The document discusses several topics related to business models and the internet landscape:

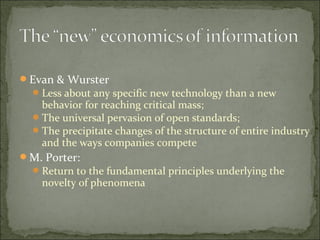

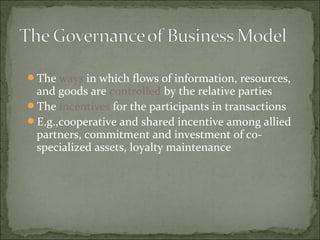

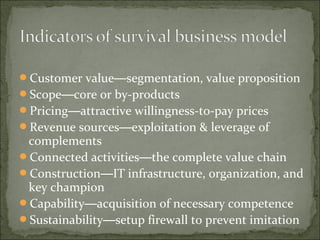

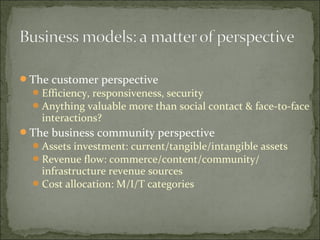

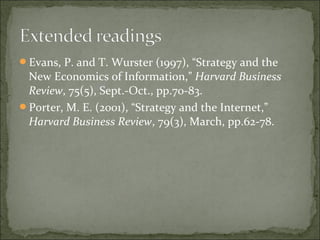

1) It discusses frameworks for analyzing business models from authors like Evan & Wurster, Porter, Amit & Zott.

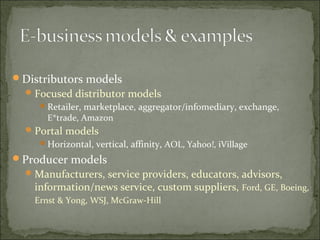

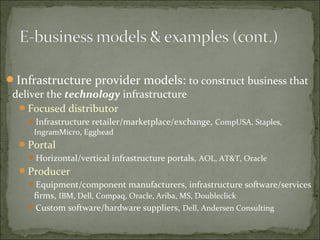

2) It covers different types of business models that emerged on the internet like distributor, portal, and producer models.

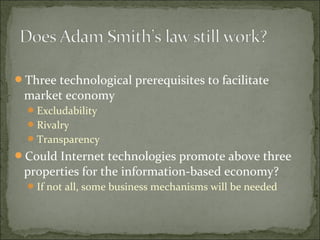

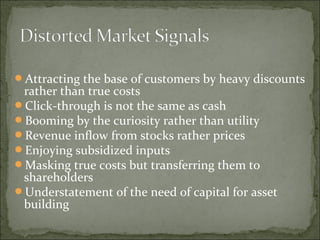

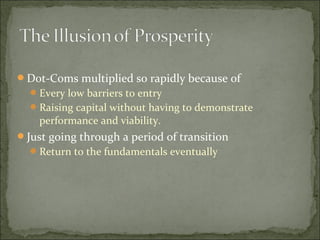

3) It analyzes technological and economic factors that impact internet business models like excludability, rivalry, and transparency.