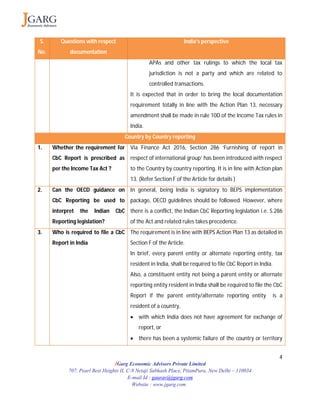

The document discusses the implementation of a three-tier transfer pricing documentation framework in India in accordance with BEPS Action Plan 13, which aims to enhance transparency and consistency in tax compliance for multinational enterprises (MNEs). It outlines India's compliance as a G20 member, detailing the requirements for a master file, local file, and country-by-country reporting, along with associated penalties for non-compliance. The changes are positioned to provide tax administrations with necessary information for risk assessment and auditing while aligning Indian tax regulations with OECD guidelines.