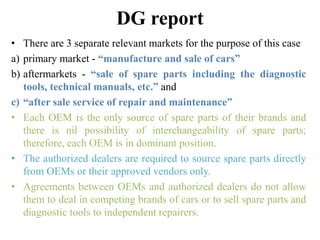

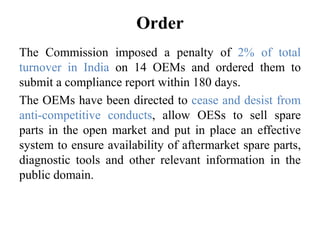

The document summarizes an Indian Competition Commission case regarding alleged anti-competitive practices in the automobile industry. The Commission found that original equipment manufacturers (OEMs) dominate three separate relevant markets: car sales, spare parts sales, and repair/maintenance. It ruled that OEMs' agreements restricting independent suppliers' and dealers' sales of spare parts amounted to abuse of dominance and anti-competitive vertical agreements. The Commission imposed fines and ordered OEMs to allow open spare parts markets and independent repairers access to parts/tools.