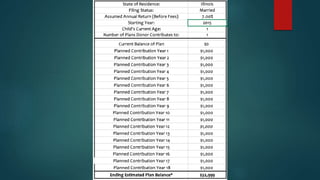

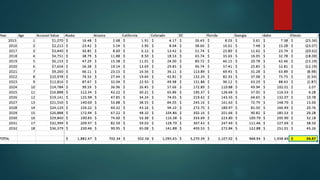

The document discusses various options for long-term college savings plans such as 529 plans, Coverdell ESAs, UGMA/UTMA accounts, and prepaid tuition plans. It notes that college costs are increasing exponentially and it is best to start saving early and make regular contributions. The key aspects and tradeoffs of each option are outlined, including tax benefits, investment control, risk level, ability to transfer funds, eligible withdrawals, and impact on financial aid eligibility. The document recommends focusing on low fee 529 plans and doing thorough research when considering options.