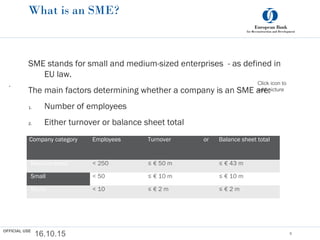

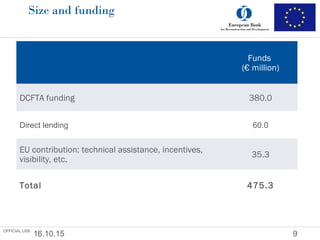

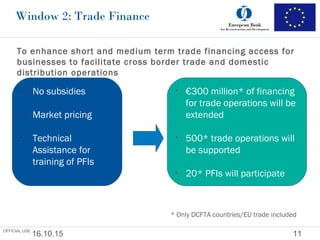

The document summarizes an EBRD program to support small and medium enterprises (SMEs) in Ukraine, Georgia, and Moldova as part of their implementation of Deep and Comprehensive Free Trade Agreements (DCFTAs) with the EU. The EBRD will provide €475 million in funding through various windows including improving SME access to long-term financing, facilitating cross-border trade, providing business advice, and engaging in policy dialogue. The program aims to strengthen SMEs in the partner countries to better implement obligations under their DCFTAs with the EU.