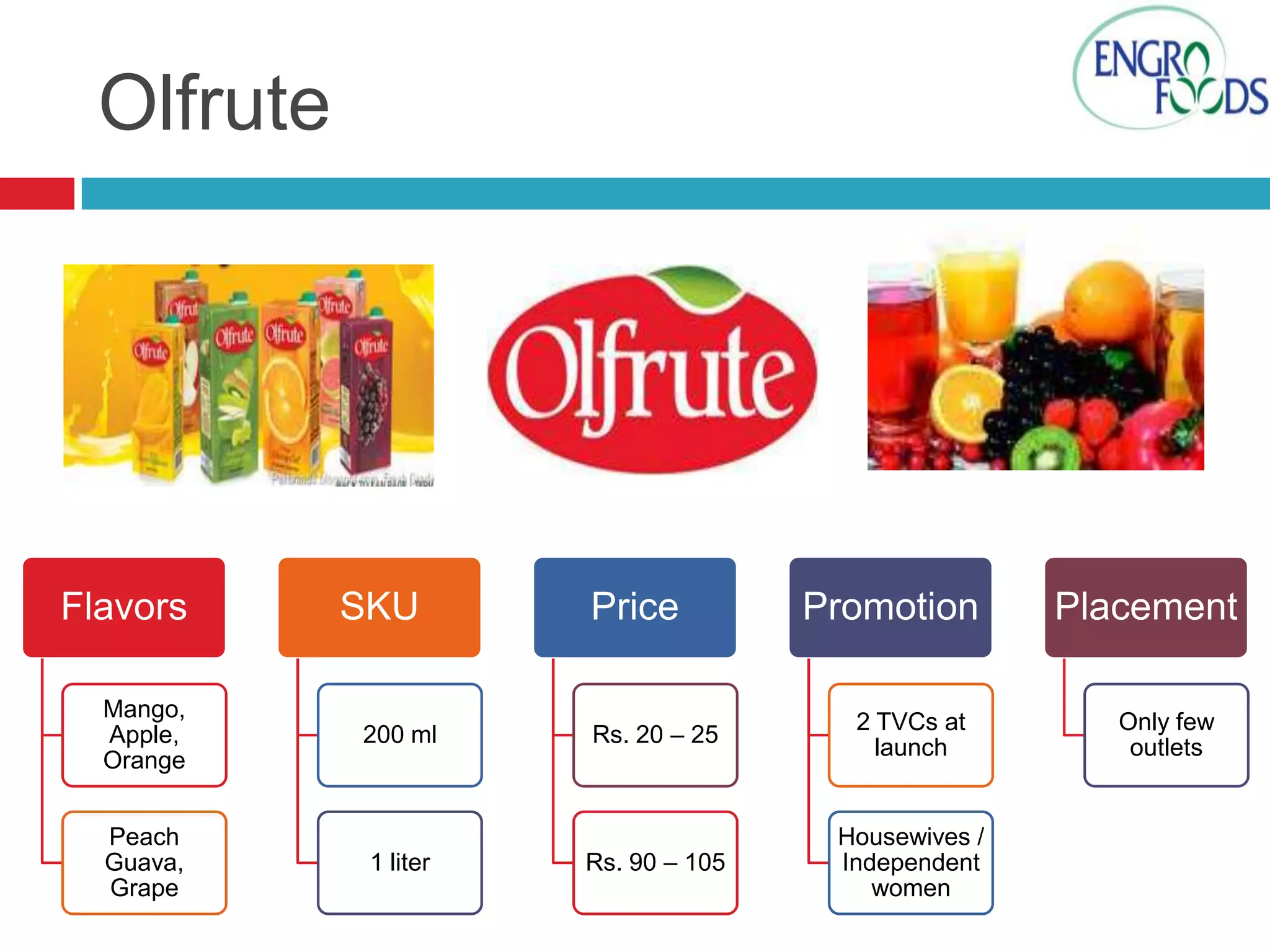

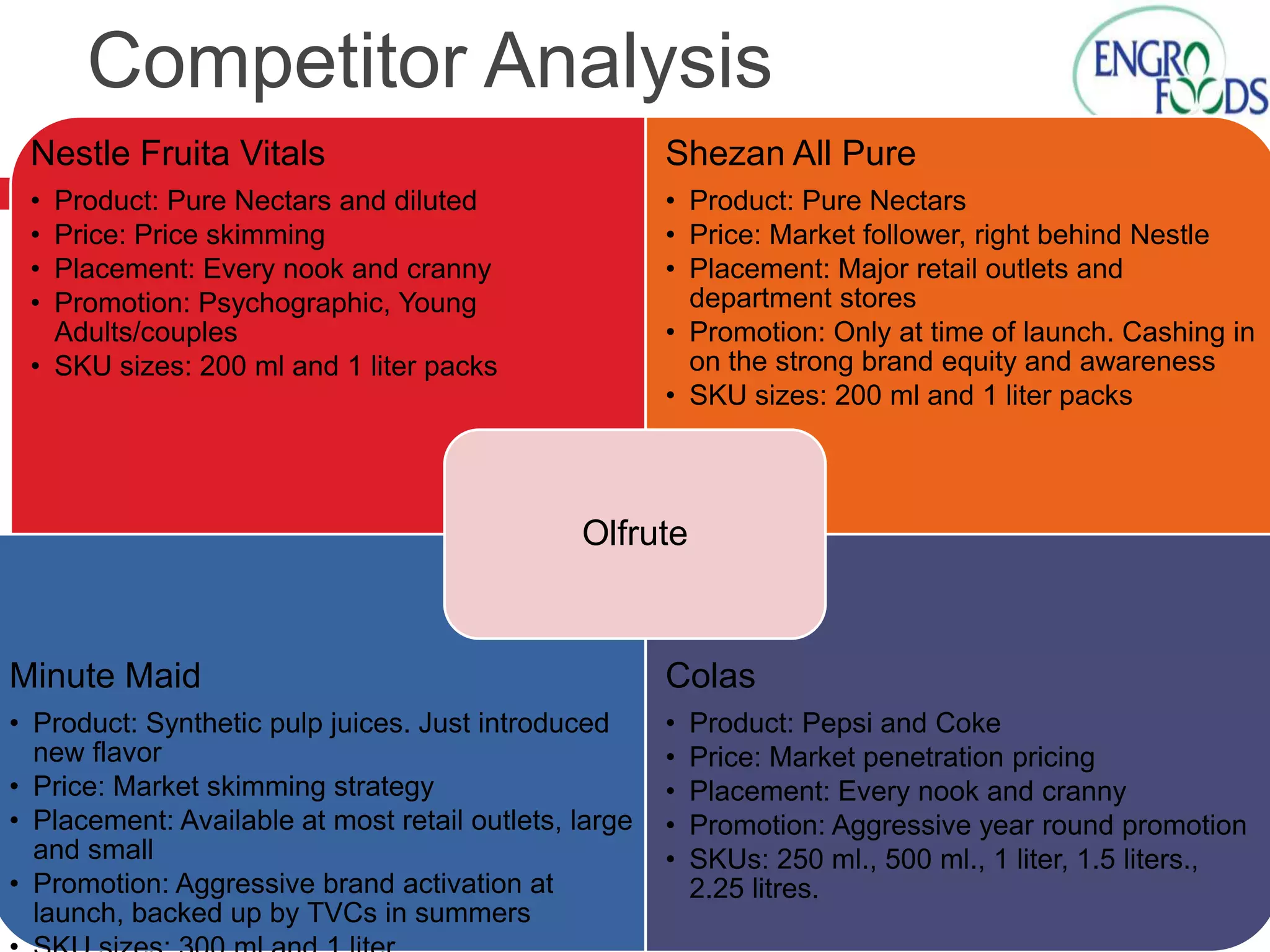

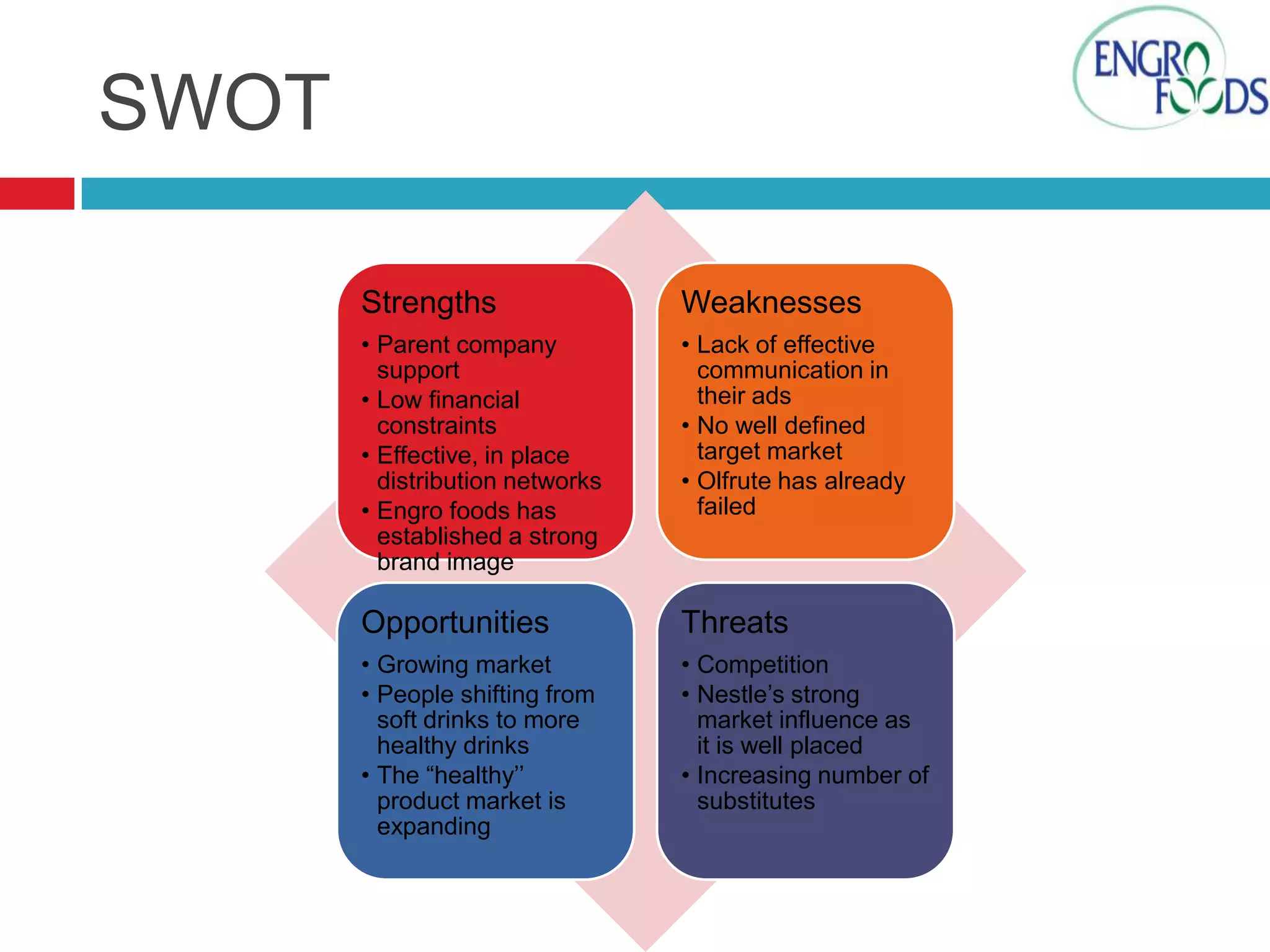

