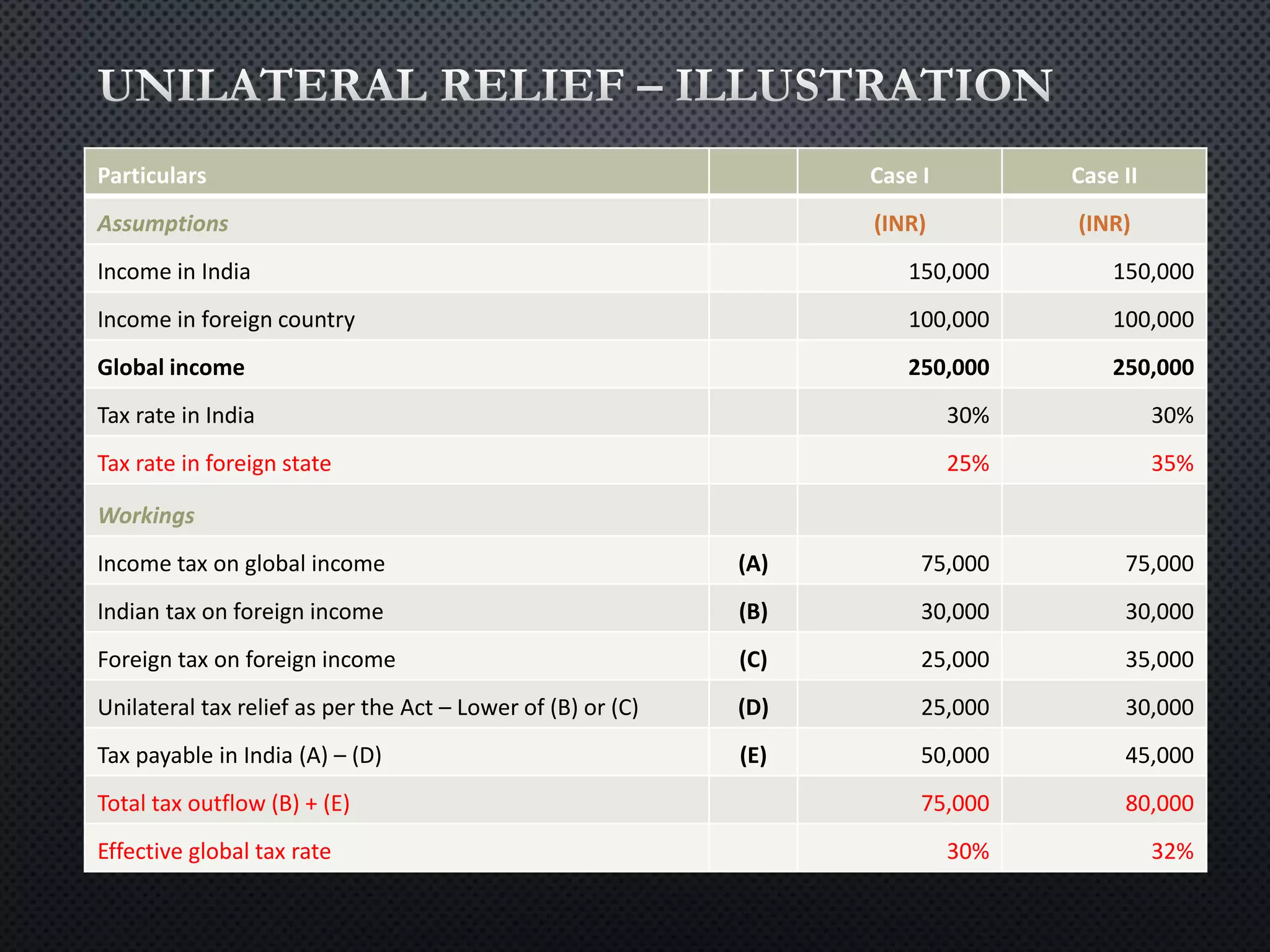

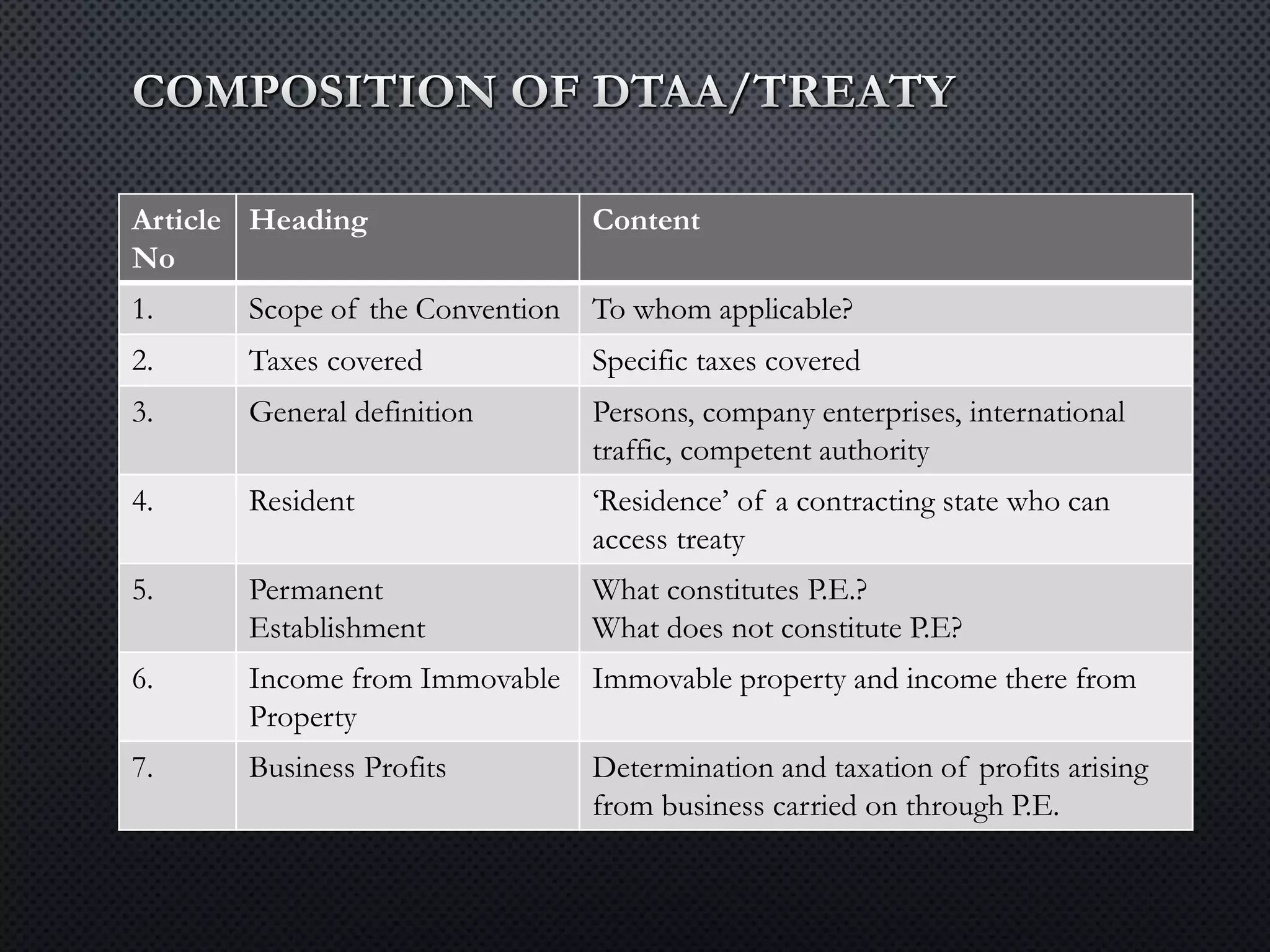

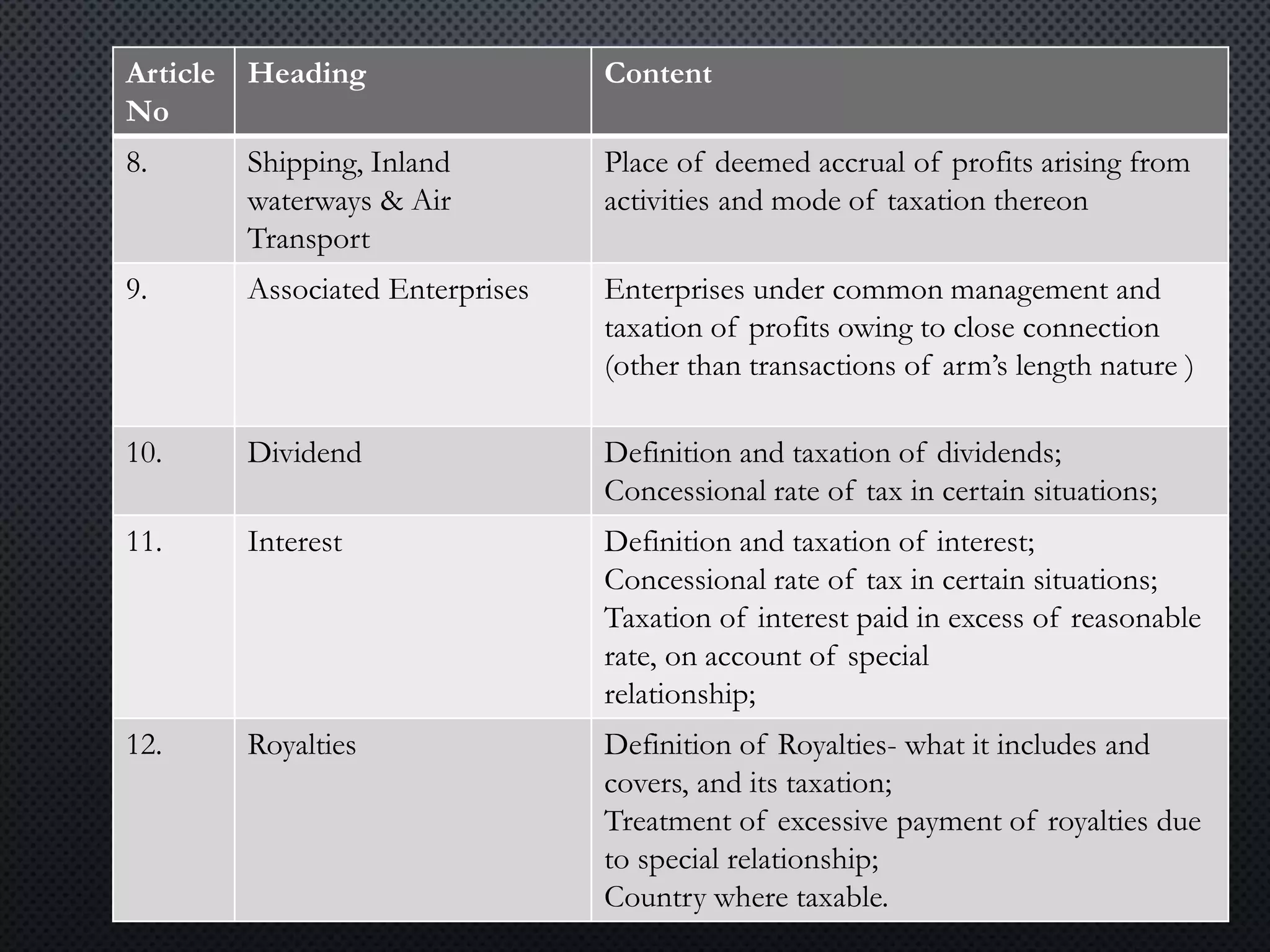

