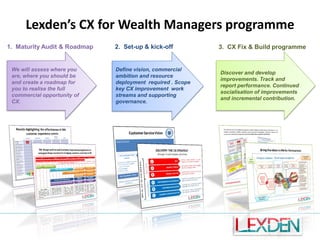

The document discusses the importance of customer experience (CX) for wealth managers, highlighting how it influences investor confidence and decision-making. It emphasizes that wealth managers must reclaim control of the customer experience from third-party advisers to capture client attention and preference. Lexden offers a CX maturity audit and improvement programs to help wealth management firms enhance their customer strategies for better financial performance.