This document discusses investor losses related to passive activities. It provides definitions of key terms like material participation, active participation in real estate, and at-risk amounts. It also addresses how losses from passive activities can be used to offset other income, including portfolio income, active business income, and special rules for real estate professionals and significant participation activities. The document appears to be an educational summary of tax rules around passive losses.

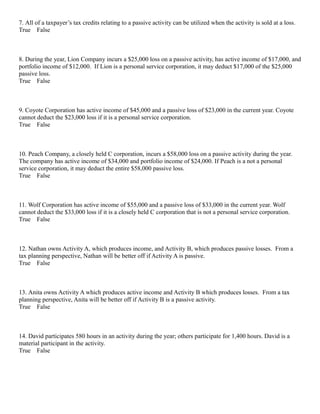

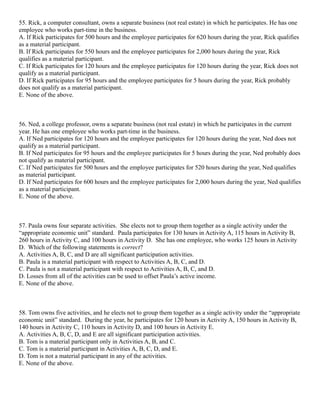

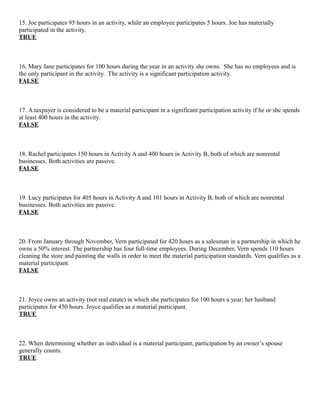

![75. Lucy dies owning a passive activity with an adjusted basis of $90,000. Its fair market value at that date is

$145,000. Suspended losses relating to the property were $75,000. Which of the following statements is true?

A. The heir’s adjusted basis is $145,000, and Lucy’s final deduction is $20,000.

B. The heir’s adjusted basis is $145,000, and Lucy’s final deduction is $75,000.

C. The heir’s adjusted basis is $90,000, and Lucy’s final deduction is $75,000.

D. The heir’s adjusted basis is $220,000, and Lucy has no final deduction.

E. None of the above.

76. Caroyl made a gift to Tim of a passive activity (adjusted basis of $50,000, suspended losses of $20,000, and

a fair market value of $80,000). No gift tax resulted from the transfer.

A. Tim’s adjusted basis is $80,000, and Tim can deduct the $20,000 of suspended losses in the future.

B. Tim’s adjusted basis is $80,000.

C. Tim’s adjusted basis is $50,000, and the suspended losses are lost.

D. Tim’s adjusted basis is $50,000, and Tim can deduct the $20,000 of suspended losses in the future.

E. None of the above.

77. Identify from the list below the type of disposition of a passive activity where the taxpayer keeps the

suspended losses of the disposed activity and utilizes them on a subsequent taxable disposition.

A. Disposition of a passive activity by gift.

B. Nontaxable exchange of a passive activity.

C. Disposition of a passive activity at death.

D. Installment sale of a passive activity.

E. None of the above.

78. Tony is married and files a joint tax return for 2011. He has investment interest expense of $95,000 for a

loan made to him in 2011 to purchase a parcel of unimproved land. His income from investments [dividends

(not qualified) and interest] totaled $18,000. Tony paid $3,600 of real estate taxes on the unimproved land.

Tony also has a $4,500 net long-term capital gain from the sale of stock held as an investment. Calculate Tony’s

maximum investment interest deduction for 2011.