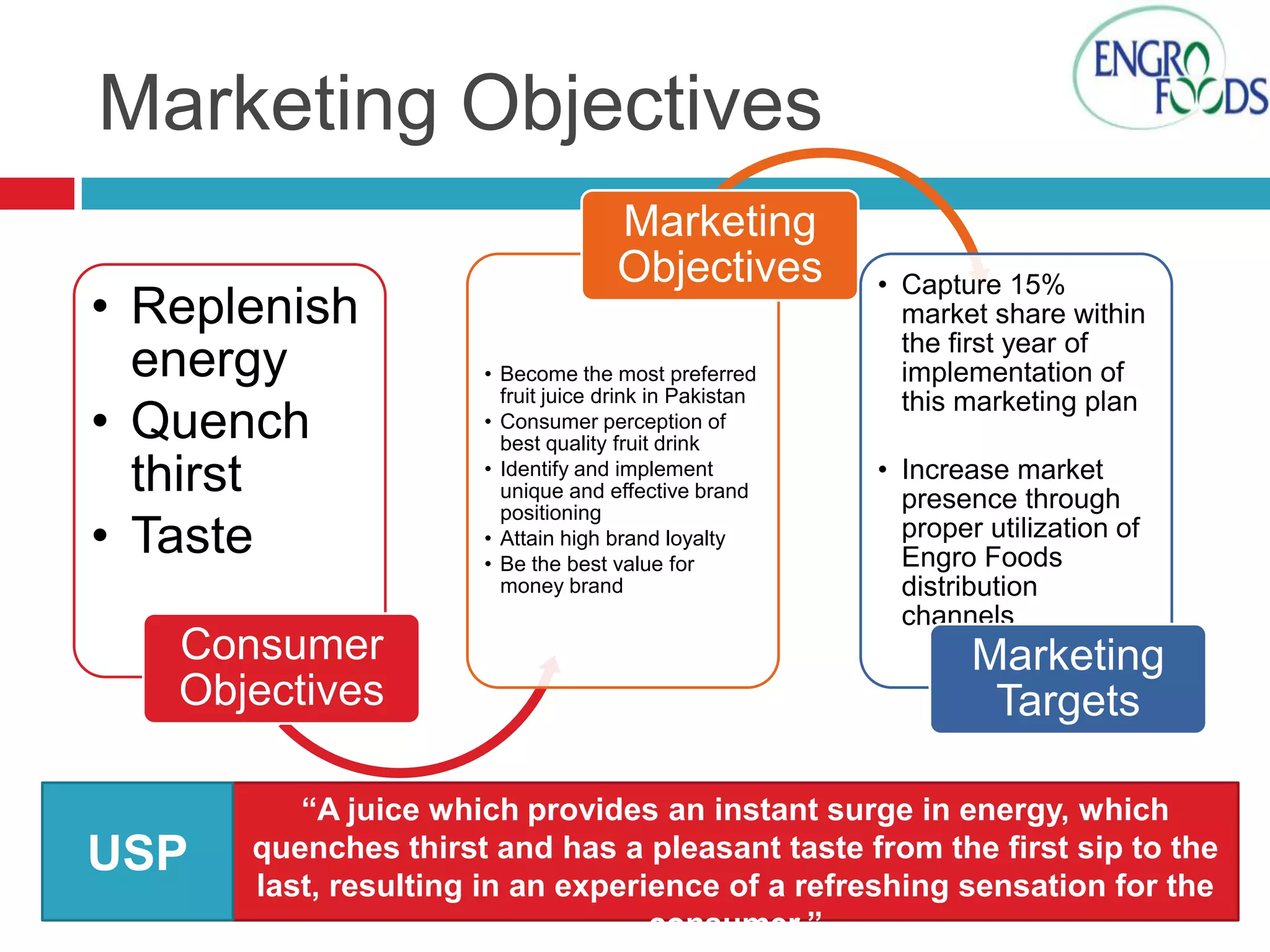

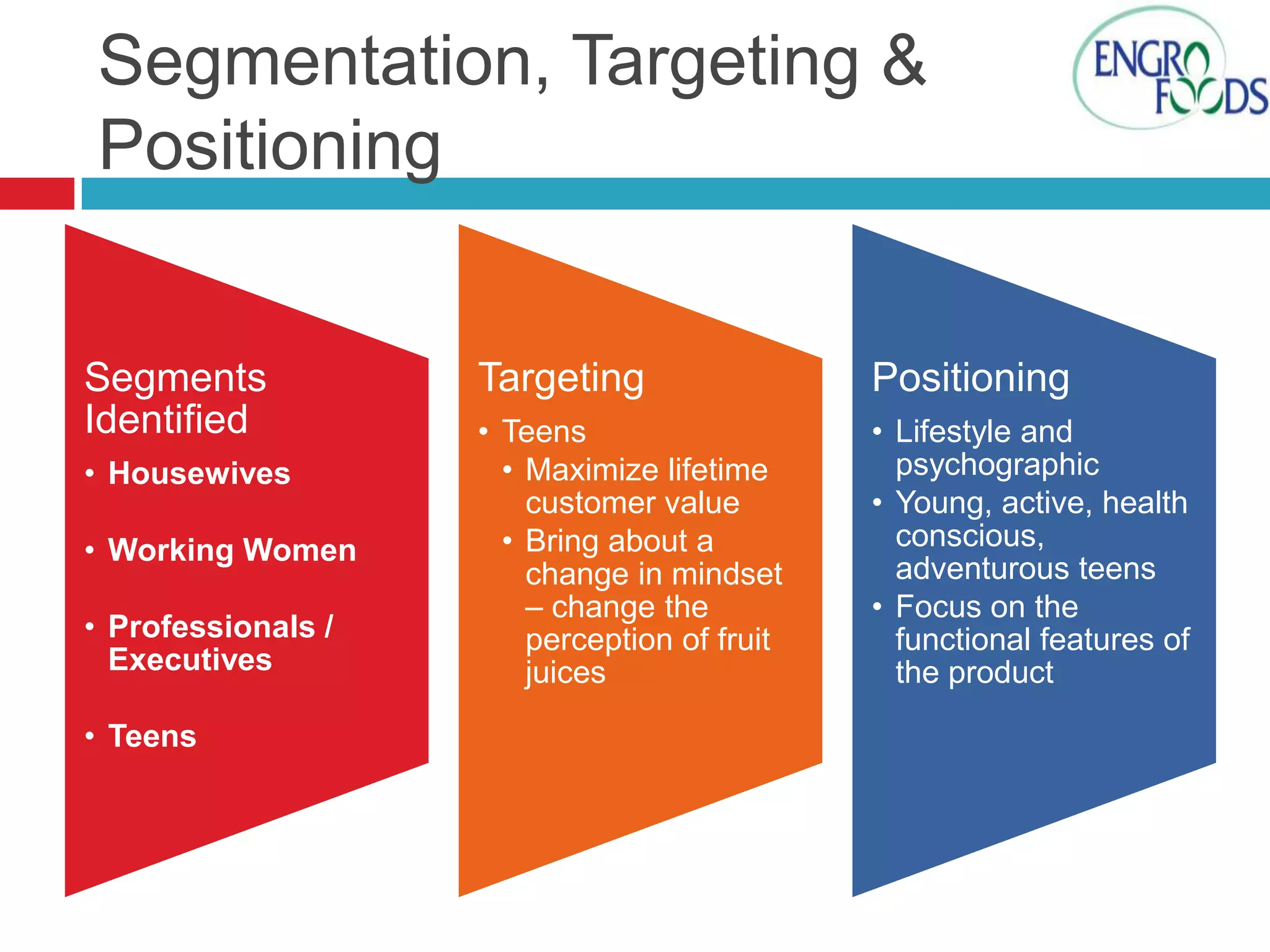

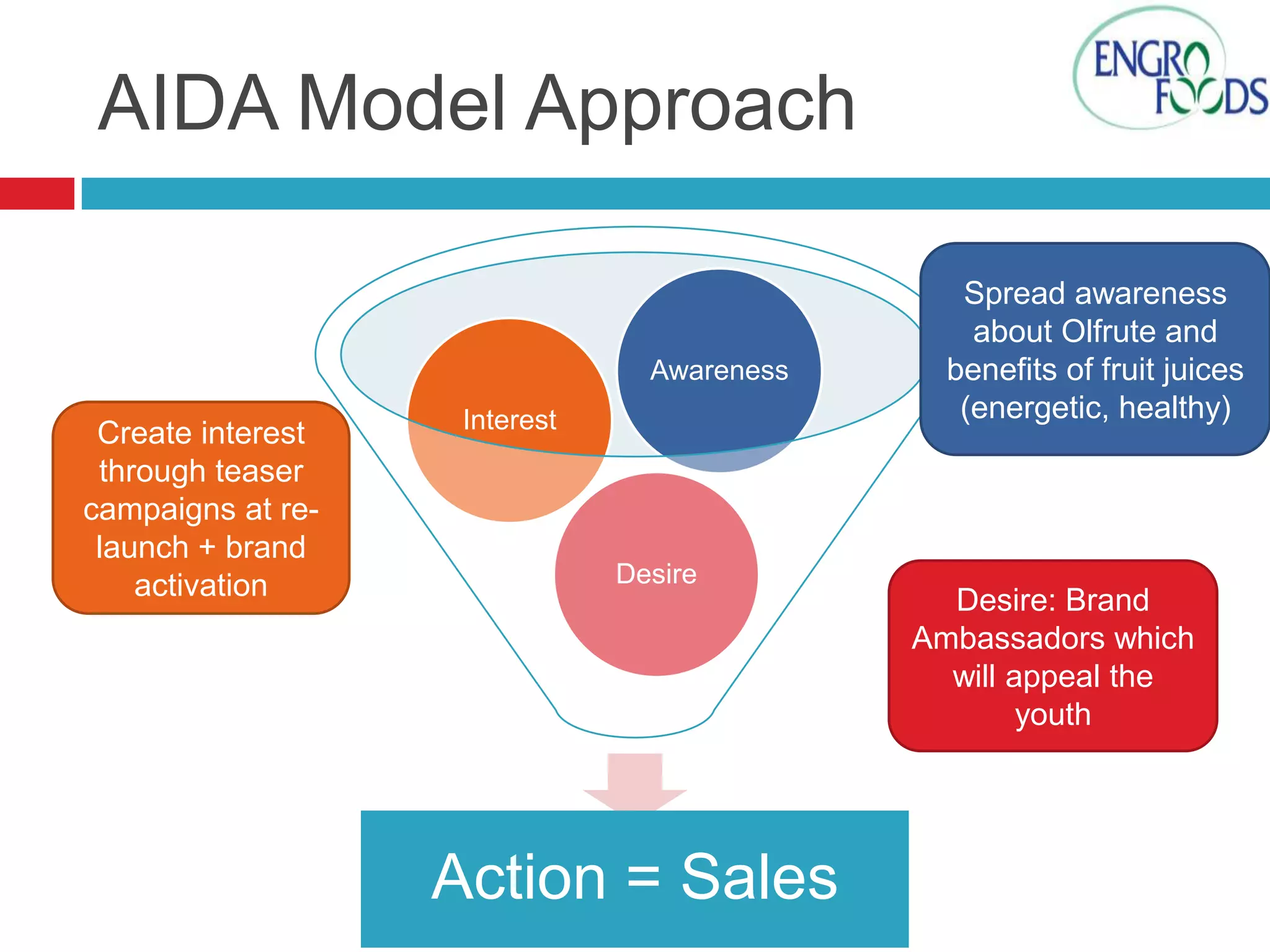

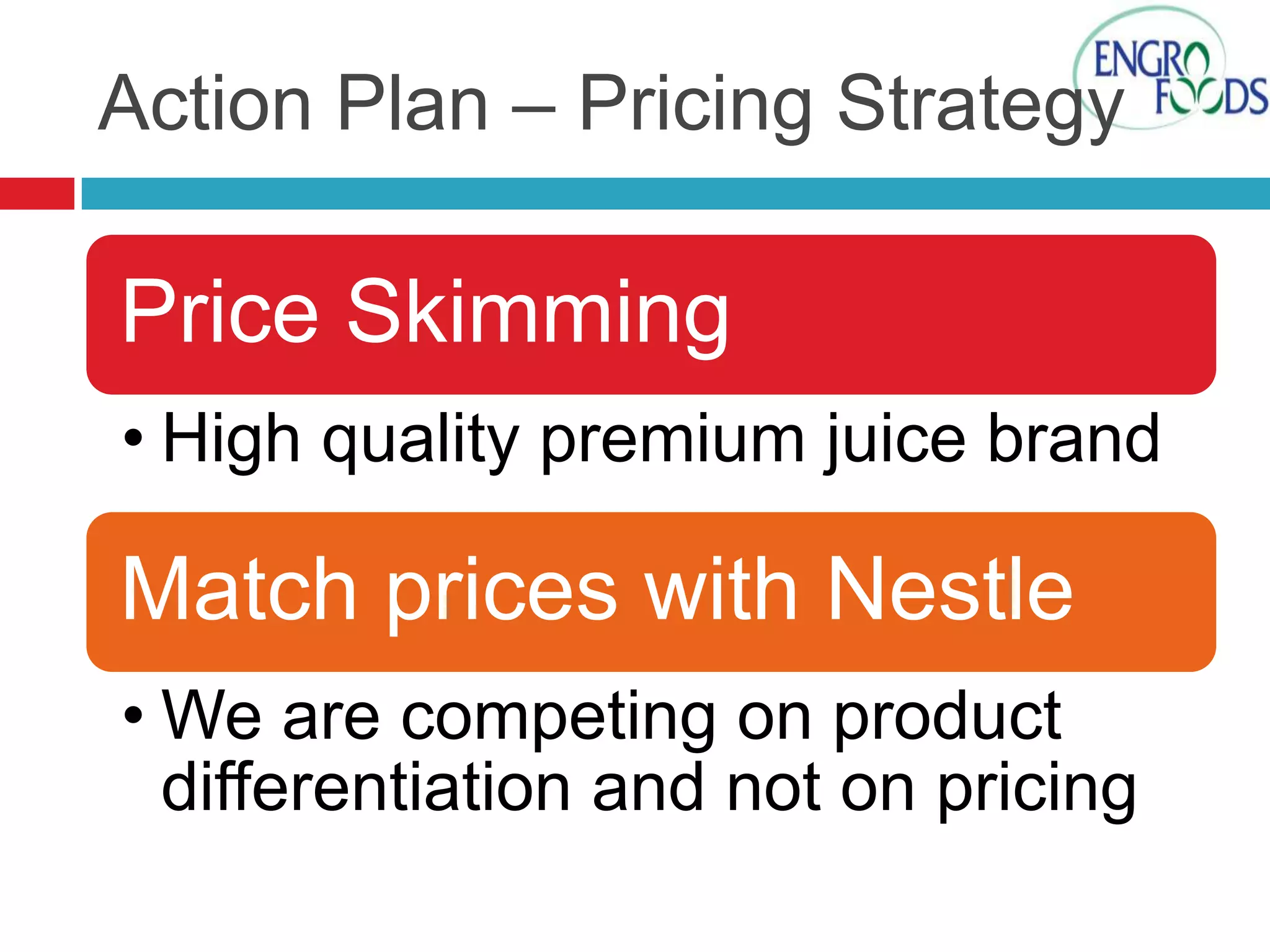

