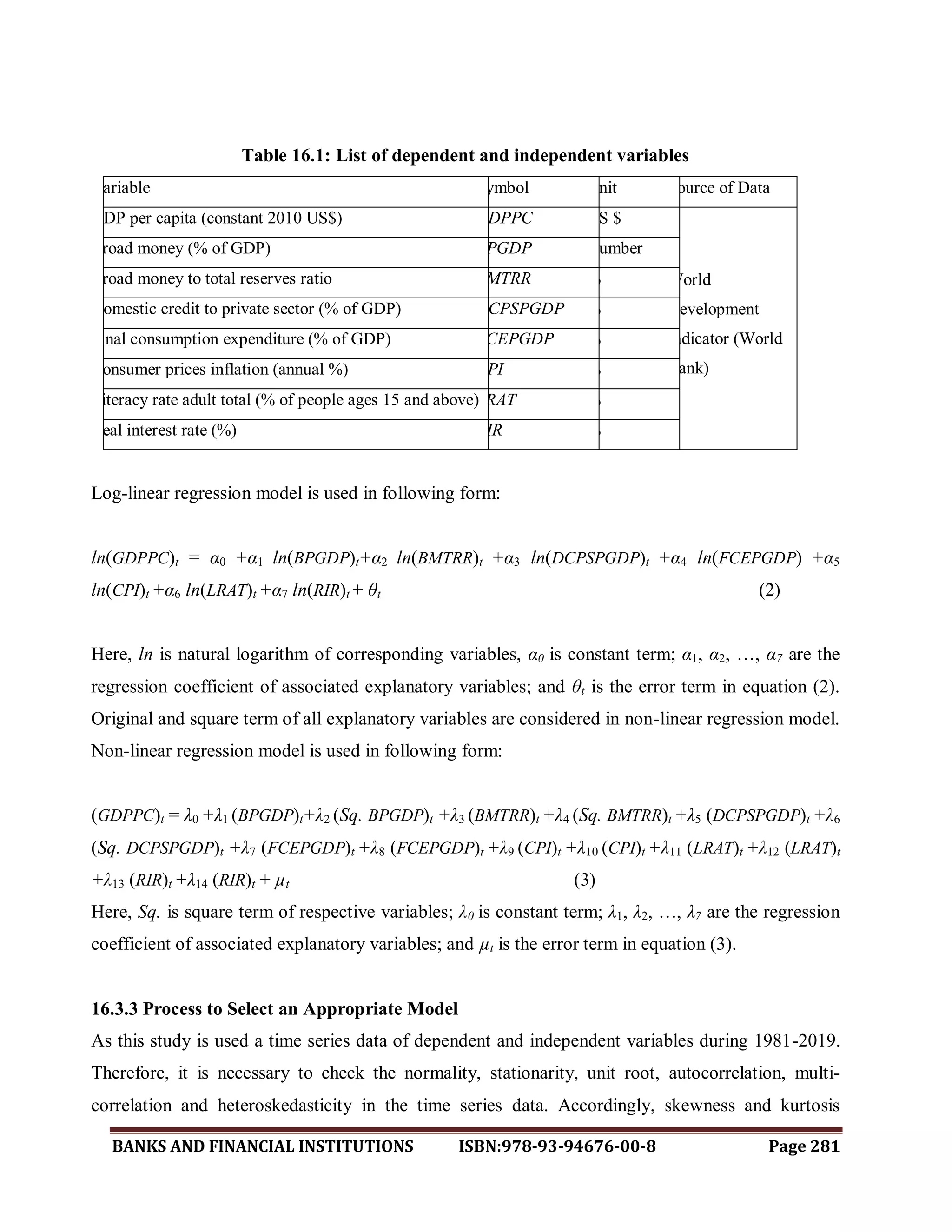

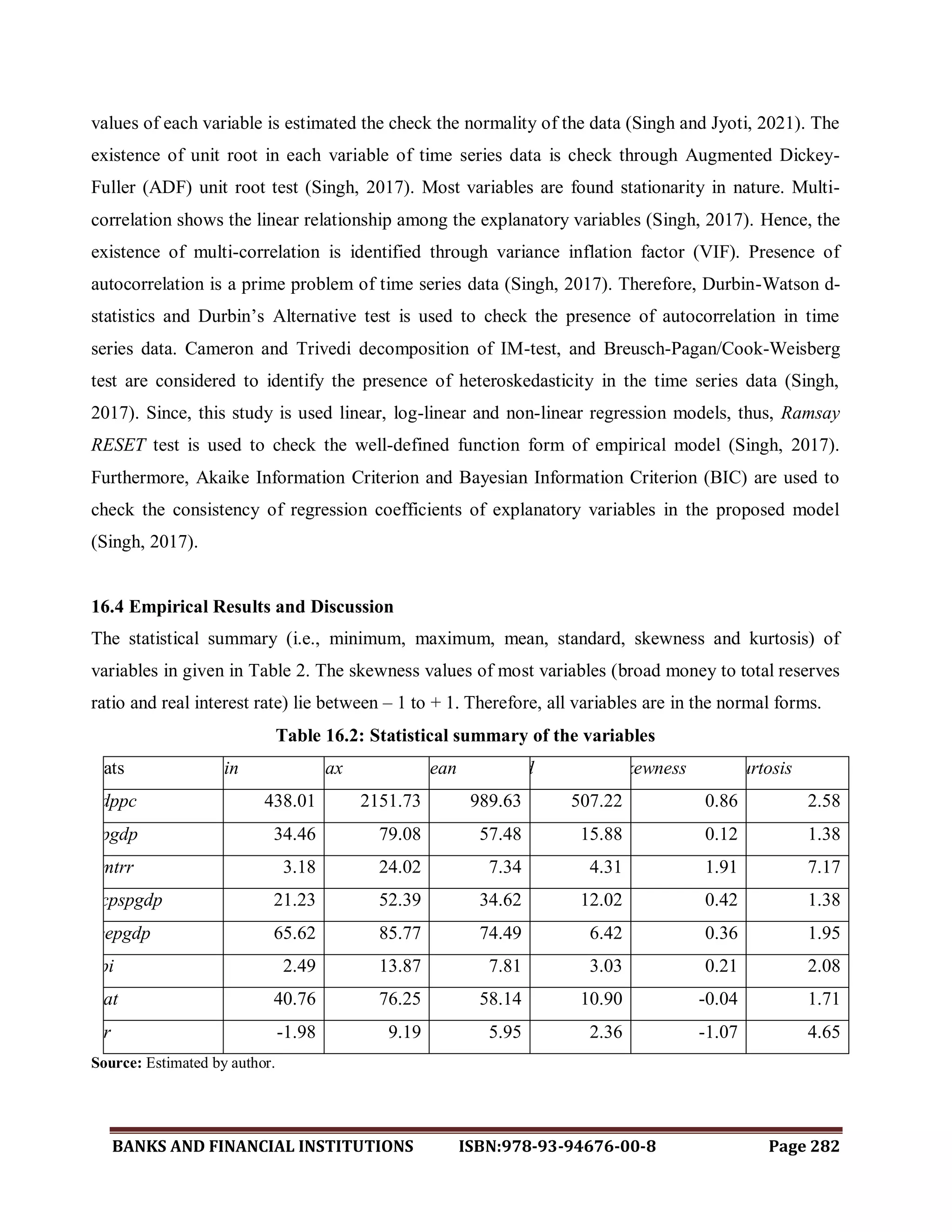

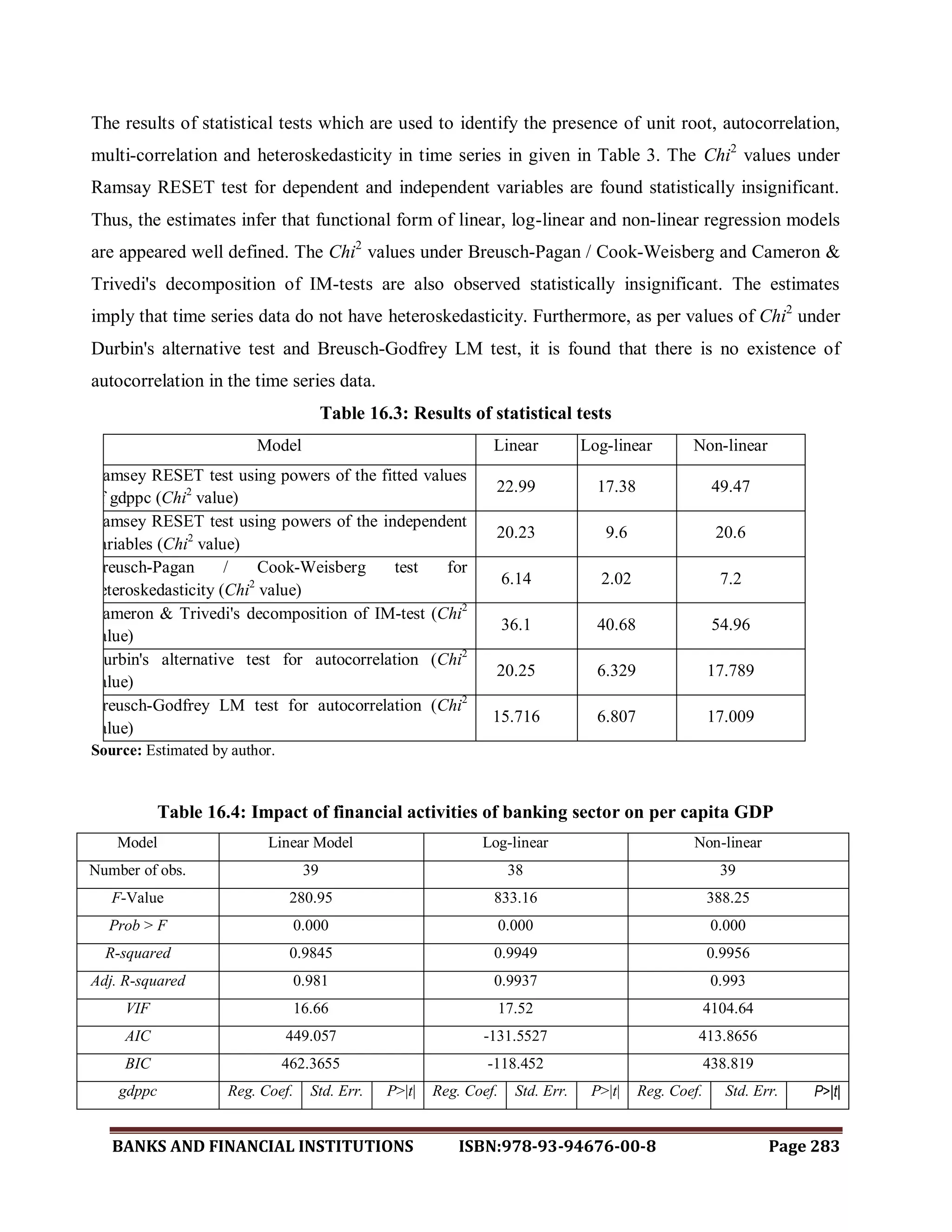

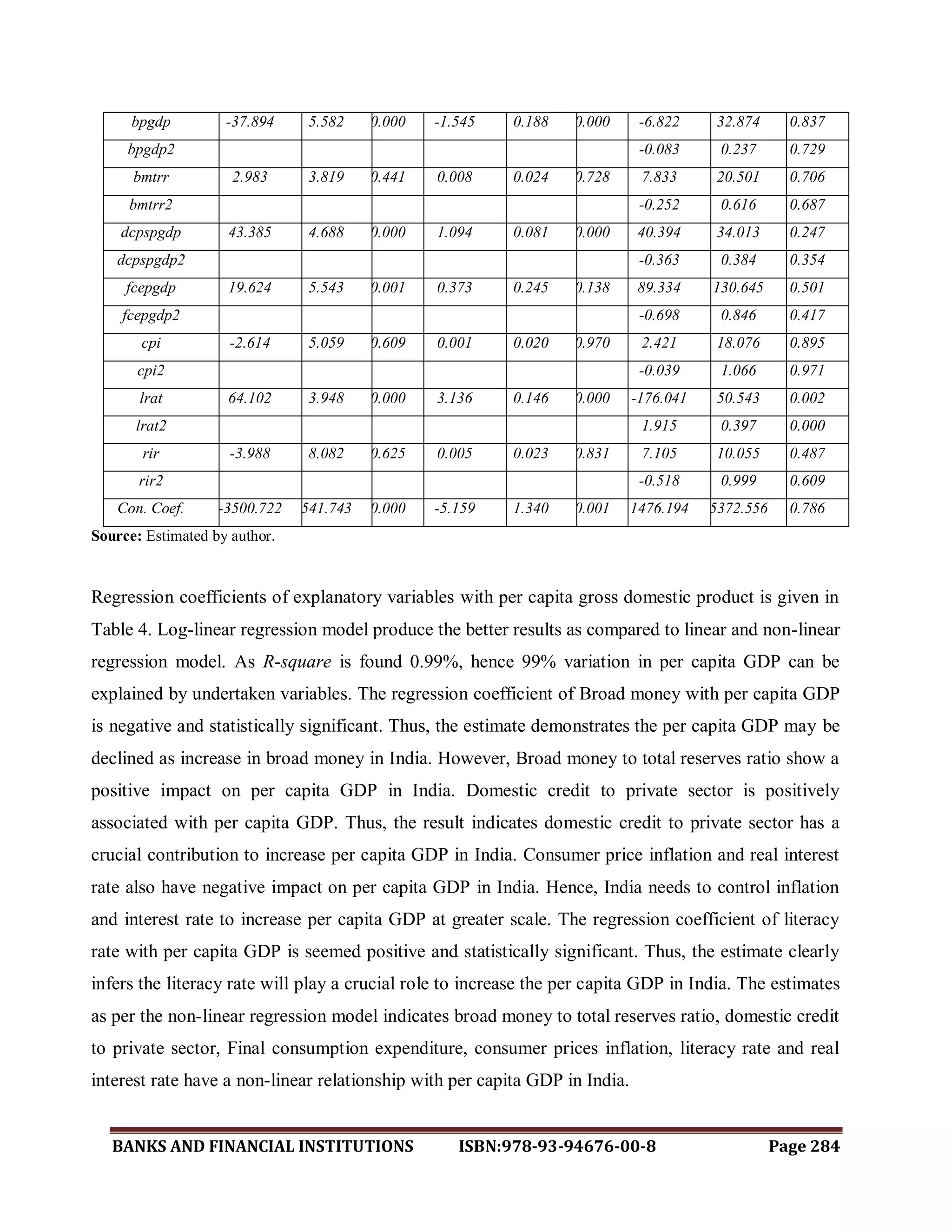

The document examines the impact of the banking sector on economic development in India, utilizing a time series analysis from 1981 to 2019 to assess various financial indicators in relation to per capita GDP. Key findings indicate that factors such as broad money to total reserves and domestic credit positively influence economic growth, while inflation and real interest rates have negative effects. The study underscores the crucial role of a well-functioning banking sector in fostering economic growth and development through increased efficiency and financial accessibility.