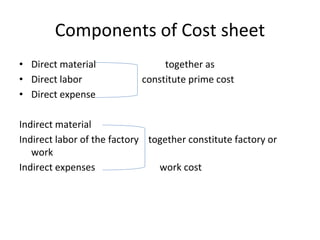

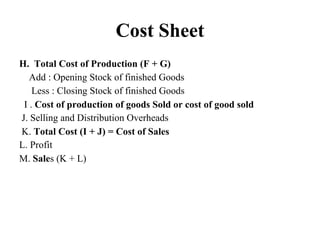

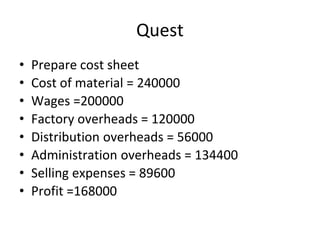

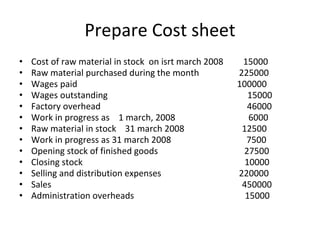

The document discusses the components and computation of a cost sheet. It explains that a cost sheet tracks direct material costs, direct labor costs, direct expenses, factory/works overhead costs, office and administration overhead costs, and selling and distribution overhead costs. It provides a template for a cost sheet showing accounts for materials consumed, direct labor, prime costs, factory costs, production costs, cost of goods sold, and sales. It then provides an example cost sheet with specific costs to populate the template for a company.