Universal Insurance Company Limited provides a range of non-life insurance products and services customized for businesses, industries, and individuals. It has separate risk management and engineering teams that work with clients to identify risks and provide specific insurance policies, helping to prevent losses and reduce premium costs. The company aims to not only provide insurance but also help clients develop risk prevention capabilities.

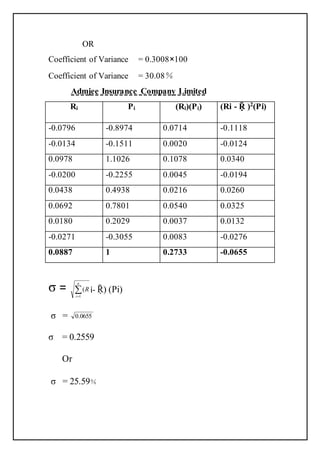

Admjee Insurance Company Limited is a leading Pakistani insurance company with a regional presence in the UAE. It has sizable assets, capital, and reserves. The company's vision is to become the largest global insurance player through innovative products, pricing, packaging, and distribution. It offers various classes of insurance including engineering, fire, marine, motor, and miscellaneous insurance