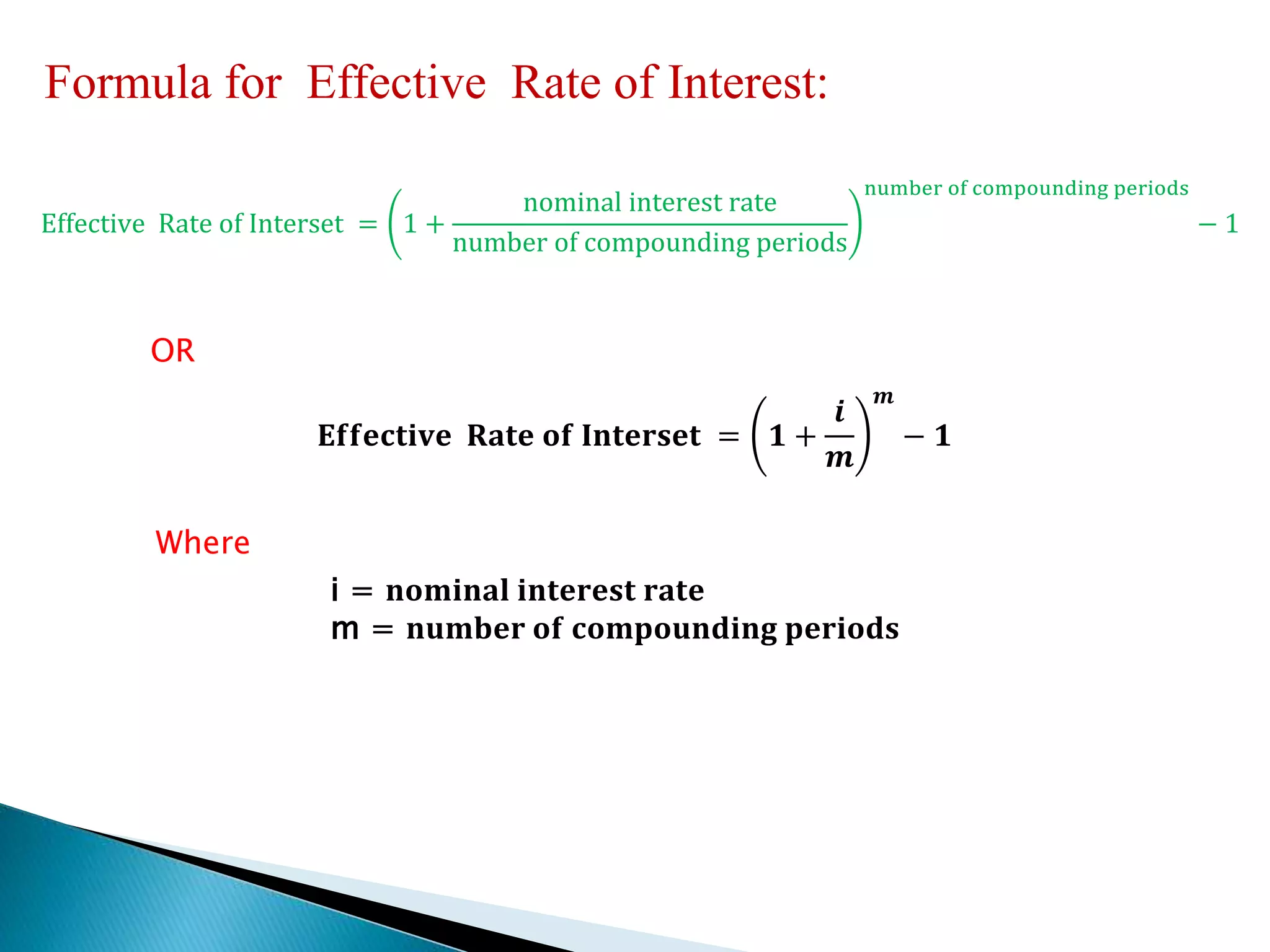

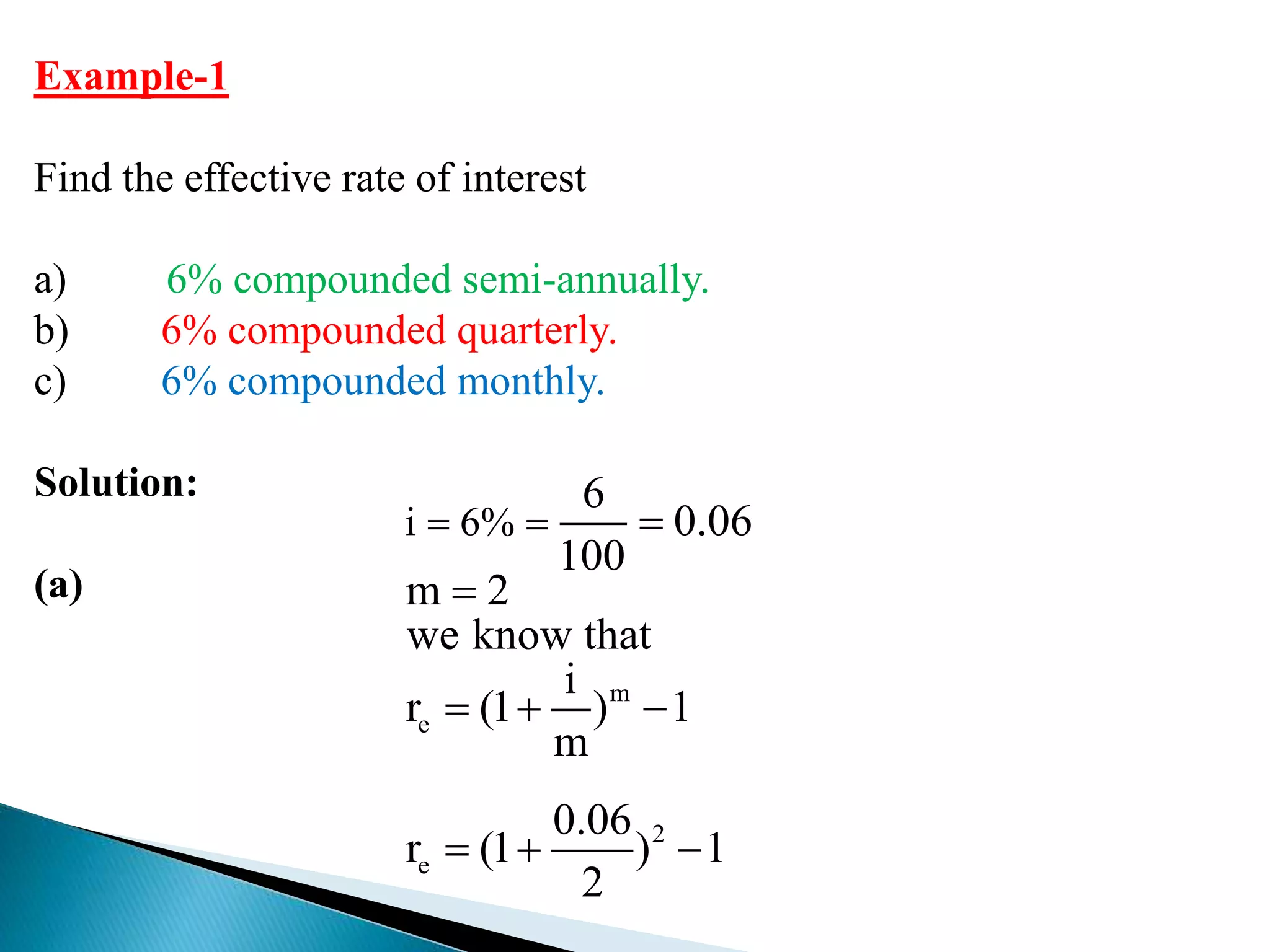

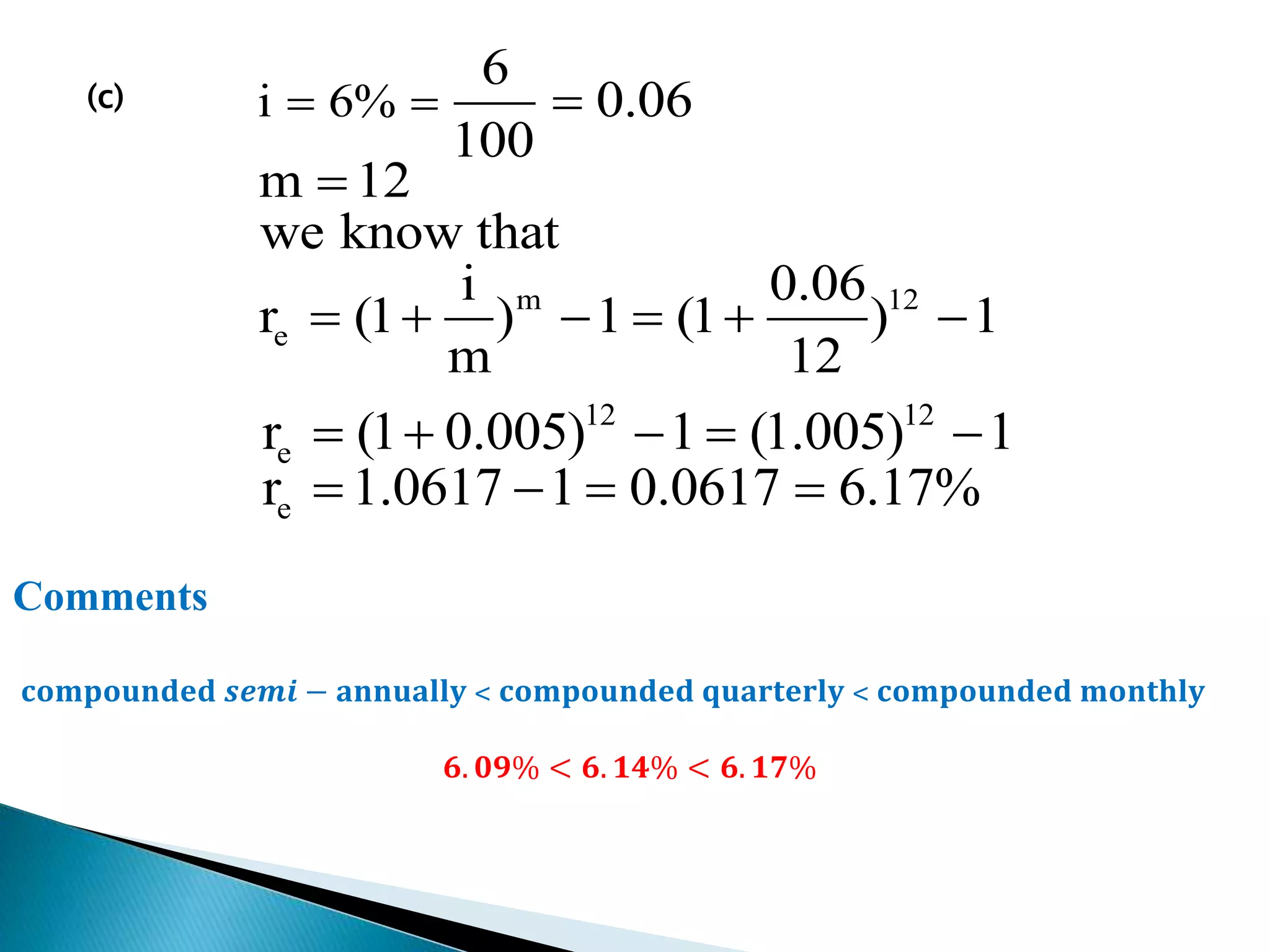

The effective rate of interest is the actual rate earned or paid on an investment when interest is compounded over time. It is usually higher than the nominal rate. The effective rate depends on both the nominal rate and the number of compounding periods. More compounding periods result in a higher effective rate. In the example given, a 6% nominal interest rate compounded semi-annually yields an effective rate of 6.09%, compounded quarterly yields 6.14%, and compounded monthly yields the highest rate of 6.17%.