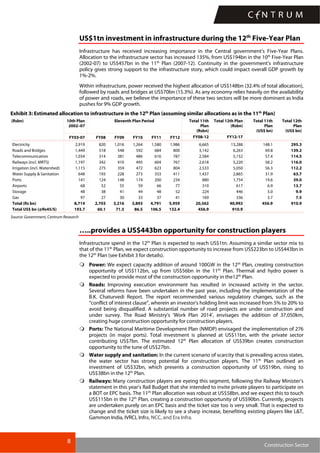

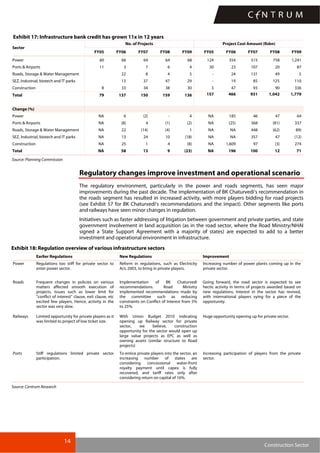

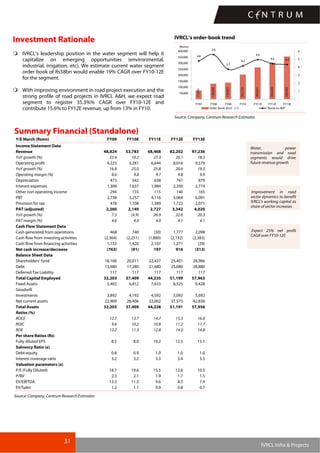

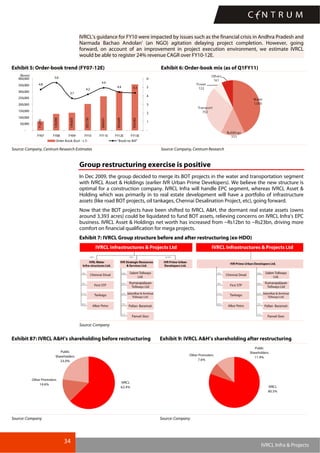

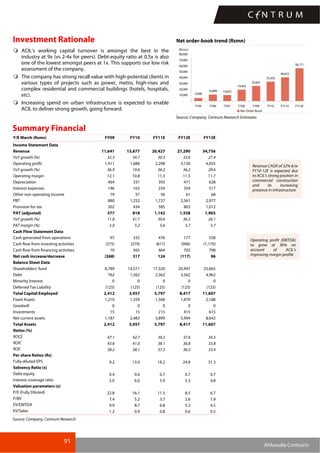

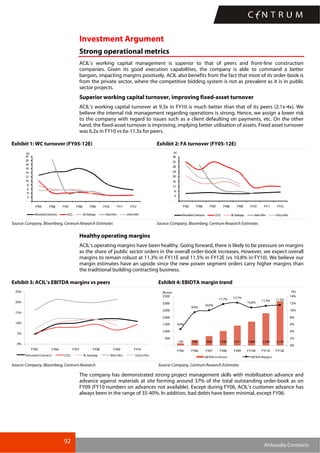

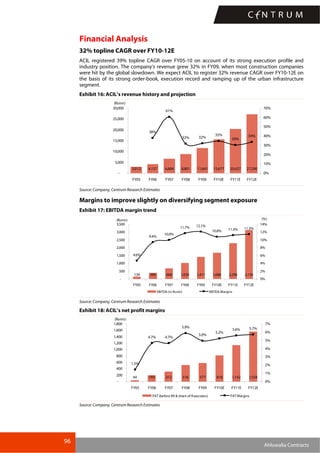

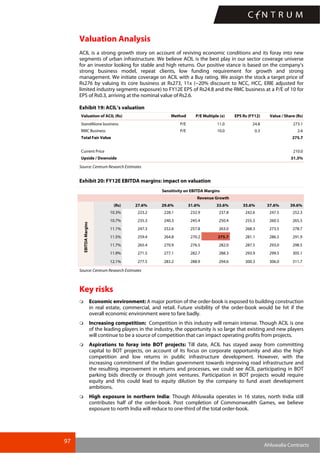

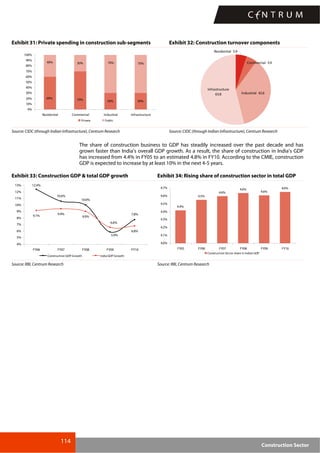

The document provides an analysis of the Indian construction sector and recommends buying stocks in the sector. It estimates a US$443 billion construction opportunity in India over the next five years driven by large infrastructure projects and increased private sector spending. Key positives for the sector include a strong project pipeline, improving funding availability, and regulatory changes. However, risks remain from land acquisition issues and a shortage of skilled labor. The analyst initiates coverage with a Buy rating on six construction companies, identifying Ahluwalia Contracts as the top pick.