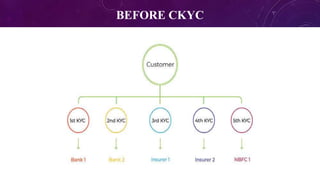

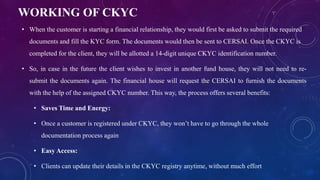

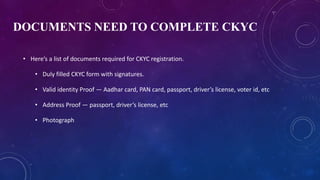

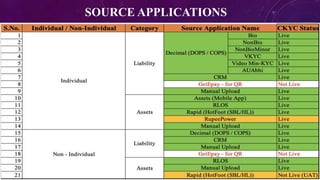

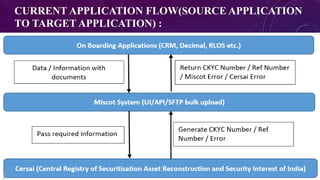

The document discusses the Central Know Your Customer (CKYC) initiative in India, which simplifies the traditional KYC process for onboarding customers in the financial sector. CKYC allows customers to undergo KYC verification only once with any financial entity, streamlining documentation and enhancing security against fraud. The system, managed by CERSAI, utilizes a 14-digit identification number and ensures easier access and updates to customer records while facilitating compliance for financial institutions.