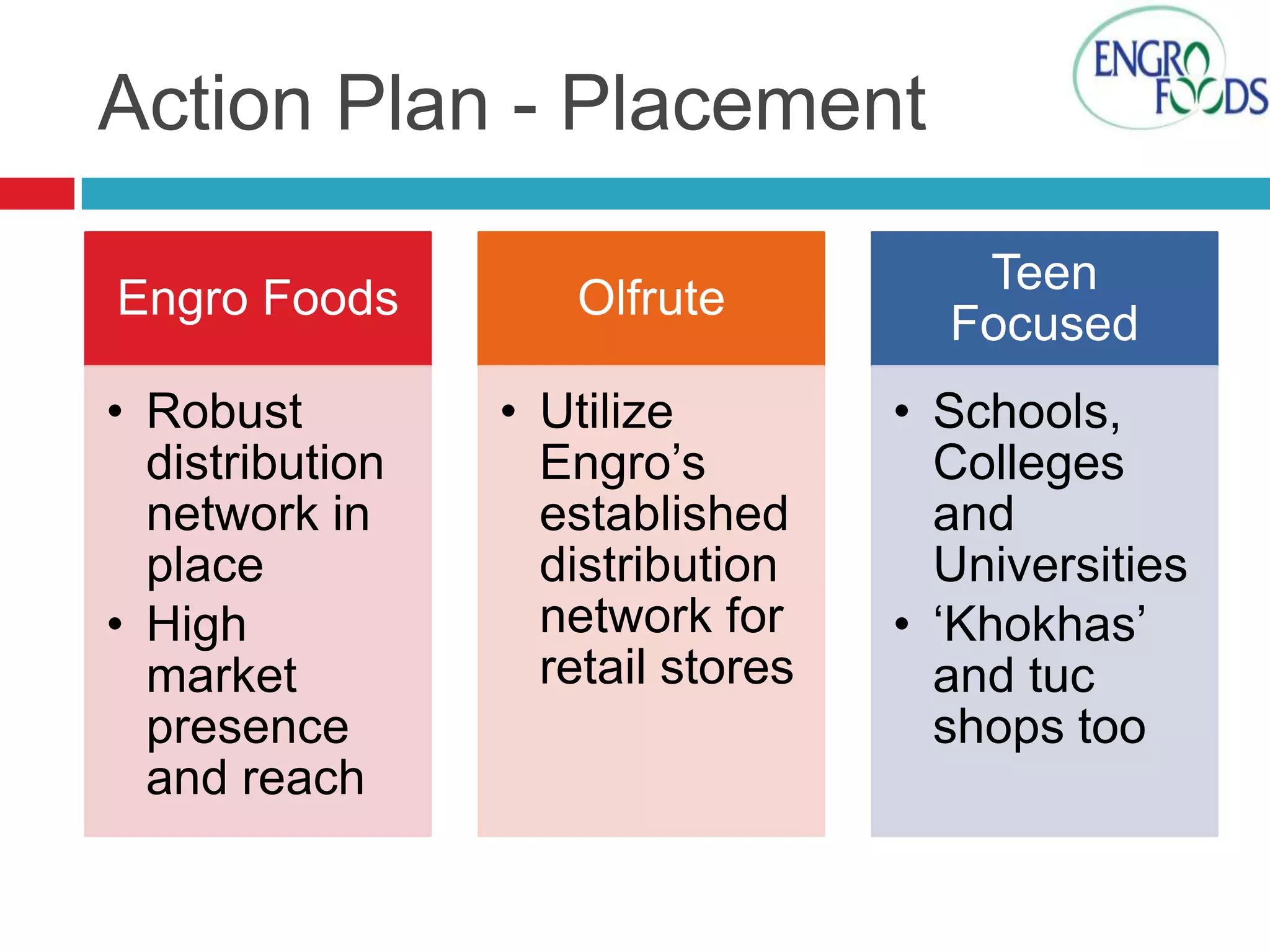

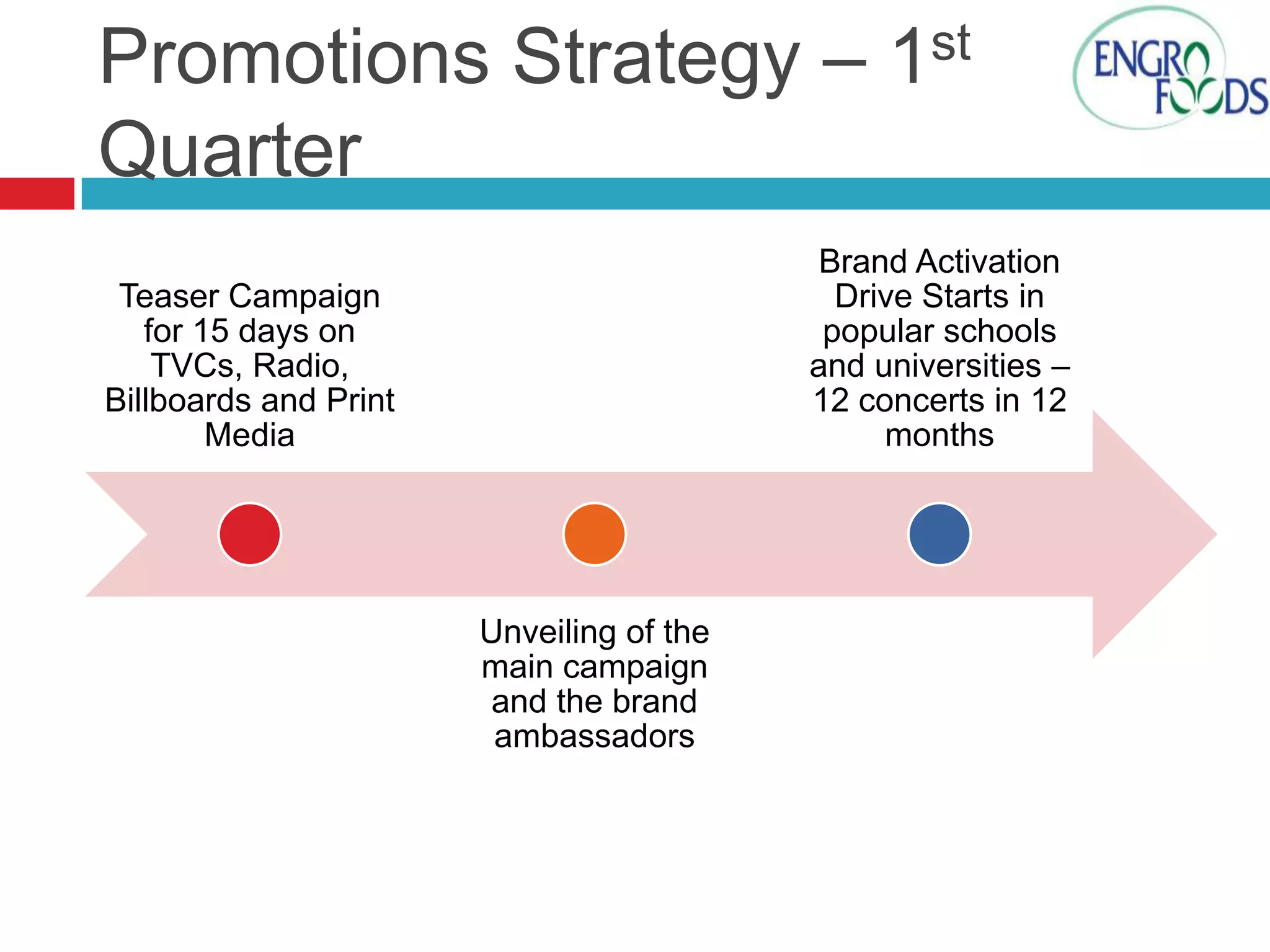

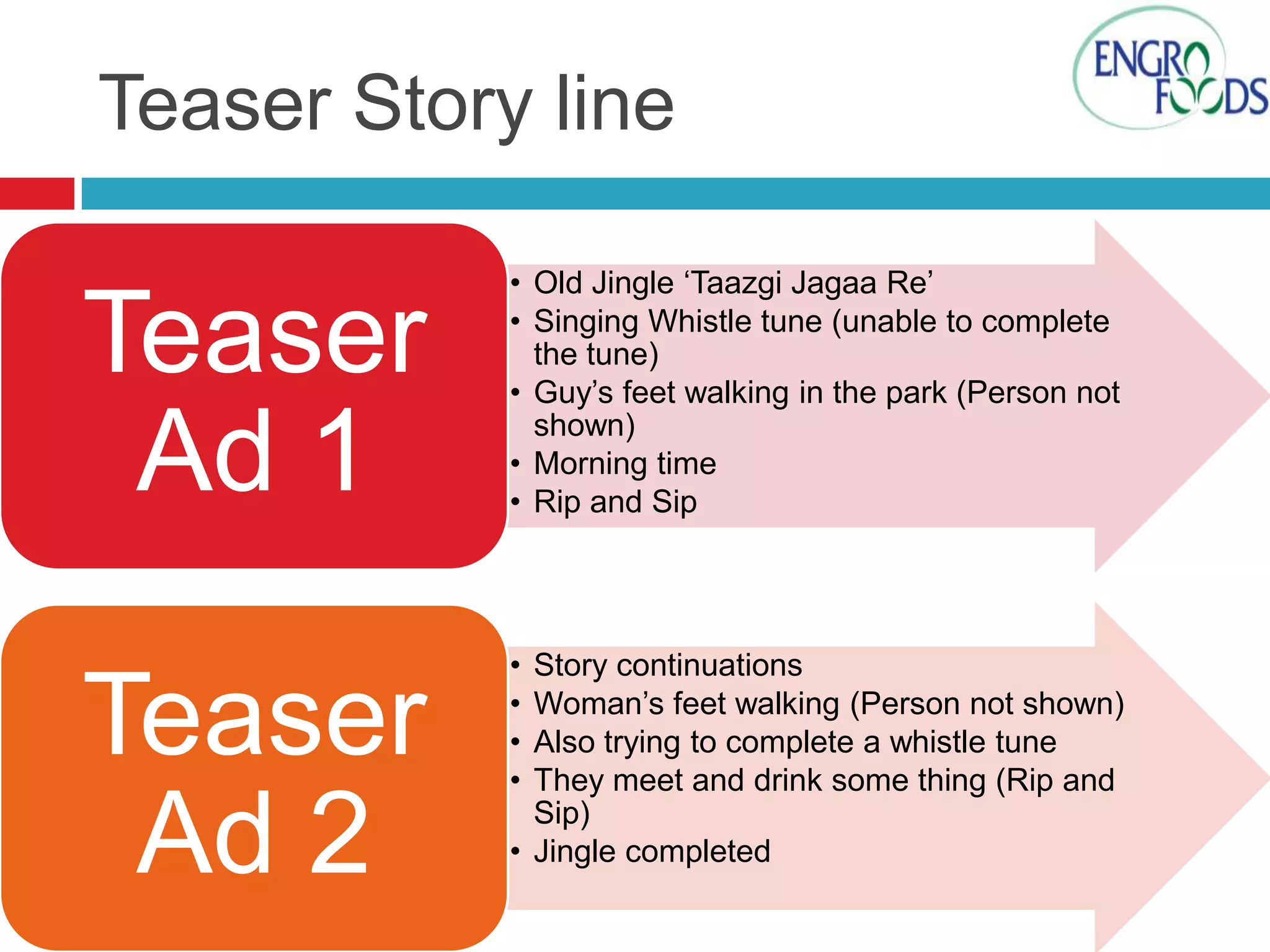