A. $95,000.

B. $22,500.

C. $18,900.

D. $18,000.

E. None of the above.](https://image.slidesharecdn.com/comprehensivevolumechaptechapter11-130305204451-phpapp01/85/Comprehensive-volume-chapte-chapter-11-15-320.jpg)

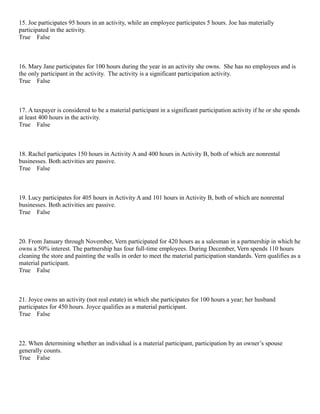

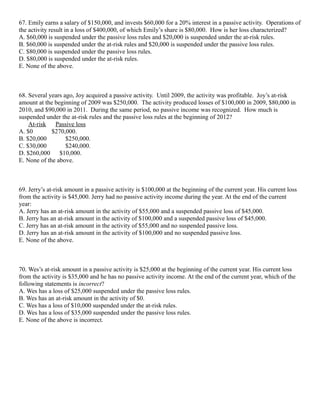

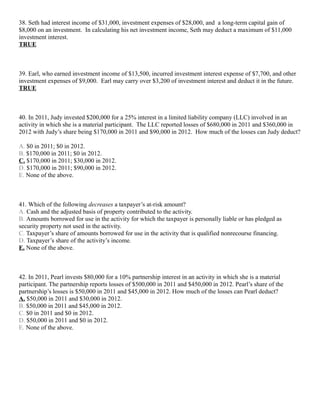

![75. Lucy dies owning a passive activity with an adjusted basis of $90,000. Its fair market value at that date is

$145,000. Suspended losses relating to the property were $75,000. Which of the following statements is true?

A. The heir’s adjusted basis is $145,000, and Lucy’s final deduction is $20,000.

B. The heir’s adjusted basis is $145,000, and Lucy’s final deduction is $75,000.

C. The heir’s adjusted basis is $90,000, and Lucy’s final deduction is $75,000.

D. The heir’s adjusted basis is $220,000, and Lucy has no final deduction.

E. None of the above.

76. Caroyl made a gift to Tim of a passive activity (adjusted basis of $50,000, suspended losses of $20,000, and

a fair market value of $80,000). No gift tax resulted from the transfer.

A. Tim’s adjusted basis is $80,000, and Tim can deduct the $20,000 of suspended losses in the future.

B. Tim’s adjusted basis is $80,000.

C. Tim’s adjusted basis is $50,000, and the suspended losses are lost.

D. Tim’s adjusted basis is $50,000, and Tim can deduct the $20,000 of suspended losses in the future.

E. None of the above.

77. Identify from the list below the type of disposition of a passive activity where the taxpayer keeps the

suspended losses of the disposed activity and utilizes them on a subsequent taxable disposition.

A. Disposition of a passive activity by gift.

B. Nontaxable exchange of a passive activity.

C. Disposition of a passive activity at death.

D. Installment sale of a passive activity.

E. None of the above.

78. Tony is married and files a joint tax return for 2011. He has investment interest expense of $95,000 for a

loan made to him in 2011 to purchase a parcel of unimproved land. His income from investments [dividends

(not qualified) and interest] totaled $18,000. Tony paid $3,600 of real estate taxes on the unimproved land.

Tony also has a $4,500 net long-term capital gain from the sale of stock held as an investment. Calculate Tony’s

maximum investment interest deduction for 2011.

A. $95,000.

B. $22,500.

C. $18,900.

D. $18,000.

E. None of the above.](https://image.slidesharecdn.com/comprehensivevolumechaptechapter11-130305204451-phpapp01/85/Comprehensive-volume-chapte-chapter-11-38-320.jpg)

