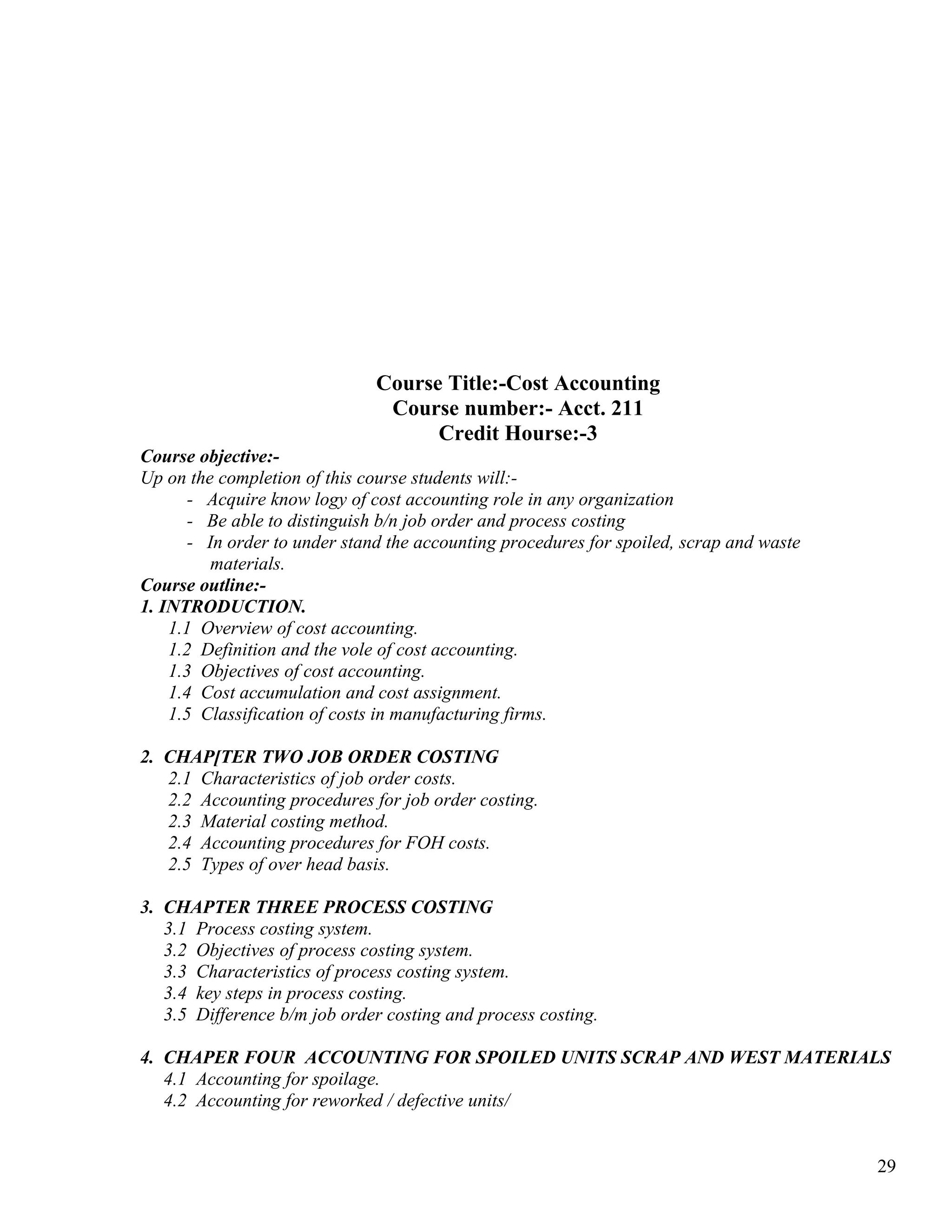

This document provides an overview of cost accounting, including key definitions and concepts. It discusses:

