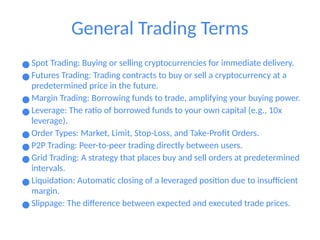

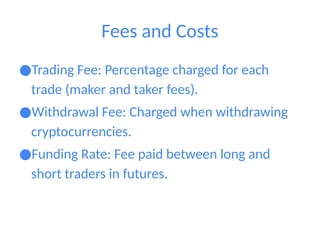

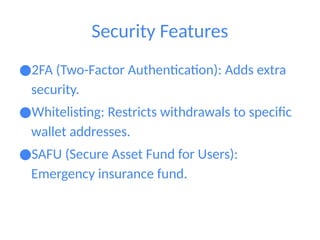

The document provides a comprehensive overview of trading terms and concepts specific to Binance, including spot trading, futures trading, margin trading, and various order types. It highlights key features of Binance such as Binance Earn, Launchpad, and Binance Smart Chain, along with different types of cryptocurrencies like altcoins, stablecoins, and NFTs. Additionally, it covers risk management strategies, security features, and important market indicators.