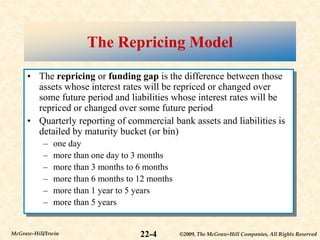

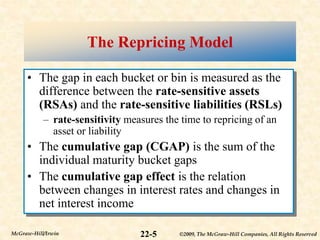

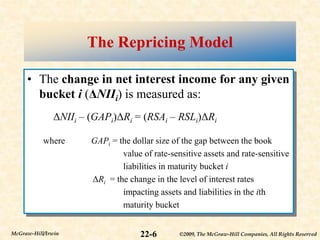

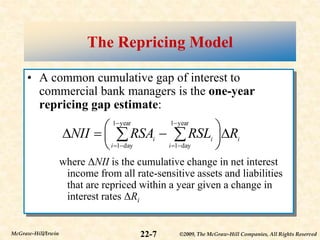

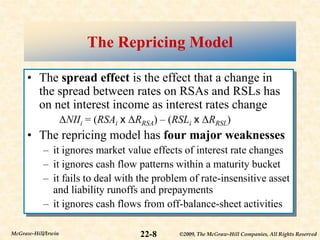

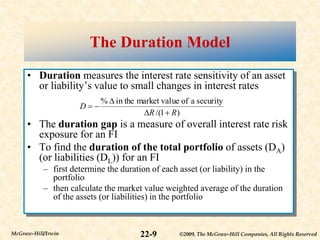

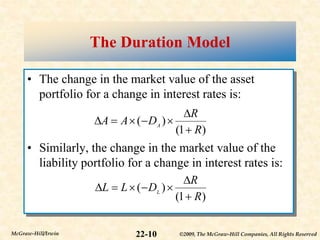

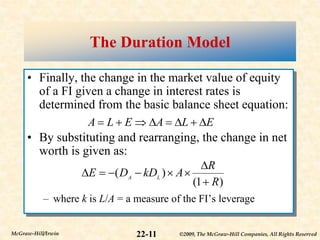

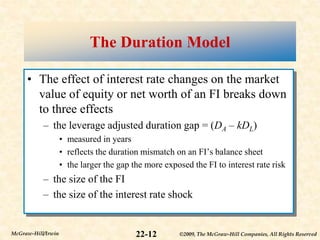

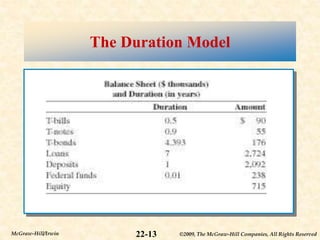

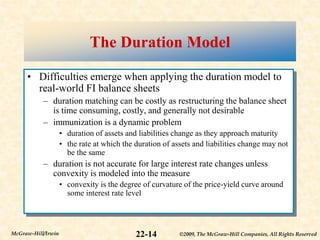

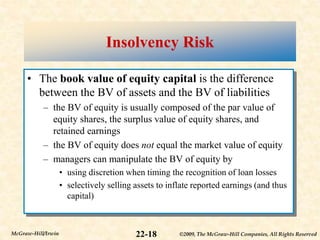

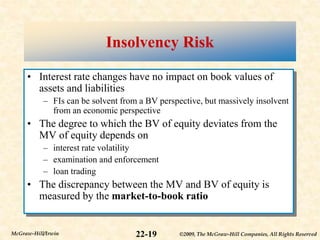

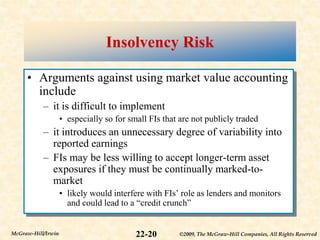

The document discusses managing interest rate risk and insolvency risk for financial institutions, detailing methods like the repricing model and duration model to assess interest rate exposure. It emphasizes the role of equity capital in mitigating insolvency risk and the differences between market value and book value of equity, highlighting the regulatory challenges. Additionally, the document outlines the consequences of interest rate changes on asset and liability values, and the impact on the financial health of institutions.