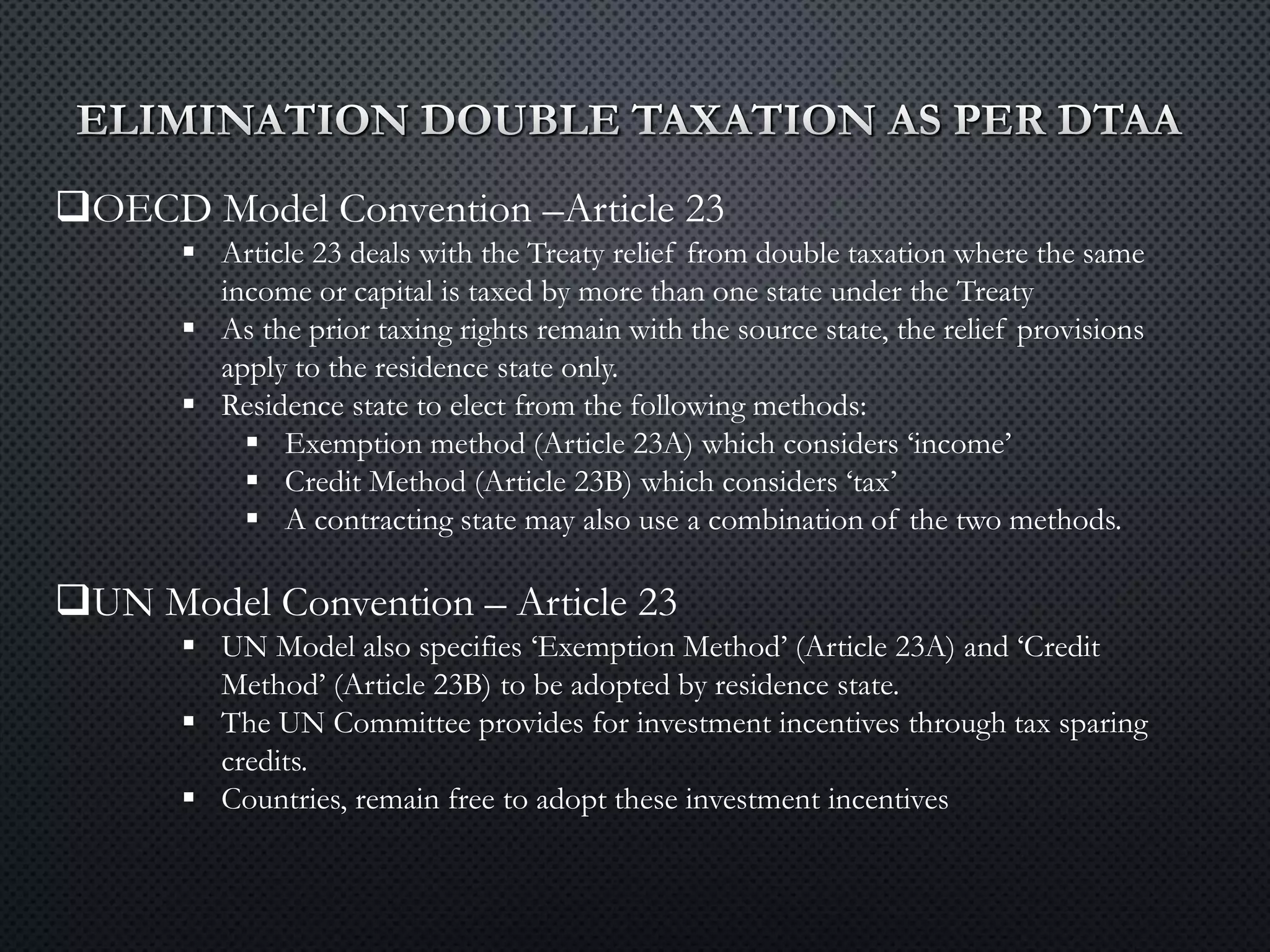

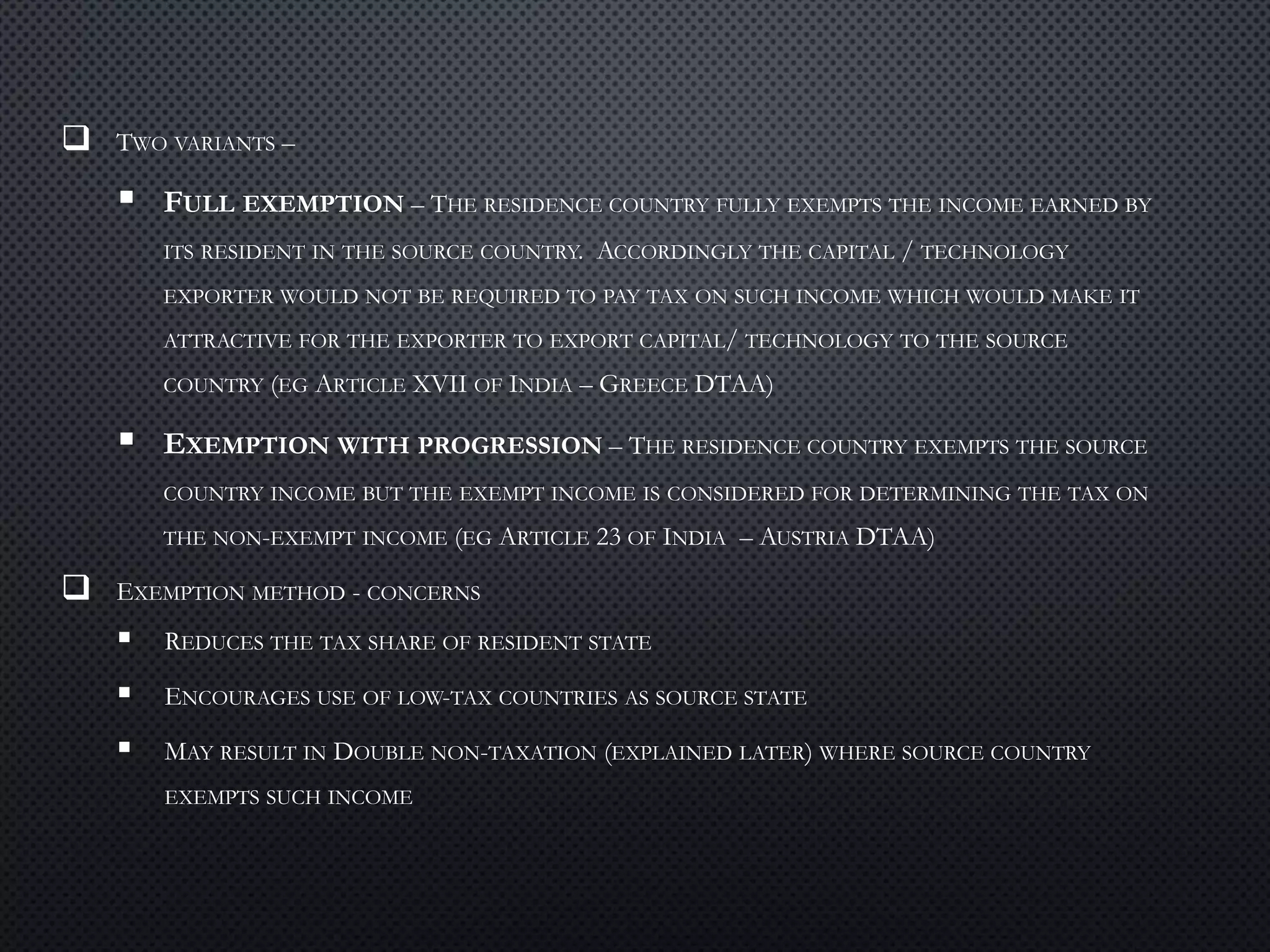

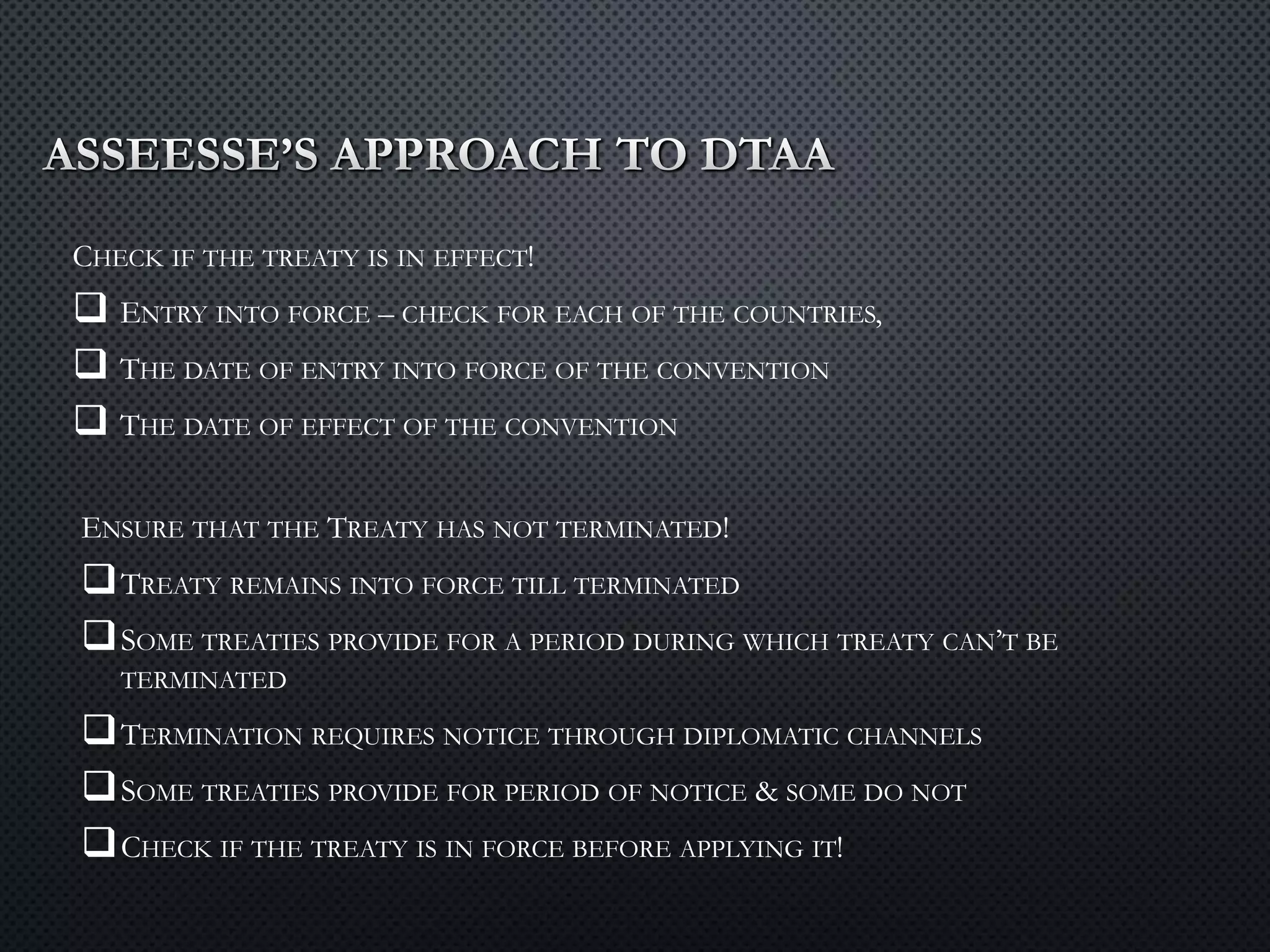

The document discusses the concept of double taxation and the relevance of Double Taxation Avoidance Agreements (DTAA) in mitigating this issue. It outlines the jurisdictional and economic double taxation scenarios, the legal framework under sections 90 and 91 of the Indian Income Tax Act, and provides an analysis of different methods for eliminating double taxation, including examples. Additionally, it emphasizes the implications of DTAA on international trade, investment, and the necessity for understanding the terms of treaties between countries.