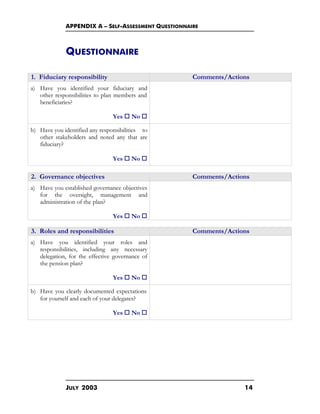

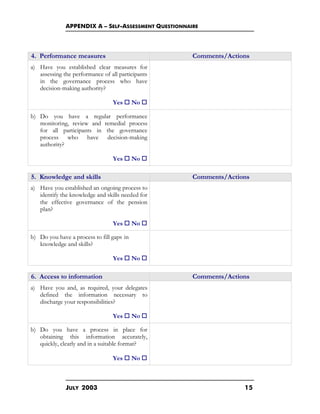

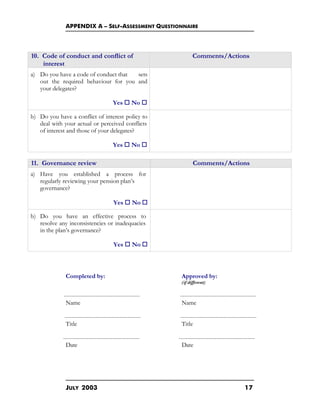

This document provides guidelines for pension plan governance, including 11 principles established by CAPSA (Canadian Association of Pension Supervisory Authorities). The document includes an introduction explaining the context and purpose of the guidelines. It then lists the 11 principles, which address issues like fiduciary responsibility, governance objectives, roles and responsibilities, performance monitoring, risk management, and regular governance reviews. The guidelines are intended to help pension plan administrators meet their governance responsibilities in overseeing pension plans.