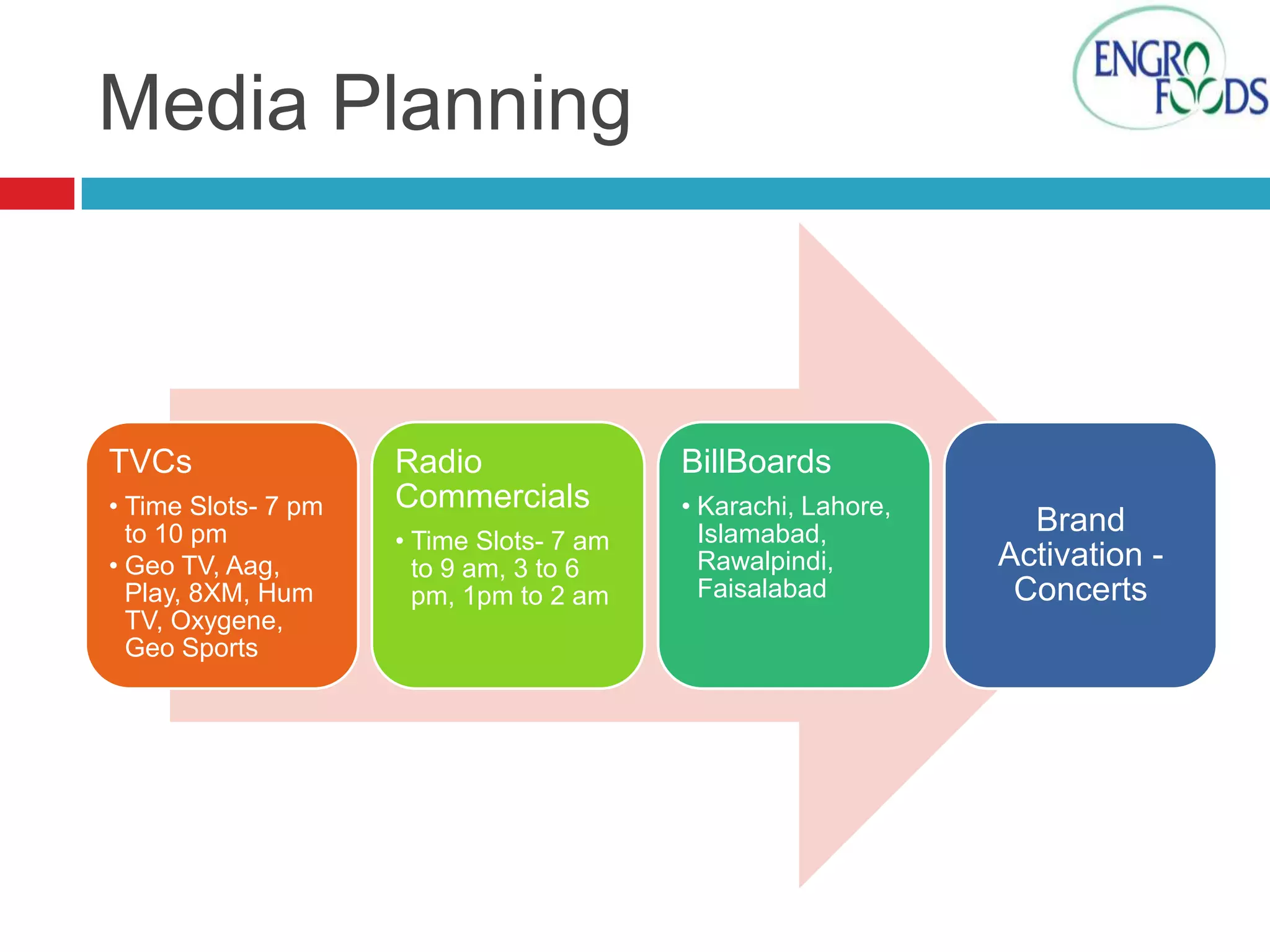

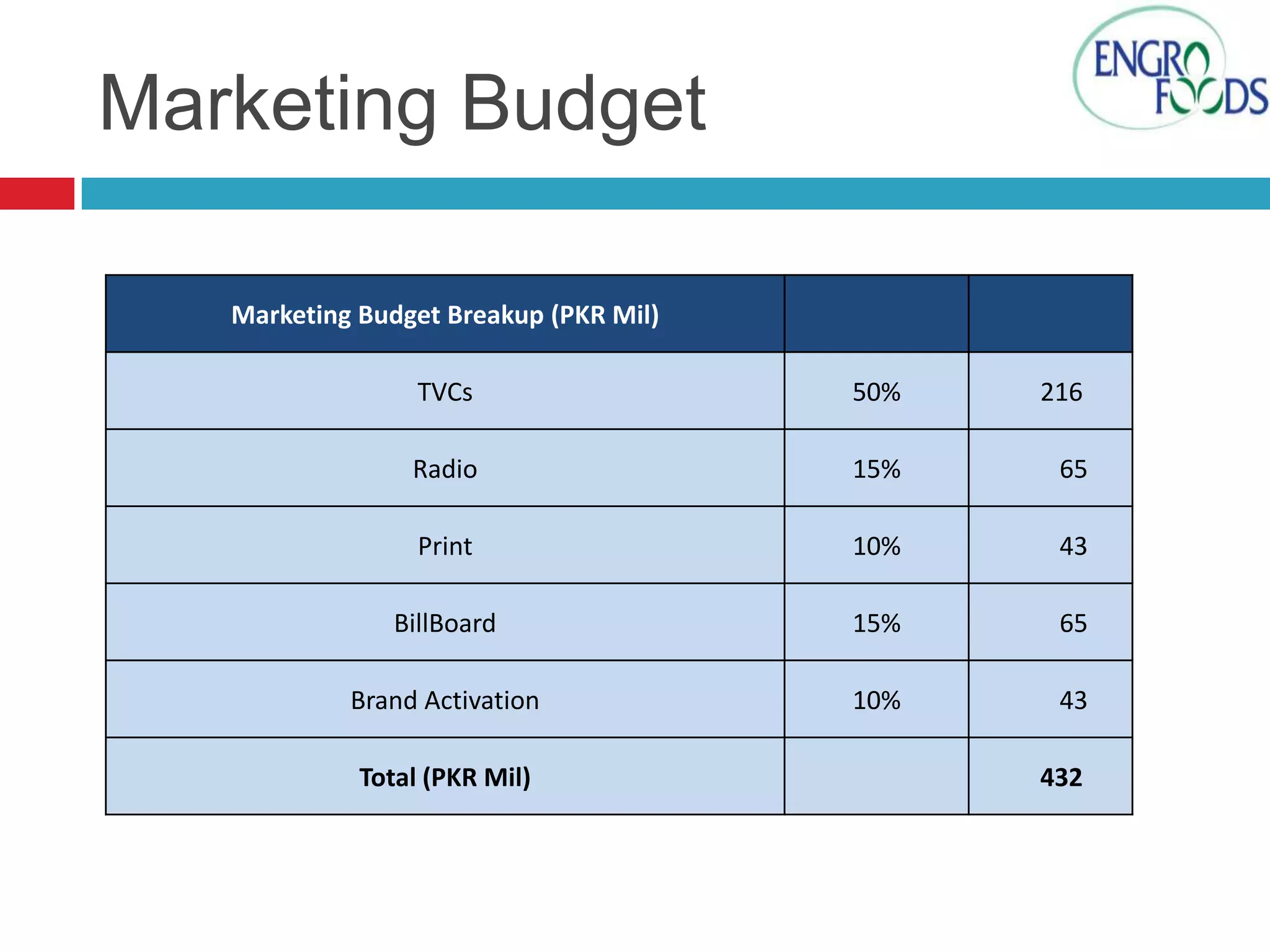

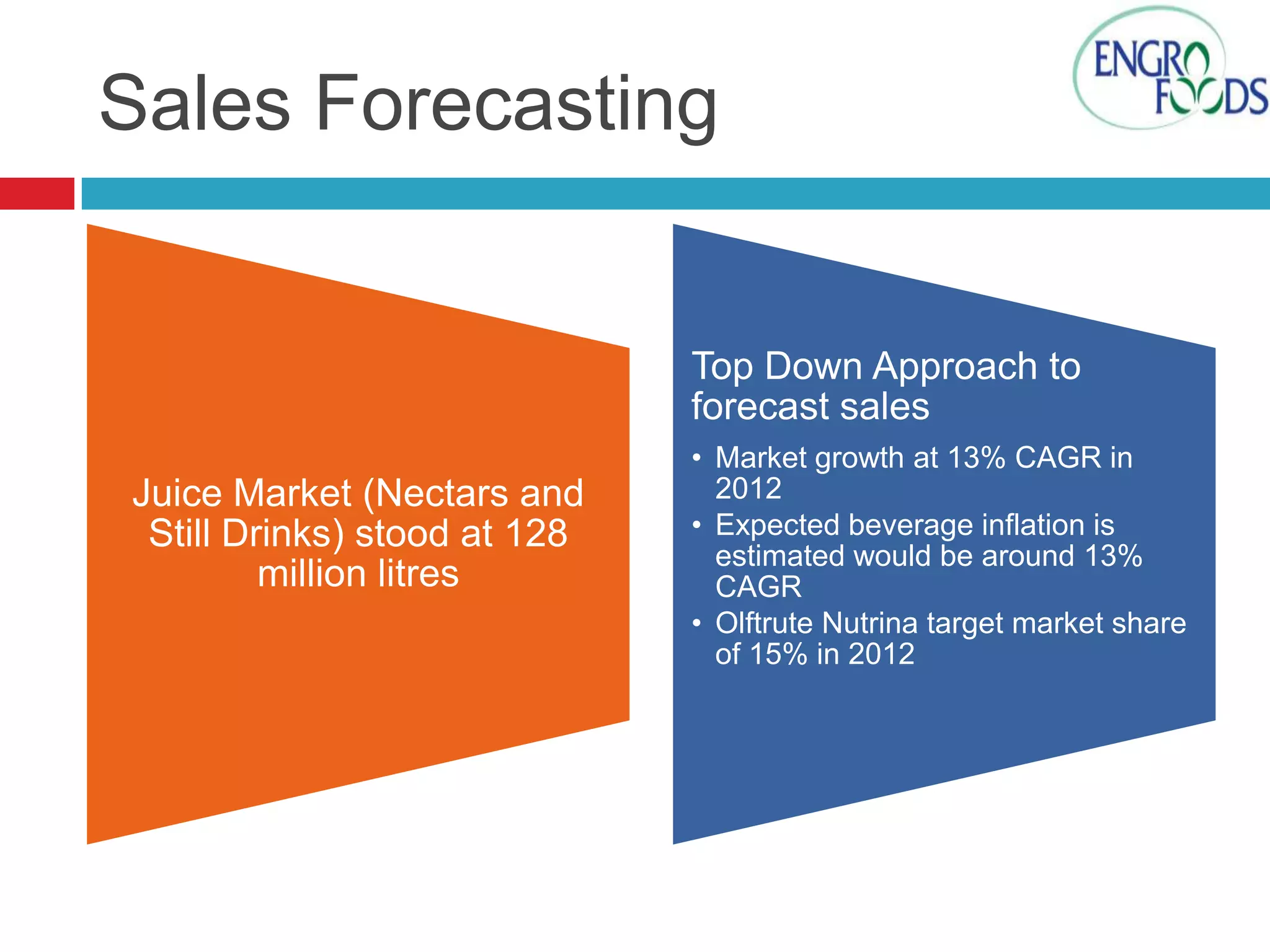

