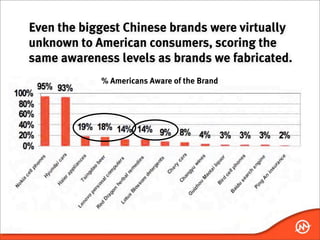

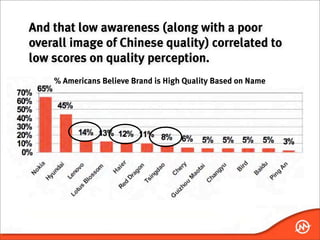

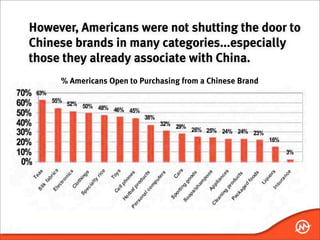

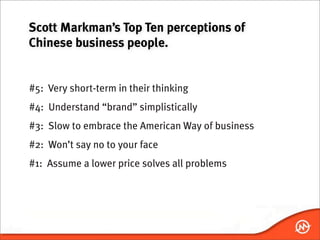

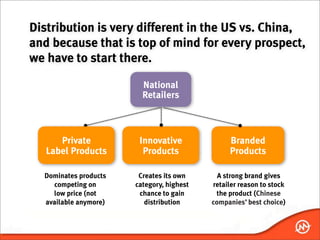

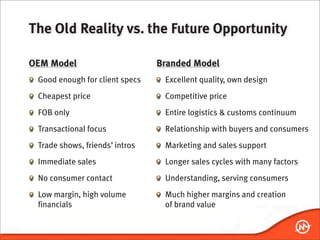

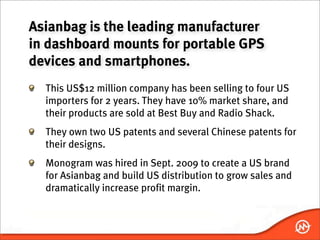

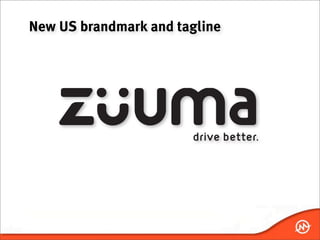

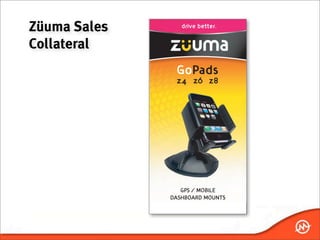

The document discusses Monogram Group's work helping Chinese companies enter the US market through branding. It outlines Monogram's research finding low awareness of Chinese brands in the US. The document then details Monogram's process of developing brand strategies, including creating a new US brand called Züuma for a Chinese GPS mount company called Asianbag. Monogram established US operations for Asianbag and helped launch its new branded products.