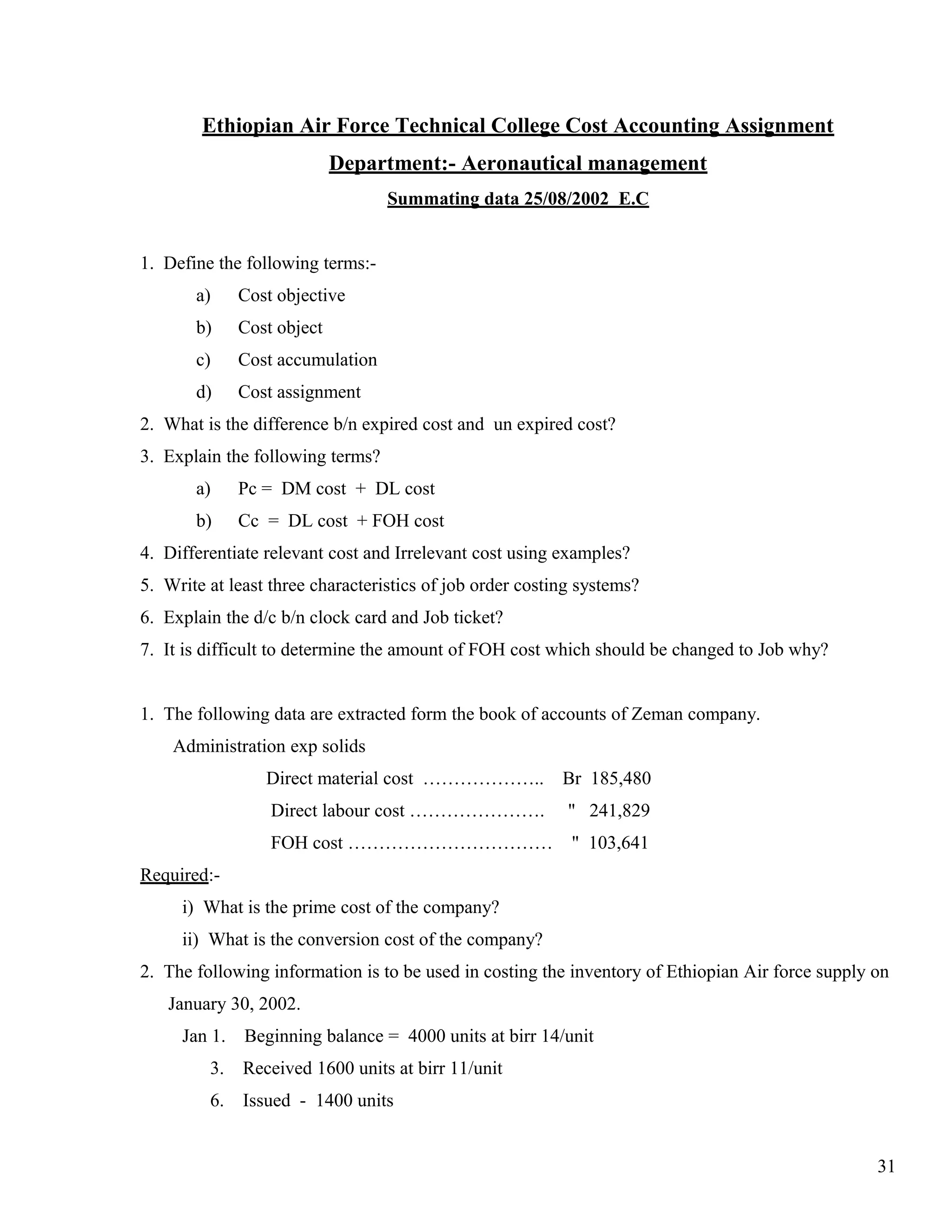

1) Cost accounting identifies, measures, records, classifies, summarizes, interprets, and communicates the costs of manufacturing firms.

