CEMBUREAU is the representative organization of the cement industry in Europe. In 2011:

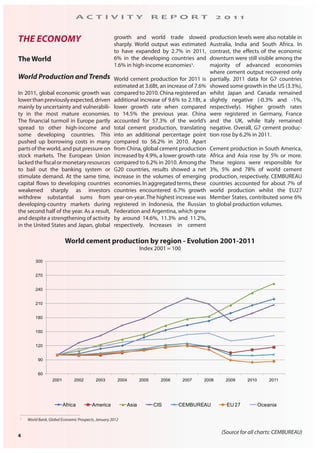

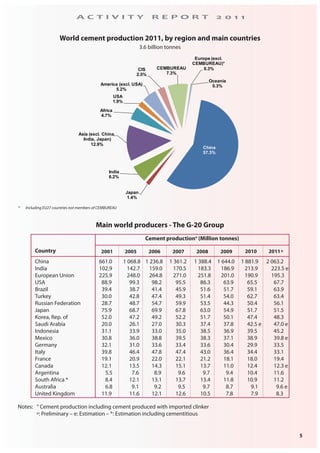

- Global economic growth slowed due to the financial crisis in Europe. World cement production increased 7.6% to 3.6 billion tonnes, with China accounting for 57.3% of production.

- Cement production increased in emerging economies like Indonesia, Russia, and Argentina but declined in most advanced economies due to economic downturn.

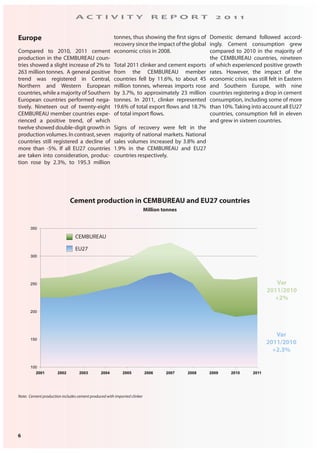

- CEMBUREAU countries accounted for about 7% of world cement production, while EU27 members contributed around 6% of the global total.

- Climate change remained a key issue but the EU's unilateral actions on international flights and low CO2 prices raised doubts about

![23

A C T I V I T Y R E P O R T 2 0 1 1

Energy Efficiency Directive

In 2011, the European Commission

adopted the Energy Efficiency Action

Plan3

. The Action Plan is designed to

provide an enhanced framework for

national energy efficiency and savings

policies. It also reviews the previous

Energy Efficiency Action Plan4

. This

was followed by a proposal for an

Energy Efficiency Directive (EED)5

.

The proposal set out several energy

efficiency requirements for end-user

sectors, such as the cement industry.

A lot is at stake for the European

cement industry, both positive and

negative. In this respect, CEMBUREAU,

echoing the position of the European

Construction Forum in which it is

active, indicated that action to

renovate Europe’s building stock, to

reduce energy use in both new and

existing buildings and to improve the

energy efficiency of infrastructure was

a desirable goal. Buildings represent

40% of the total energy consumption

in Europe and energy efficiency in

buildings is the most effective way to

reach the EU’s objective of 20%

primary energy savings in 2020.

Therefore, whilst the Association

supported the amendments which

proposed the strengthening of energy

efficiency in buildings on top of the

Energy Performance of Buildings

Directive (EPBD)6

requirements, it

regretted that they are confined to

existing buildings, highlighting that

the opportunity to tackle also new

buildings should not be missed.

CEMBUREAU also stressed the need

to ensure that the EED does not

introduce distortion of competition

between construction materials, as

well as the fact that the whole life

cycle perspective should be taken

into account in the assessment of

the energy efficiency of buildings,

rather than assessment at product

level.

In addition, concerns were raised

regarding the proposal which deals

with energy efficiency in energy

intensive industries. Regarding the

mandatory energy audits proposed,

the Association advocated in favour of

allowing qualified in-house experts to

carry out such audits.

In relation to the obligation for new

and refurbished industrial installations

to capture all waste heat and export

such heat to district heating and

cooling networks, CEMBUREAU

stressed that, in some industries, like

the cement industry, solutions other

than connecting to district heating

and cooling networks would be more

efficient and economically viable.Thus

the Association indicated that the

proposal should allow for this.

The EED proposal also envisages to

allow the setting aside of allowances

under the EU-ETS as a means to

sustain the price of EUAs. Following

other energy intensive industries,

CEMBUREAU has agreed that the

introduction of such set-aside through

the EED would not lead to energy

efficiency and is, therefore, inappropri-

ate. The Association also stressed that

incentives for emission reductions

must, in principle, only spring from

transparent and explicit political

agreements on the overall cap on

emissions, and not from interference

with the carbon market (see also under

Climate Change).

CEMBUREAU was furthermore con-

cerned that the EED appeared to mix

energy efficiency and absolute energy

savings. In the proposal, the focus is

on energy savings, rather than real

efficiency. CEMBUREAU proposed to

streamline the proposal in the sense

that energy efficiency is supported,

and – where conflicting – absolute

energy savings are not set at any cost.

CEMBUREAU will continue to monitor

developments in this field in 2012.

Industrial Emissions

Directive (IED)

On 6 January 2011, the Industrial

Emissions Directive (IED)7

entered into

force. During the course of the year,

the IED Article 13 Forum was granted

the formal status of an expert group

for the exchange of information

pursuant to Article 13 of the IED.

To receive a permit, installations

covered by IPPC rules must apply

“best available techniques” (BATs) so

as to optimise their all-round

environmental performance. Emission

Limit Values (ELVs) must be set within

the scope of the ‘BAT conclusions’.

Regarding the cement industry, at

the very end of 2011, the serious

concern that the European

Commission intended to derive ELVs

and derogations as BAT conclusions

from the Cement BAT Reference

Document (BREF), which was revised

under the IPPC, was confirmed.

Efforts by the European Commission

to require and apply retrospectively

BAT conclusions to BREFs finalised, like

the Cement, Lime and Magnesium

Oxide (CLM) BREF, under the former

IPPC Directive would result in a real

conundrum. CEMBUREAU has strongly

opposed this idea and will continue to

liaise with the European Lime

Association (EuLA) and the European

Association of Mining Industries

(Euromines), which share the same

BREF, to try and ensure that our

message is heeded.

3 Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions

Energy Efficiency Plan 2011, COM(2011)109

4 Communication from the Commission - Action Plan for Energy Efficiency: Realising the Potential, COM(2006)545

5 Proposal for a Directive of the European Parliament and of the Council on energy efficiency and repealing Directives 2004/8/EC and 2006/32/EC, COM(2011)370

6 Directive 2002/91/EC of the European Parliament and of the Council of 16 December 2002 on the energy performance of building

7 2010/75/EU, recasting the former Industrial Pollution Prevention and Control [IPPC] Directive](https://image.slidesharecdn.com/e21c6ee8-5900-4ca4-9f7b-52b206de57a3-170107180304/85/CEMBUREAU-activity-Report-25-320.jpg)