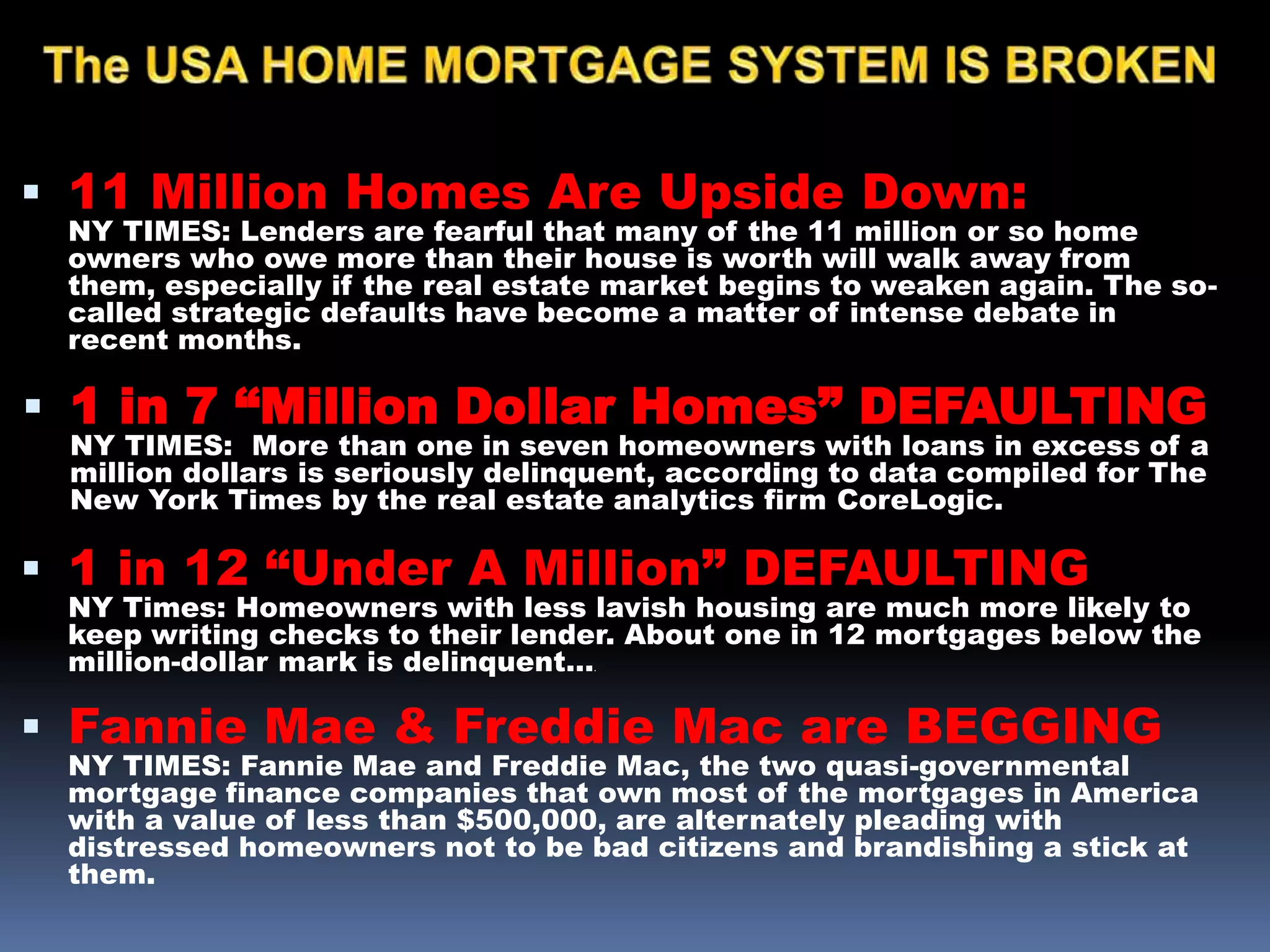

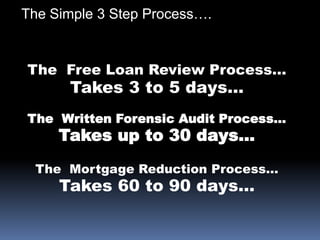

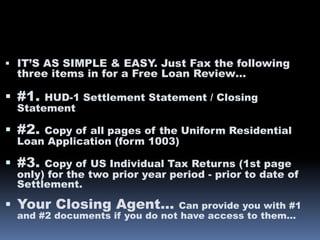

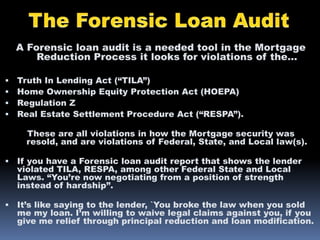

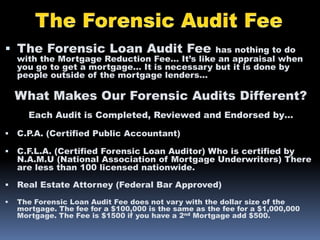

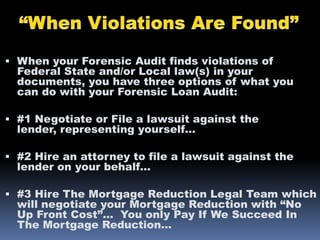

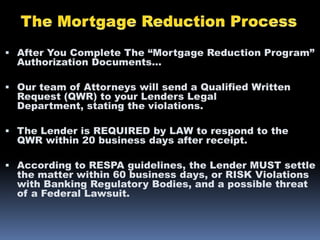

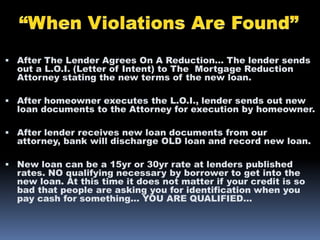

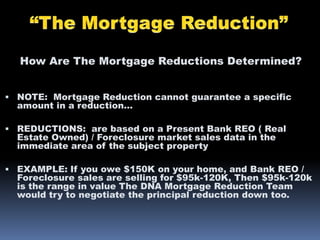

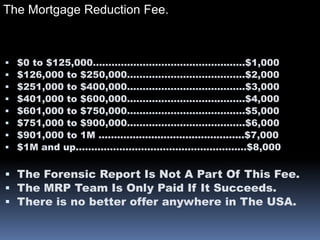

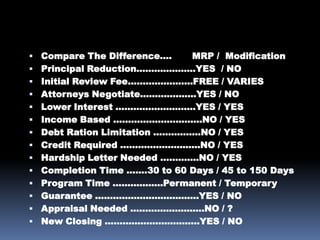

The document discusses issues with the US home mortgage system, including the high number of homeowners who owe more than their home is worth or are delinquent on payments. It notes that Fannie Mae and Freddie Mac are urging struggling homeowners not to default, but also threatening consequences. It then describes services offered to help homeowners negotiate mortgage reductions through forensic loan audits to identify lender violations, which can strengthen the homeowner's position. Key details include fees for these services and how the mortgage reduction process works.