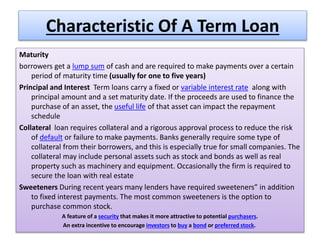

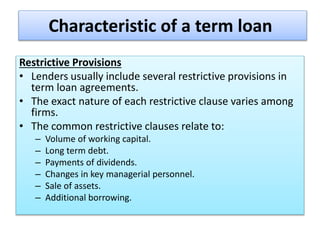

Term loans are commonly used by small businesses to purchase equipment, buildings, or other fixed assets needed to operate. They typically have maturities of 1-5 years and require collateral. Interest rates can be fixed or variable. Lenders often include restrictive covenants in loan agreements regarding working capital, debt levels, dividends, management changes, asset sales, and additional borrowing. Common sources of term loans include banks, insurance companies, finance companies, the SBA, and other government agencies.