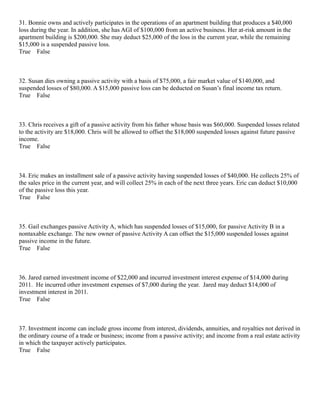

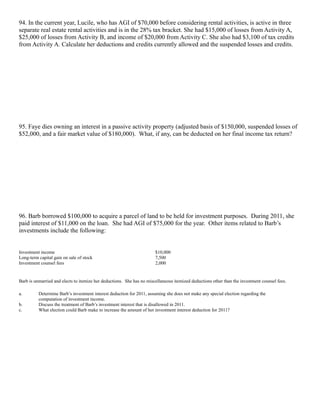

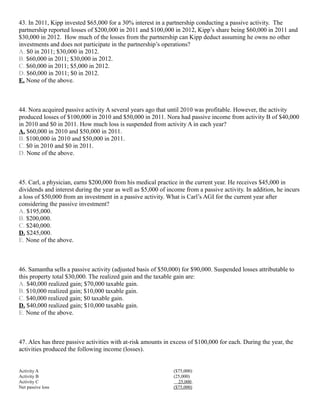

![89. Tangerine Corporation, a closely held (non-personal service) C corporation, earns active income of

$400,000 in the current year. The corporation also receives $35,000 in dividends during the year. In addition,

Tangerine incurs a loss of $60,000 from an investment in a passive activity. What is Tangerine’s income for the

year after considering the passive investment?

A closely held (non-personal service) C corporation can offset passive losses against active, but not portfolio

income. Therefore, Tangerine’s income is $375,000 [($400,000 active income – $60,000 passive loss) + $35,000

portfolio income].

90. Lloyd, a life insurance salesman, earns a $400,000 salary in the current year. As he works only 30 hours per

week in this job, he has time to participate in several other businesses. He owns an ice cream parlor and a car

repair shop in Tampa. He also owns an ice cream parlor and a car repair shop in Portland and a car repair shop

in St. Louis. A preliminary analysis on December 1 of the current year shows projected income and losses for

the various businesses as follows:

Income (Loss)

Tampa ice cream parlor (95 hours participation) $56,000

Tampa car repair shop (140 hours participation) (89,000)

Portland ice cream parlor (90 hours participation) 34,000

Portland car repair shop (170 hours participation) (41,000)

St. Louis car repair shop (180 hours participation) (15,000)](https://image.slidesharecdn.com/comprehensivevolumechaptechapter11-130305204451-phpapp01/85/Comprehensive-volume-chapte-chapter-11-42-320.jpg)

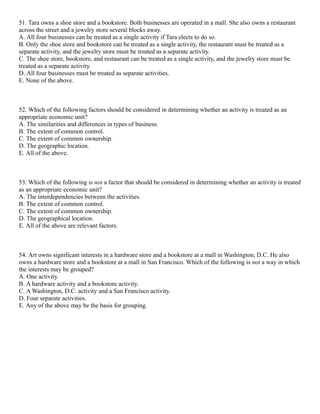

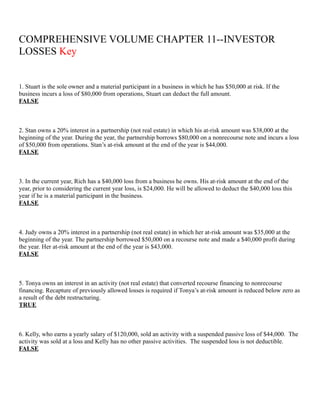

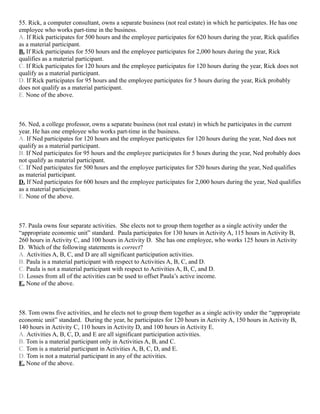

![Activity B (25,000)

Activity C 20,000

Net loss ($20,000)

Utilized loss 20,000

Suspended loss $ –0–

Utilized credit $ 1,400

Suspended credit $ 1,700

After deducting the $20,000 loss, Lucile has an available deduction equivalent of $5,000 [$25,000 (maximum loss allowed) – $20,000 (utilized

loss)]. Then the maximum amount of credits Lucile may claim is $1,400 [$5,000 deduction equivalent ´ .28 (marginal tax bracket)] that is allocated to

Activity A.

