More Related Content

Similar to Energy & Carbon Management newsletter - Dec 12

Similar to Energy & Carbon Management newsletter - Dec 12 (10)

Energy & Carbon Management newsletter - Dec 12

- 1. Energy Newsletter / December 2012

Welcome to Energy & Carbon Page 1 of 2

Management’s Newsletter

MARKET IN BRIEF

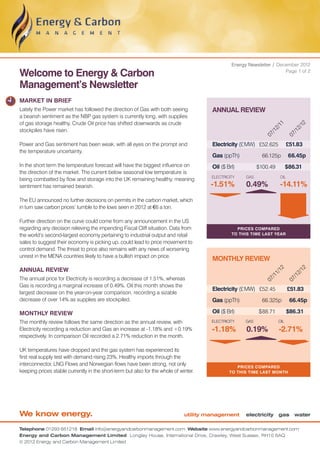

Lately the Power market has followed the direction of Gas with both seeing ANNUAL REVIEW

a bearish sentiment as the NBP gas system is currently long, with supplies

of gas storage healthy. Crude Oil price has shifted downwards as crude

11

12

2/

2/

stockpiles have risen.

/1

/1

07

07

Power and Gas sentiment has been weak, with all eyes on the prompt and Electricity (£ MW) £52.625 £51.83

the temperature uncertainty.

Gas (ppTh) 66.125p 66.45p

In the short term the temperature forecast will have the biggest influence on Oil ($ Brl) $100.49 $86.31

the direction of the market. The current below seasonal low temperature is

ELECTRICITY GAS OIL

being combatted by flow and storage into the UK remaining healthy, meaning

sentiment has remained bearish. -1.51% 0.49% -14.11%

The EU announced no further decisions on permits in the carbon market, which

in turn saw carbon prices’ tumble to the lows seen in 2012 at €6 a ton.

Further direction on the curve could come from any announcement in the US

regarding any decision relieving the impending Fiscal Cliff situation. Data from Prices compared

the world’s second-largest economy pertaining to industrial output and retail to this time last year

sales to suggest their economy is picking up, could lead to price movement to

control demand. The threat to price also remains with any news of worsening

unrest in the MENA countries likely to have a bullish impact on price.

MONTHLY REVIEW

ANNUAL REVIEW

12

12

1/

2/

/1

/1

The annual price for Electricity is recording a decrease of 1.51%, whereas

07

07

Gas is recording a marginal increase of 0.49%. Oil this month shows the

Electricity (£ MW) £52.45 £51.83

largest decrease on the year-on-year comparison, recording a sizable

decrease of over 14% as supplies are stockpiled. Gas (ppTh) 66.325p 66.45p

MONTHLY REVIEW Oil ($ Brl) $ 88.71 $86.31

The monthly review follows the same direction as the annual review, with ELECTRICITY GAS OIL

Electricity recording a reduction and Gas an increase at -1.18% and +0.19% -1.18% 0.19% -2.71%

respectively. In comparison Oil recorded a 2.71% reduction in the month.

UK temperatures have dropped and the gas system has experienced its

first real supply test with demand rising 23%. Healthy imports through the

interconnector, LNG Flows and Norwegian flows have been strong, not only Prices compared

keeping prices stable currently in the short-term but also for the whole of winter. TO this time last month

We know energy. utility management electricity gas water

Telephone 01293 651218 Email info@energyandcarbonmanagement.com Website www.energyandcarbonmanagement.com

Energy and Carbon Management Limited Longley House, International Drive, Crawley, West Sussex, RH10 6AQ

© 2012 Energy and Carbon Management Limited

- 2. Energy Newsletter / December 2012

Page 2 of 2

OTHER MARKET NEWS To cut greenhouse gas emissions by 50% on 1990 levels by

2025.To cut greenhouse gas emissions by 80% on 1990 levels

ENERGY BILL by 2050.

Energy Secretary Ed Davey announced the full details of the

GOVERNMENT DISMISSES FRACKING REPORT

Energy Bill last week and confirmed the decision to have a single

AS NONSENSE

counterparty for it Contracts for Difference (CfD mechanism. This

is expected to provide incentives for businesses to invest in low- The Government has hit back at newspaper reports which

carbon generation. suggest shale gas exploration could affect more than 60% of the

UK as “nonsense”.

The Government also introduced a Capacity Market, which

DECC said would ensure that there is sufficient gas generation A story in the Independent claimed that based on maps DECC

to provide “backup” during future supply shortages. has obtained 32,000 sq miles or 64% of the countryside would

potentially be exploited for shale gas and exploration licences

Friends of Earth, Executive Director Andy Atkins believes the considered. The areas in the report include South of England,

Energy Bill will lock the nation into increasingly expensive gas, North-West, North-East and the central belt in Scotland.

condemn cash-strapped households to rising fuel bills and

threaten the nation’s targets tackling climate change. DECC commented to say the story was unfounded. A

spokesman said: “There is a big difference between the amount

UK Engineers commented that the Government’s delay in of shale gas that might exist and what can be technically and

setting a carbon reduction target for the power sector would lead commercially extracted”. The British Geological Survey will do

to a dash for gas and drive prices upwards. There is no incentive an assessment of the UK’s shale gas resources and report its

to develop Carbon and Capture and Storage technology for gas- findings next year.

fired powered stations in the medium-term.

Having enjoyed 20 years of relatively cheap energy, the UK will

need to adjust its attitude to controlling consumption in order to

QUESTIONS?

counteract rising prices.

CONTACT US TODAY

GOVERNMENT CLIMATE CHANGE TARGETS

The Government has told energy companies that, by 2020, they Telephone

can add a total of £7.6bn to household bills to help pay for all 01293 651218

the new power plants, windfarms, etc. This figure, coincidently,

is about the same amount as the UK currently spends on Fax

importing gas. 01293 512030

The Government hopes by allowing energy providers to

Email

charge more that they will have the confidence to invest heavily

info@energyandcarbonmanagement.com

generating clean power.

The Government’s own figures show that energy companies Website

currently charge about £20 extra per year to help pay for clean www.energyandcarbonmanagement.com

energy projects, with this anticipated to rise to £95 in 2020.

To produce 30% of electricity from renewable sources by 2020.

We know energy. utility management electricity gas water

Telephone 01293 651218 Email info@energyandcarbonmanagement.com Website www.energyandcarbonmanagement.com

Energy and Carbon Management Limited Longley House, International Drive, Crawley, West Sussex, RH10 6AQ

© 2012 Energy and Carbon Management Limited