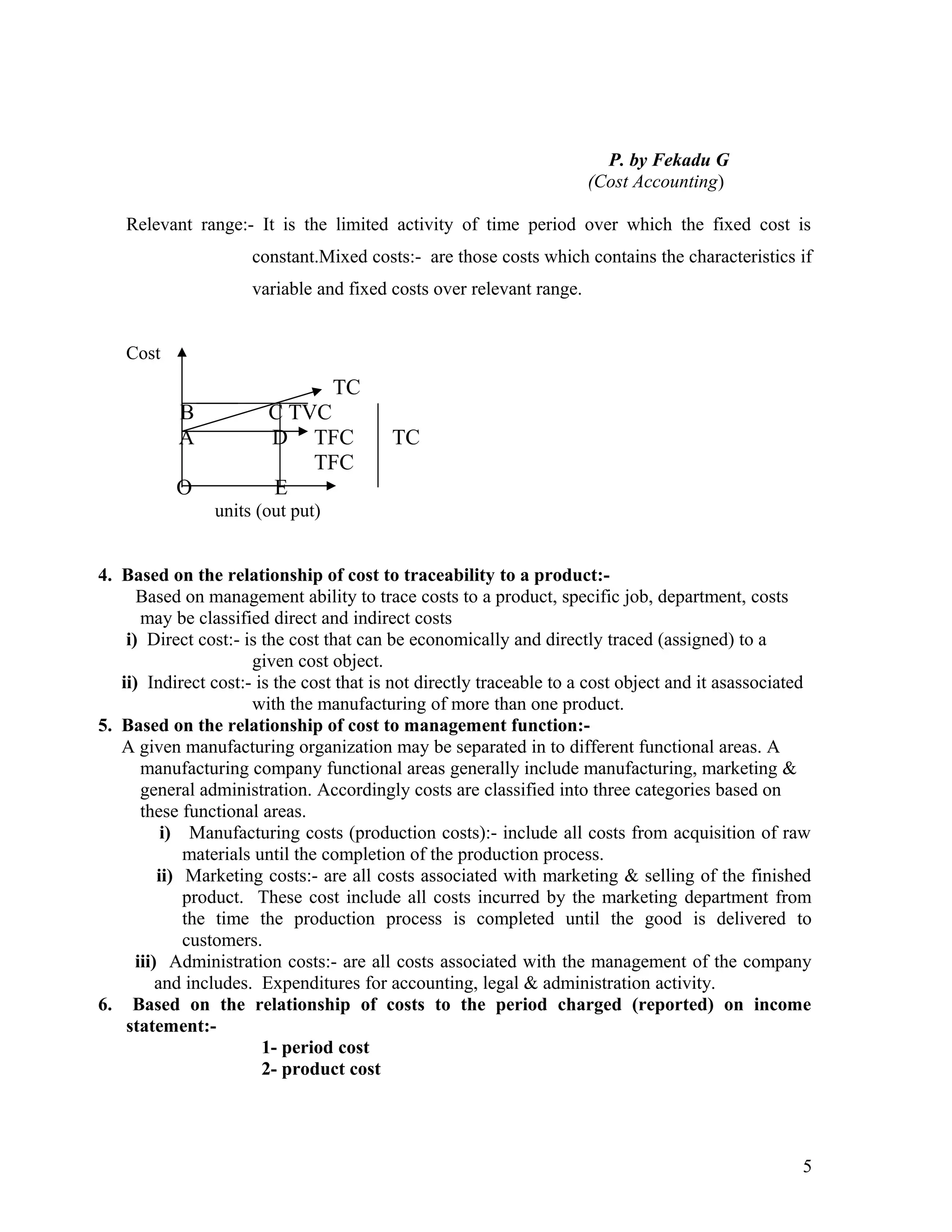

2) Costs are classified in various ways, including by relationship to products (direct vs indirect), behavior (fixed vs variable), and traceability.

