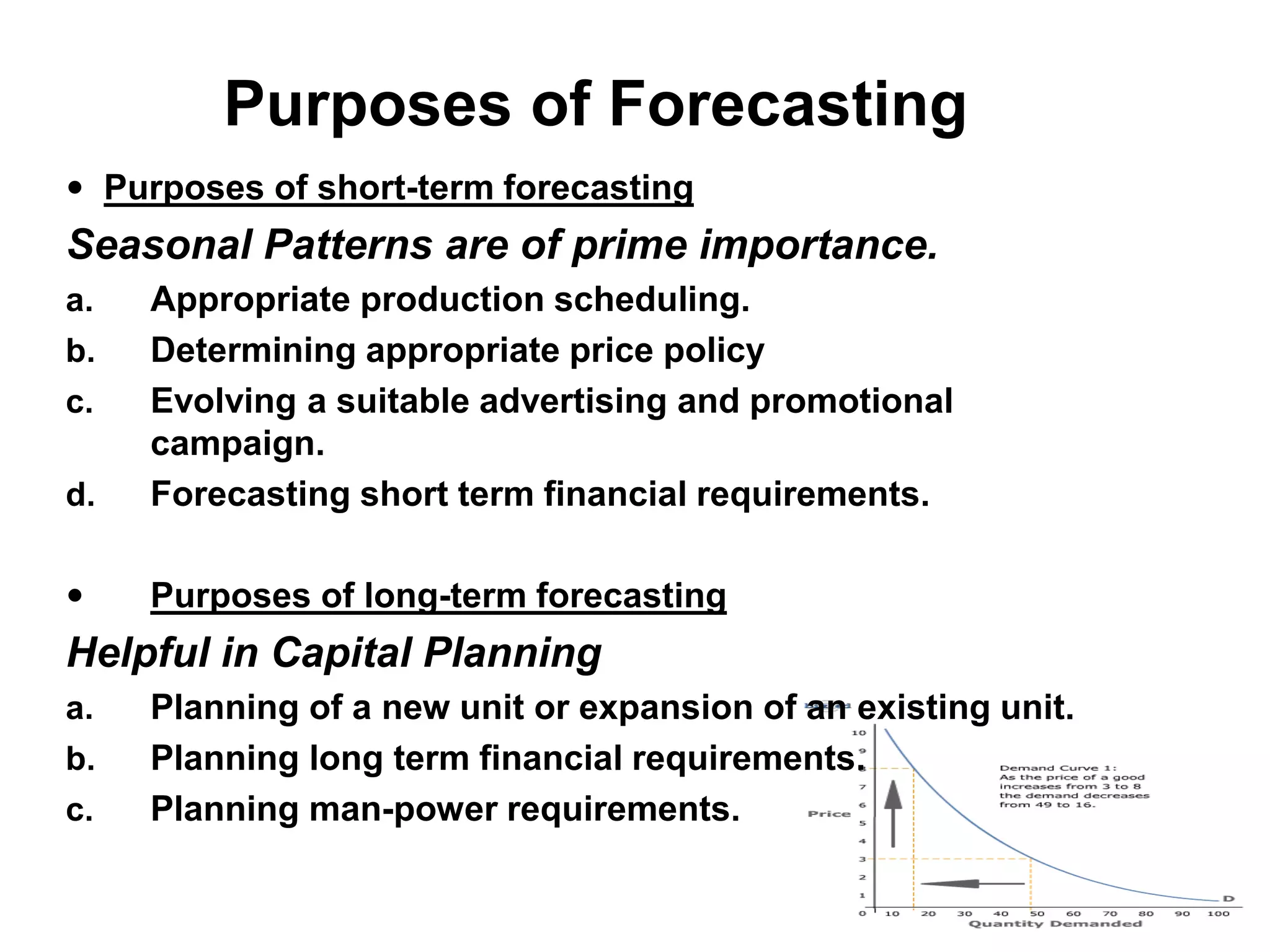

Demand estimation involves estimating the demand for a product or service within a specific timeframe using various methods such as market experiments, surveys, and regression analysis. Forecasting can be classified into passive and active, aiding in short-term and long-term planning for production, pricing, and financial requirements based on past trends and current market conditions. Key determinants for demand forecasts include consumer characteristics, economic factors, and product types.