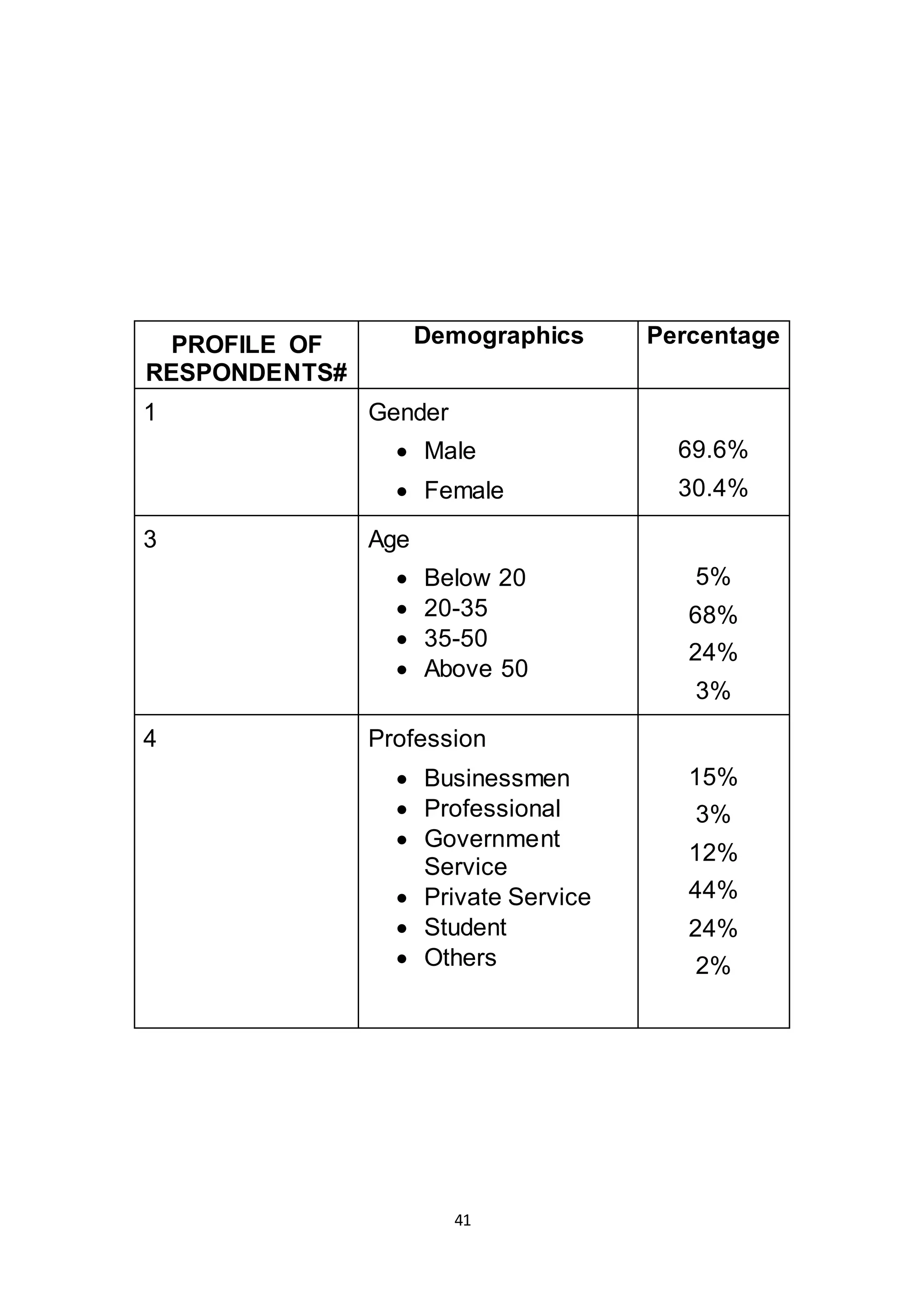

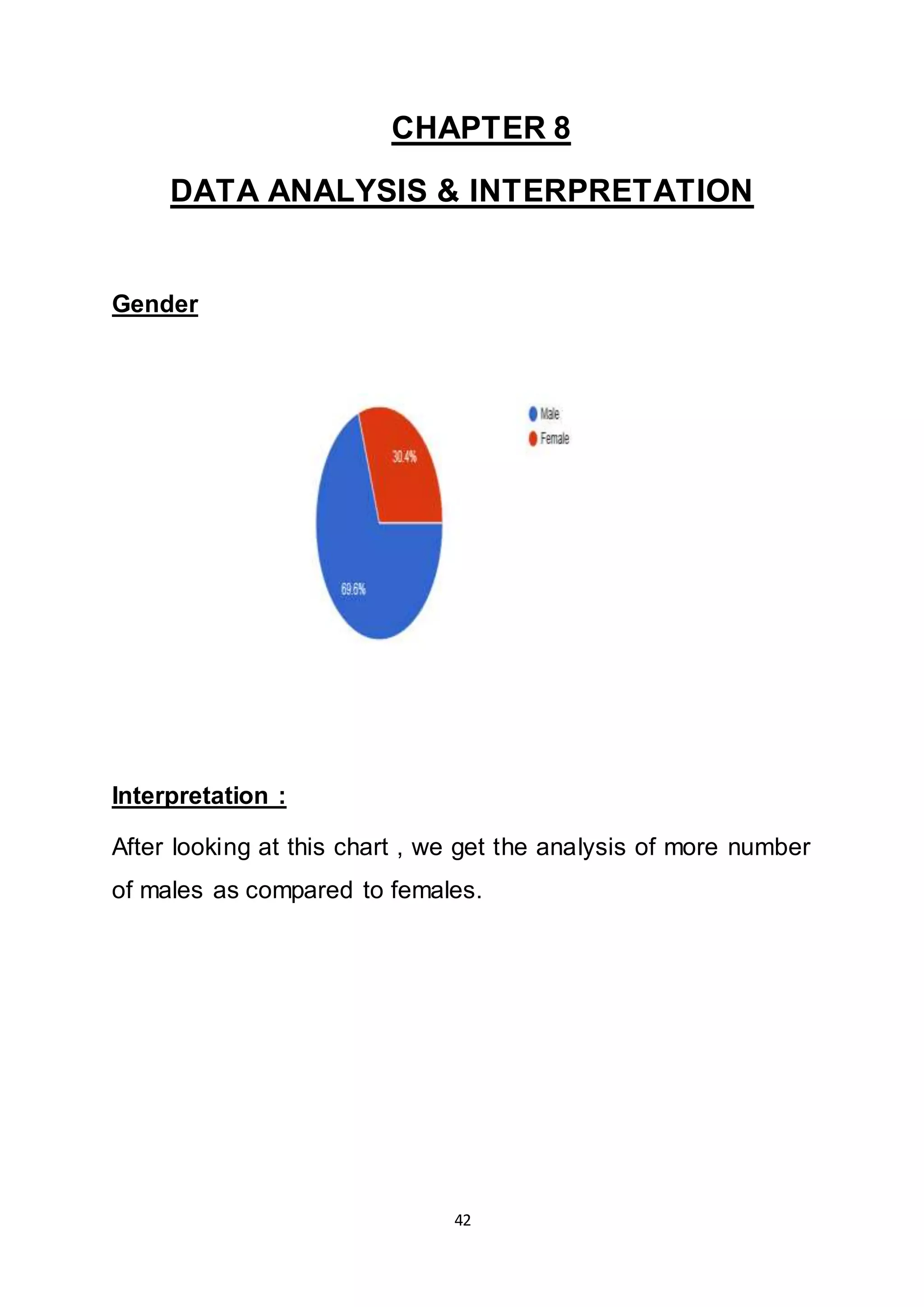

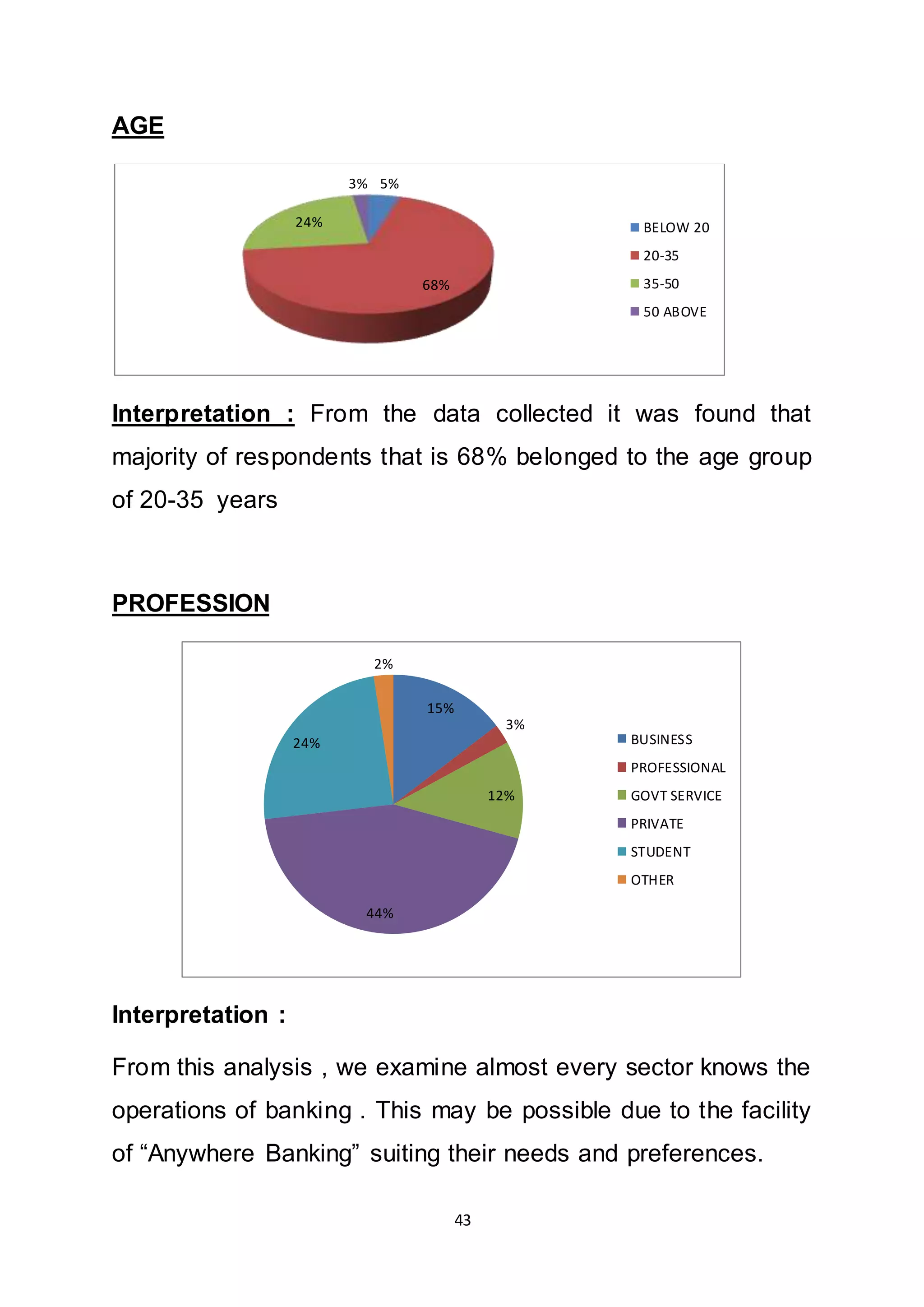

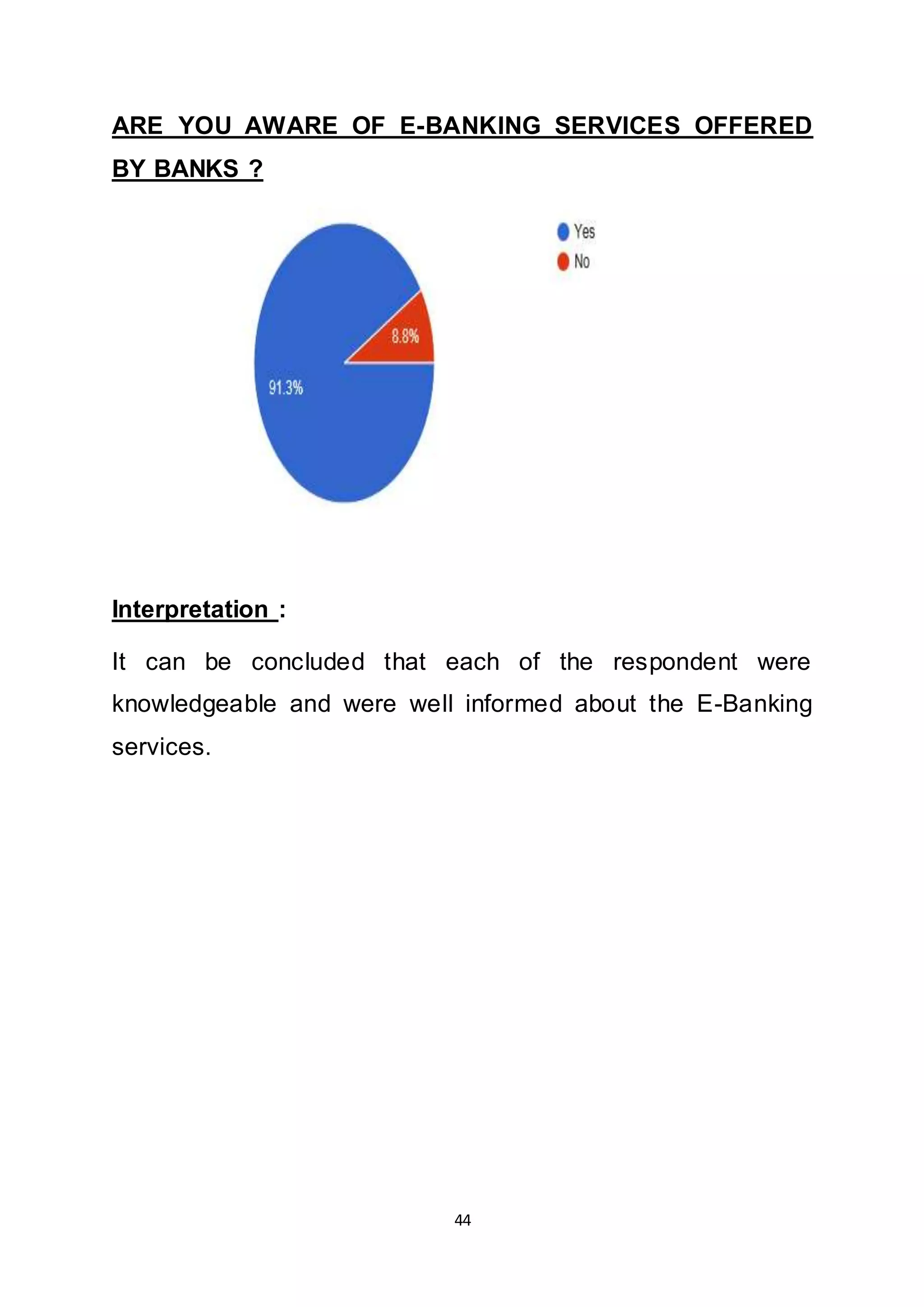

