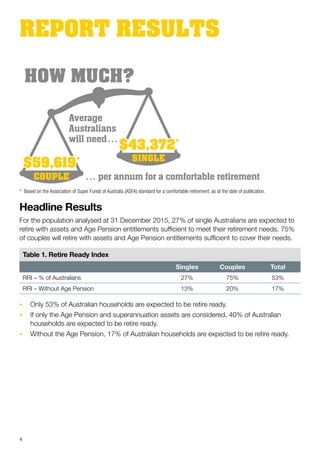

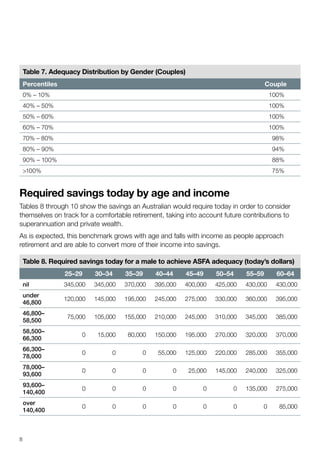

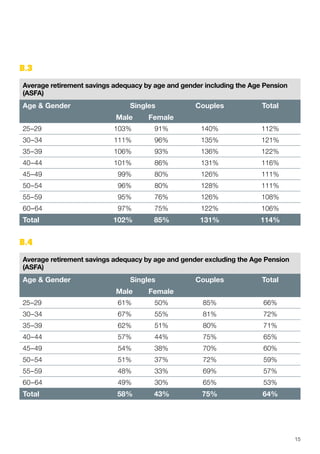

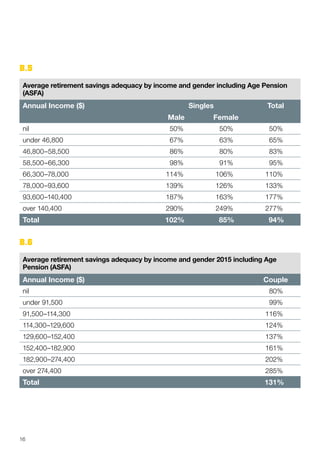

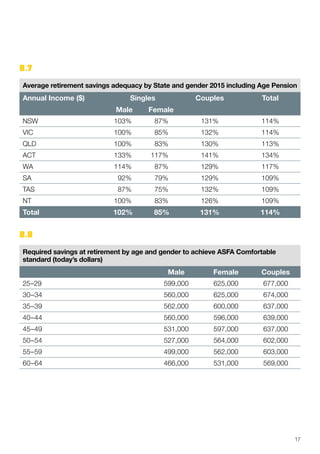

The CommBank Retire Ready Index report indicates that 53% of Australian households are expected to be financially prepared for a comfortable retirement, but this figure drops significantly to 17% when excluding the age pension. The report highlights disparities in retirement readiness between demographics, notably that couples are more likely to be prepared than singles and women generally have lower retirement savings due to various socio-economic factors. It emphasizes the critical role of superannuation in securing retirement funds, especially for younger Australians, and provides five actionable tips for improving retirement readiness.