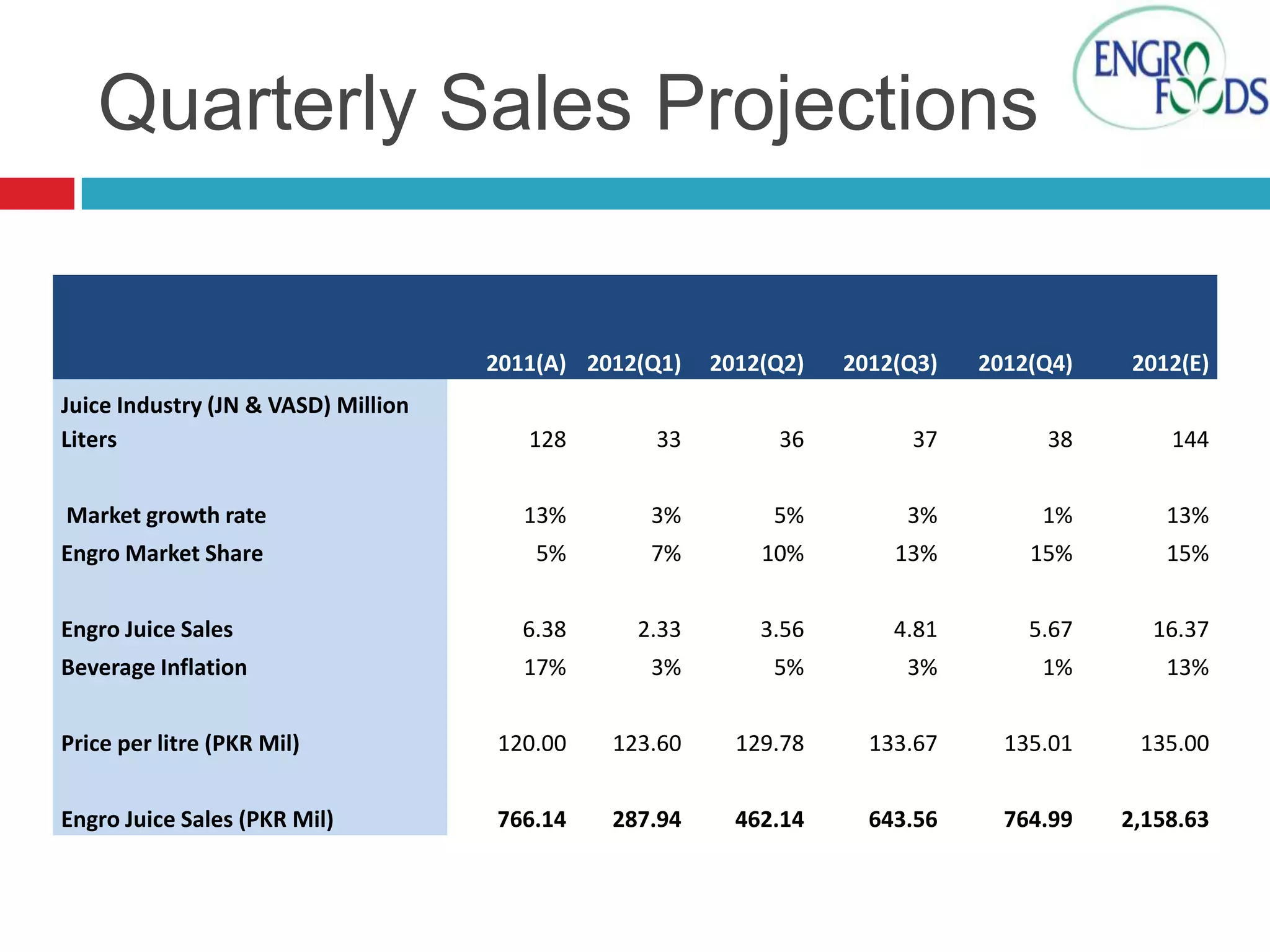

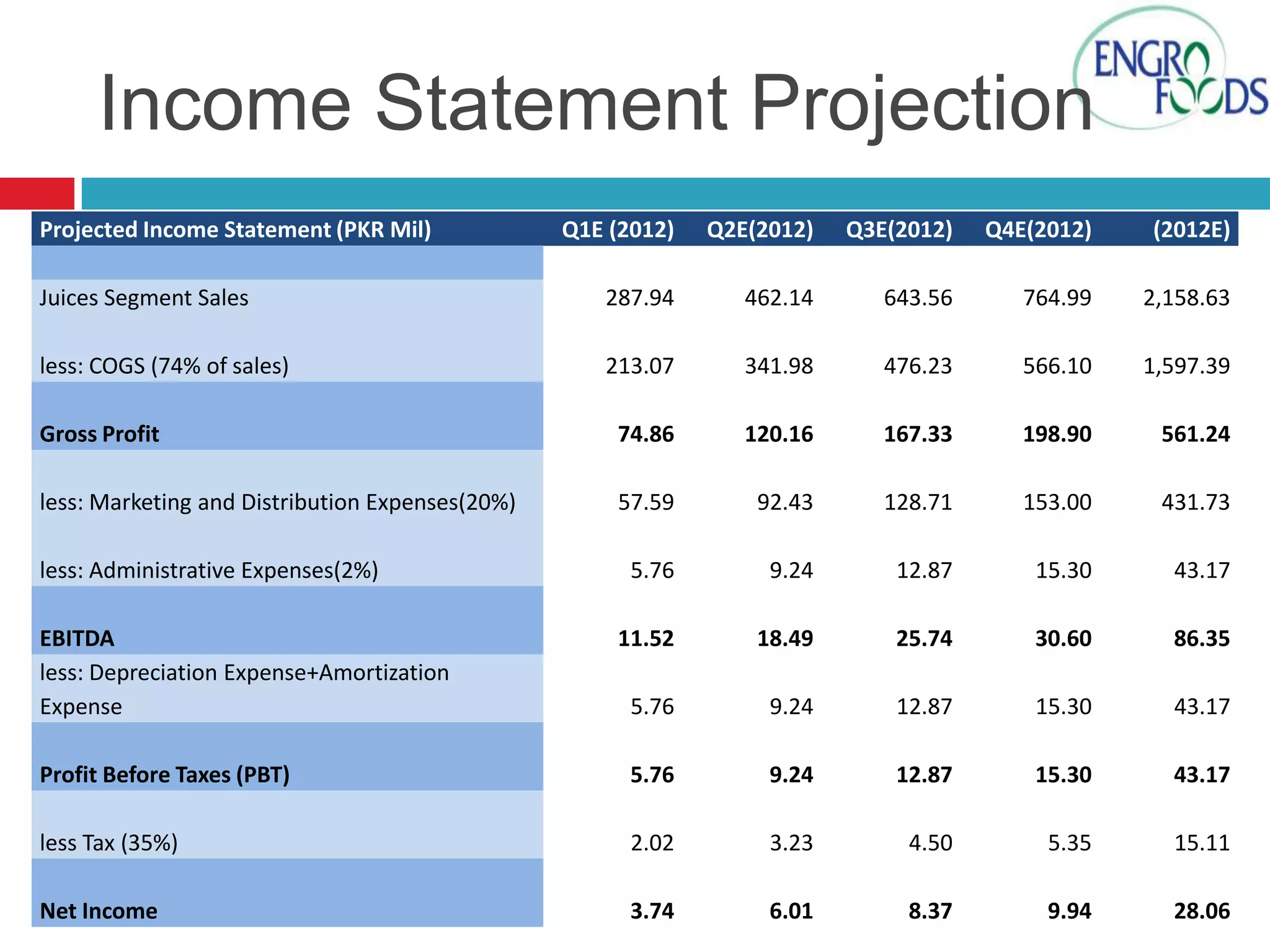

The document outlines Engro Foods' marketing plan for its Olfrute juice brand, launched in 2010 but currently holding only 1% market share. It details competitor analysis, SWOT assessment, and marketing objectives, including targeting health-conscious youth and achieving a 15% market share in the first year. The plan includes product differentiation, pricing strategies, extensive promotional activities, and a robust distribution network leveraging Engro's established channels.