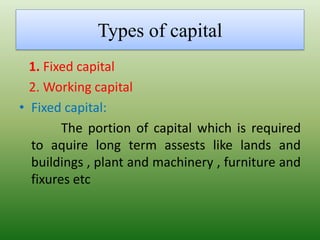

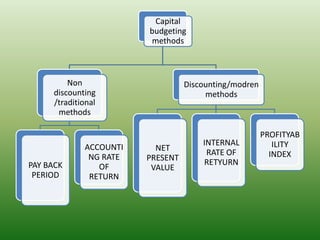

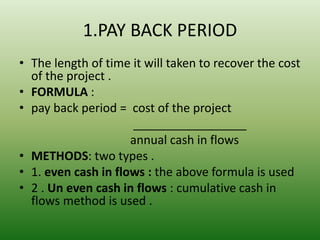

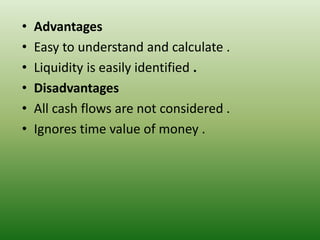

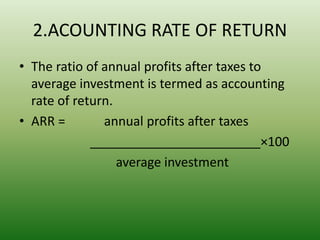

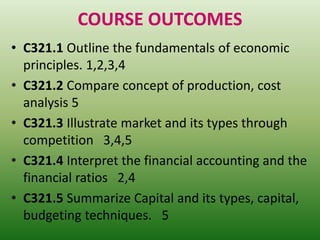

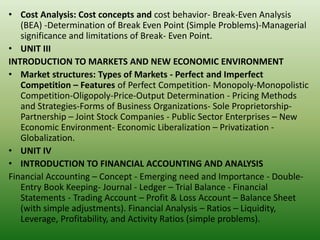

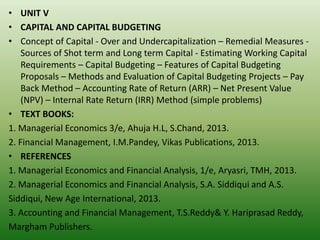

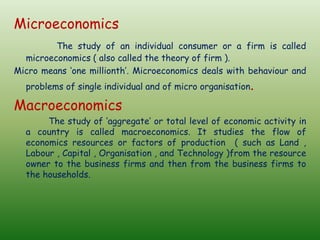

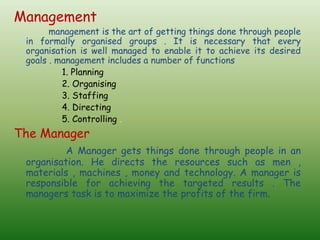

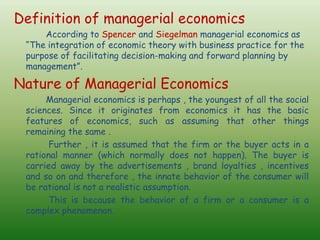

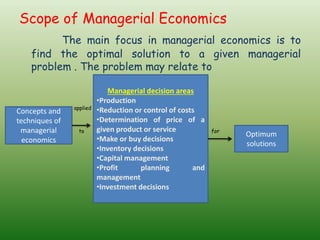

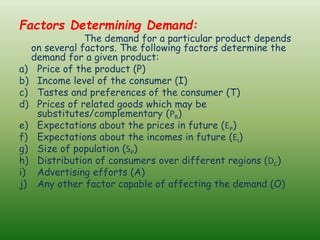

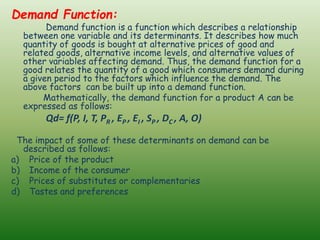

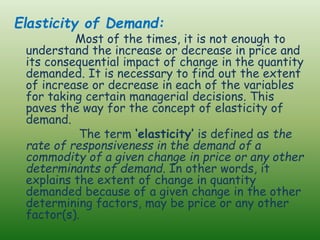

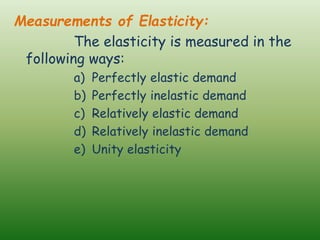

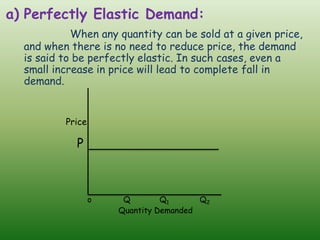

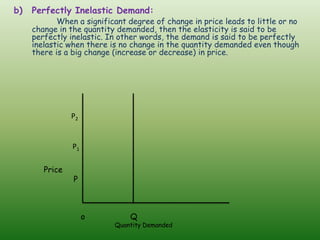

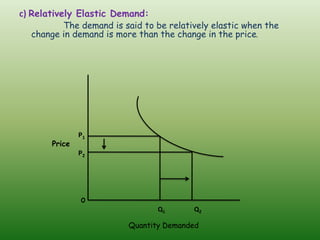

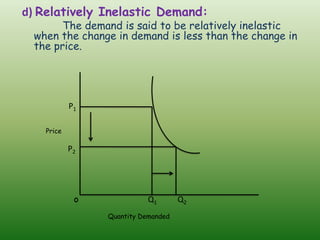

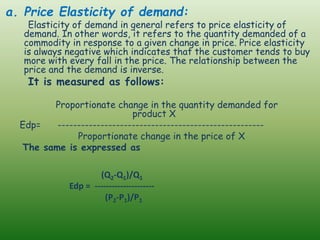

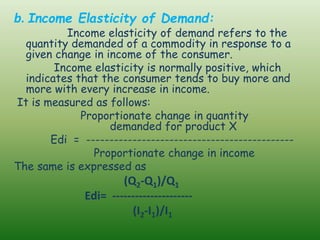

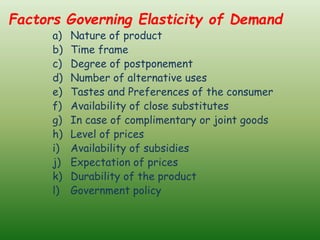

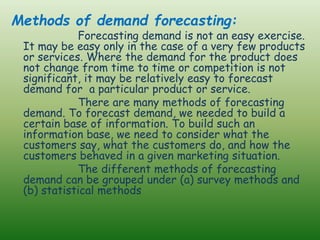