95. Faye dies owning an interest in a passive activity property (adjusted basis of $150,000, suspended losses of

$52,000, and a fair market value of $180,000). What, if any, can be deducted on her final income tax return?

On Faye’s final income tax return, a deduction of $22,000 is allowed, determined as follows:

FMV of property at death $180,000

Adjusted basis of property (150,000)

Increase (step-up) in basis $ 30,000

Suspended loss ($ 52,000)

Increase in basis 30,000

Suspended loss allowable on Faye’s final income tax return ($ 22,000)

96. Barb borrowed $100,000 to acquire a parcel of land to be held for investment purposes. During 2011, she

paid interest of $11,000 on the loan. She had AGI of $75,000 for the year. Other items related to Barb’s

investments include the following:

Investment income $10,000

Long-term capital gain on sale of stock 7,500

Investment counsel fees 2,000

Barb is unmarried and elects to itemize her deductions. She has no miscellaneous itemized deductions other than the investment counsel fees.

a. Determine Barb’s investment interest deduction for 2011, assuming she does not make any special election regarding the

computation of investment income.

b. Discuss the treatment of Barb’s investment interest that is disallowed in 2011.

c. What election could Barb make to increase the amount of her investment interest deduction for 2011?

a. Barb’s investment interest deduction is limited to net investment income, which is computed as follows:

Income from investments $10,000

Less: Investment expenses* (500)

Net investment income $ 9,500](https://image.slidesharecdn.com/comprehensivevolumechaptechapter11-130305204451-phpapp01/85/Comprehensive-volume-chapte-chapter-11-45-320.jpg)

![*Because Barb has no other miscellaneous itemized deductions, the deductible investment expenses are the smaller of (1)

$2,000, the amount of investment expenses included in the total of miscellaneous itemized deductions subject to the 2%-of-AGI

floor, or (2) $500, the amount of miscellaneous expenses deductible after the 2%-of-AGI floor is applied [$2,000 – $1,500 (2%

of $75,000 AGI)].

Barb’s investment interest expense deduction in 2011 would be limited to $9,500, the amount of net investment income. The

balance of $1,500 would be disallowed in 2011.

Total investment interest expense $11,000

Less: Net investment income (9,500)

Investment interest disallowed in 2011 $ 1,500

b. The $1,500 of investment interest disallowed may be carried over and becomes investment interest expense in the subsequent

year subject to the net investment income limitation in 2012.

c. Barb could increase her investment interest deduction by electing to treat the LTCG as investment income. This would increase

her investment income for purposes of calculating her investment interest deduction. So she would be able to deduct the full

$11,000 of investment interest expense. If she makes the election, the amount so elected would not be available for beneficial

alternative tax rate treatment for net capital gain.

97. Explain how a taxpayer’s at-risk amount in a business venture is adjusted periodically.

Once a taxpayer’s initial at-risk amount in an investment is established, it must be revised periodically to reflect

the impact of various events. The at-risk amount generally is increased each year by the taxpayer’s share of

income and decreased by the taxpayer’s share of losses from the activity. In the case of a partnership, the at-risk

amounts are increased when the partnership increases its debt and decreased when the partnership reduces its

debt. Cash and the adjusted basis of property contributed to the activity increase the at-risk amount, while

withdrawals decrease the at-risk amount.

98. Identify how the passive loss rules broadly classify various types of income and losses. Provide examples of

each category.

The passive loss rules require income and losses to be classified into one of three categories: active, passive, or

portfolio. Active income includes salary and wages, profit from a trade or business in which the taxpayer is a

material participant, and gain on the sale of assets used in an active trade or business. Portfolio income includes

interest, dividends, annuities, and royalties not derived in the ordinary course of a trade or business. The final

category, passive income or loss, is generated by a passive activity. The following activities are treated as

passive: (1) any trade or business or income-producing activity in which the taxpayer does not materially

participate, and (2) subject to exceptions, all rental activities, whether the taxpayer materially participates or

not.](https://image.slidesharecdn.com/comprehensivevolumechaptechapter11-130305204451-phpapp01/85/Comprehensive-volume-chapte-chapter-11-46-320.jpg)