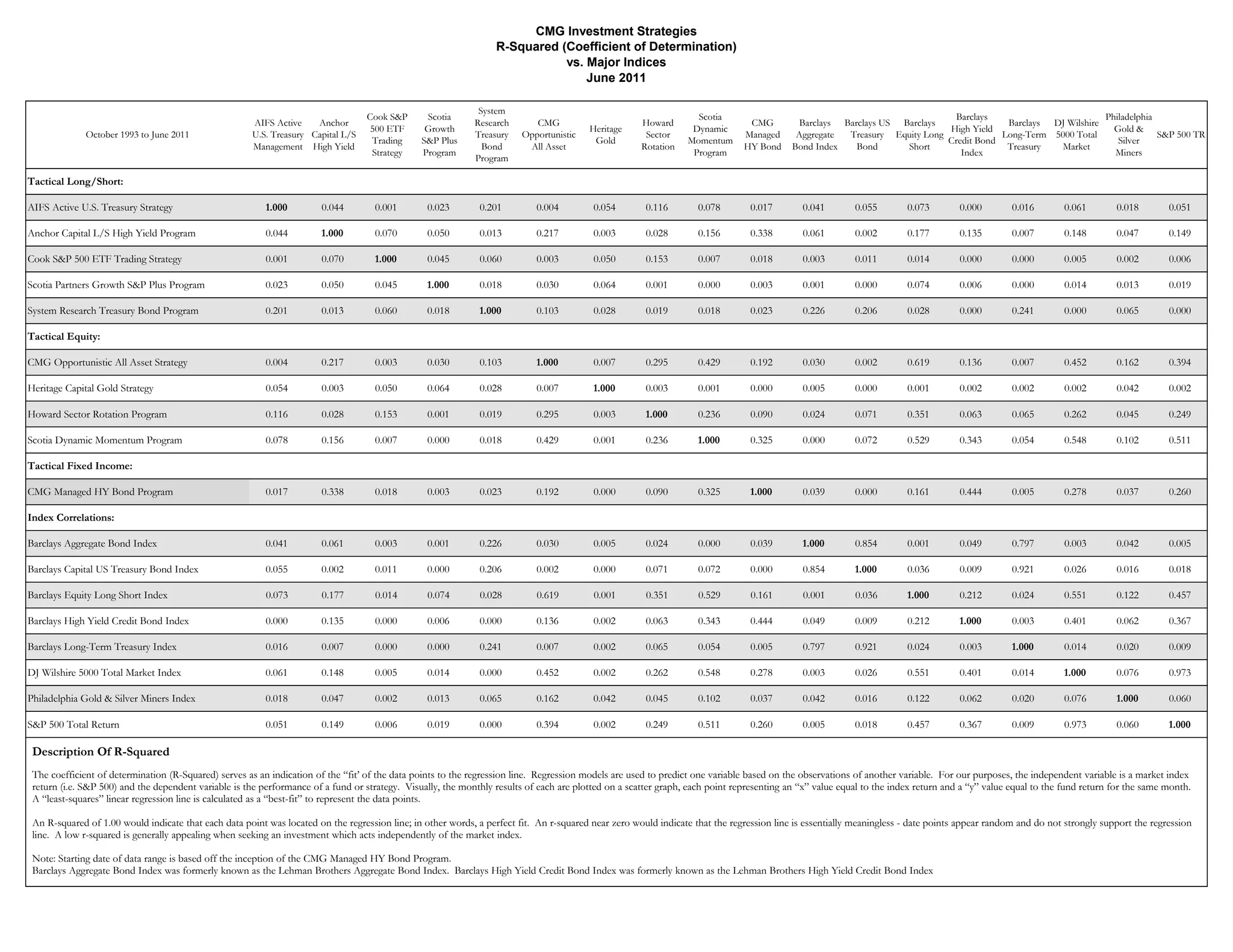

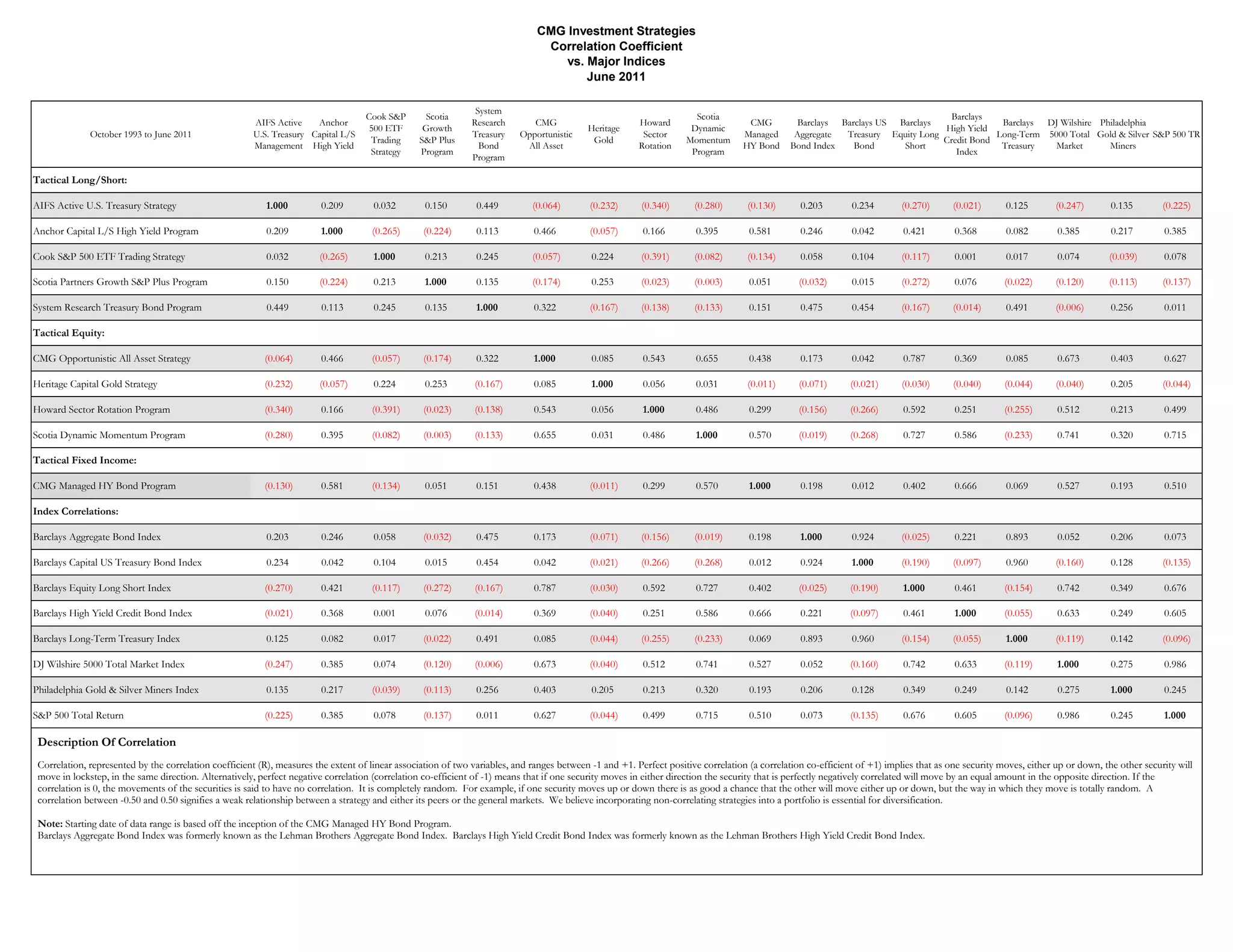

This document presents a correlation coefficient table, also known as R-Squared, comparing the performance of various investment strategies and indexes from October 1993 to June 2011. The strategies include long/short equity, tactical equity, tactical fixed income, and benchmark indexes. Correlation coefficients range from 0 to 1, with 1 indicating perfect correlation and 0 no correlation. Most strategies show low correlation to major indexes like the S&P 500, suggesting they act independently from the broader market.