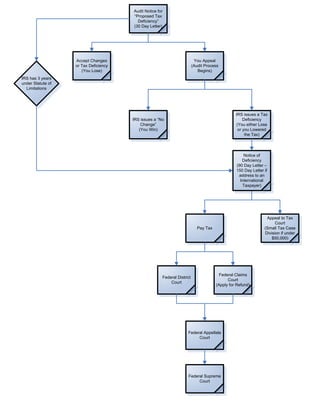

The document outlines the audit process and options for taxpayers who receive an audit notice from the IRS regarding a potential tax deficiency. It shows that after receiving an audit notice, taxpayers can either accept the changes and potential tax deficiency proposed by the IRS, or they can appeal and start the audit process which may result in the IRS issuing a "no change" notice, a final tax deficiency notice, or the taxpayer lowering the amount of tax owed. The graphic illustrates the steps a taxpayer can take including appealing first to the tax court and then various federal courts if they disagree with the IRS's findings.