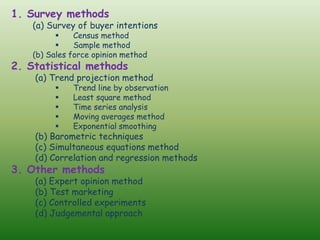

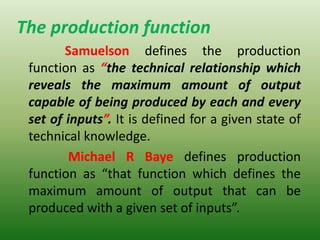

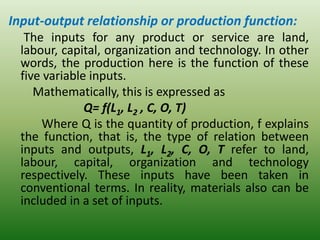

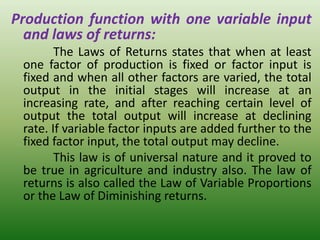

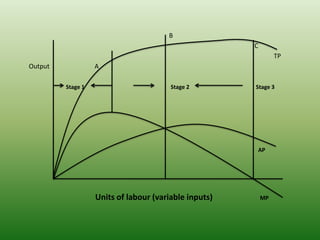

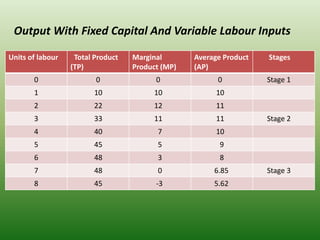

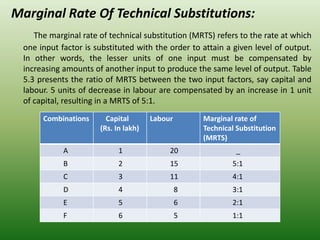

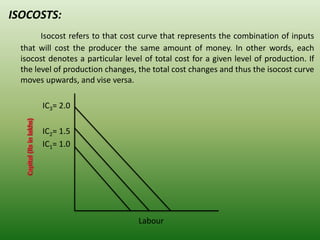

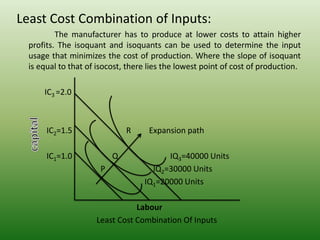

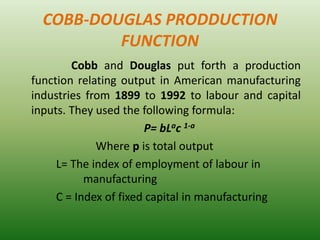

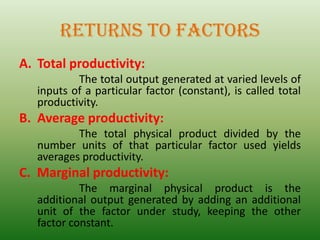

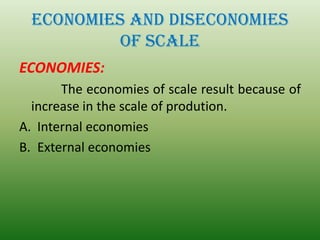

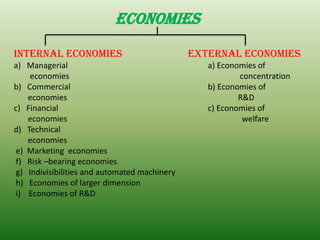

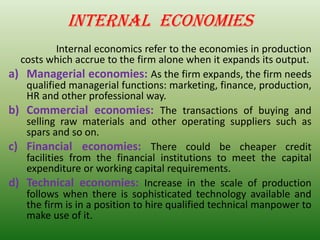

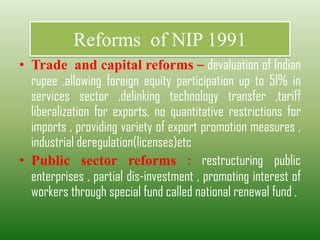

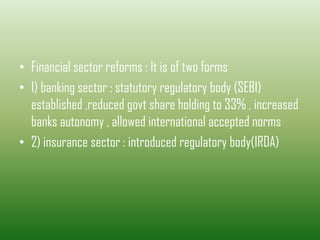

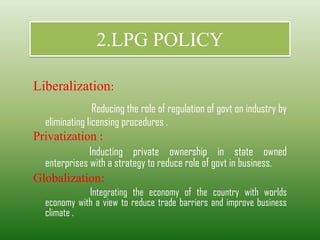

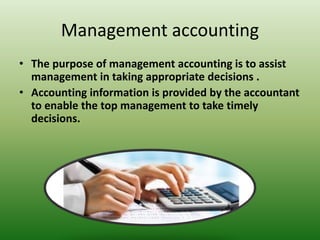

The document provides a comprehensive overview of managerial economics and financial analysis, detailing fundamental economic principles, production and cost analysis, market structures, financial accounting, capital budgeting, and methods of demand forecasting. It outlines course outcomes and the relationships between concepts applicable to business practices. Additionally, the text discusses managerial decision-making areas, the nature and types of demand, elasticity of demand, and various methods of demand forecasting.

![Journal

• The word Journal has been derived from the

French word “Jour” which means daily

records.

• Another name “Day book”

• Journal is the first in which transactions are

recorded in a chronological order[date

wise],the moment they take place in

business.](https://image.slidesharecdn.com/befappt-241002163731-5d882119/85/Business-economics-notes-for-btech-students-158-320.jpg)

![Format of Journal

Date particulars Lf

no

Dr.

Amount

[Rs]

Cr.

Amount[

Rs]

[debit ends with] -Dr.

[credit start with] To

(narration start as being…… and must be

with in brackets)](https://image.slidesharecdn.com/befappt-241002163731-5d882119/85/Business-economics-notes-for-btech-students-159-320.jpg)