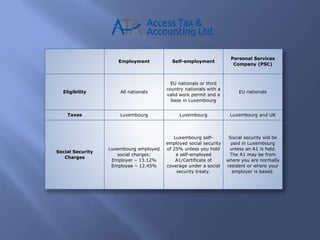

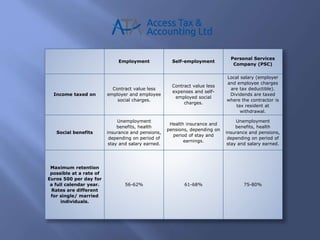

This document compares employment, self-employment, and personal services companies (PSCs) in Luxembourg. It outlines that nationals and those with valid work permits are eligible. Taxes and social security charges are paid in Luxembourg and potentially the UK for a PSC. Income is taxed differently based on employment versus self-employment. Social benefits like unemployment, health insurance, and pensions vary depending on time spent and earnings in Luxembourg. Retention rates for a PSC are highest at 75-80% of contract value.