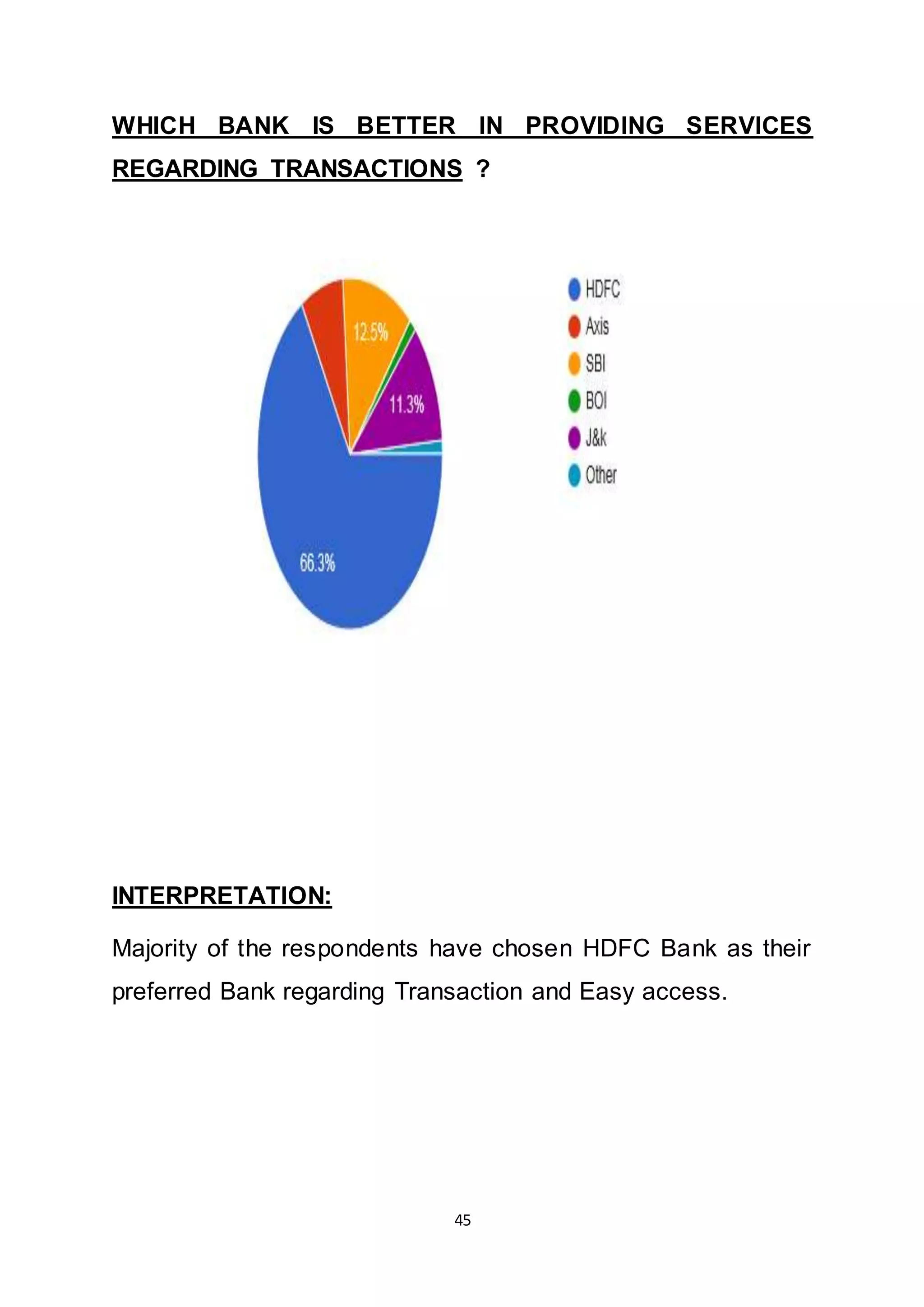

This document is a summer training project report submitted to HDFC Bank. It discusses digitalization in banking and its impact on industries. The report contains chapters on digital banking, HDFC Bank's profile and operations, their digital banking services, the impact of digital banking, research methodology, data analysis, findings, and conclusions. HDFC Bank aims to become a world-class digital bank in India by offering various online and mobile banking services to customers and transforming transactions to digital platforms.