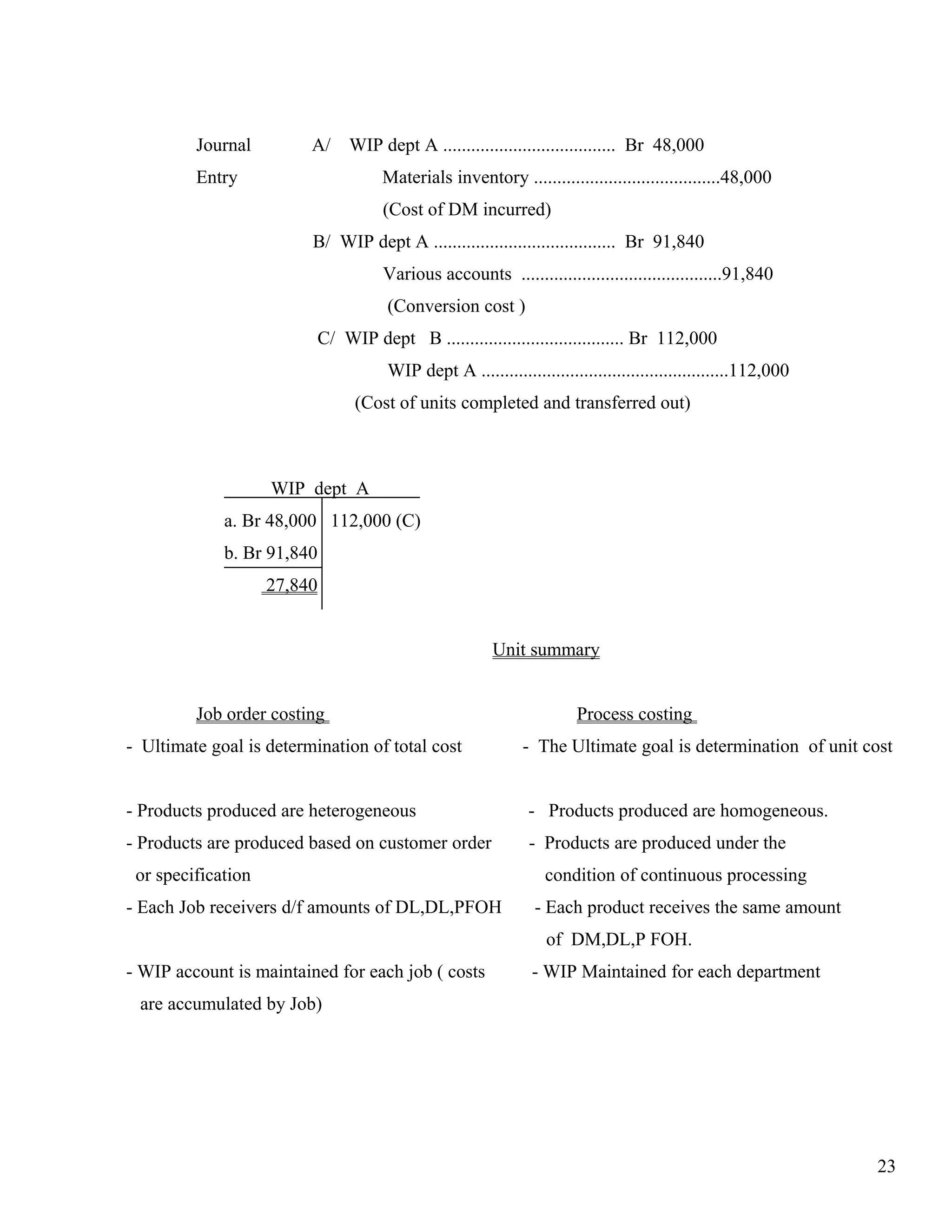

3) Job order costing is used when products are made to customer order. It accumulates costs by job and uses a work in process account for each job.