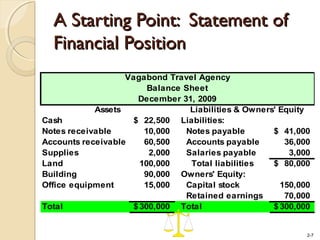

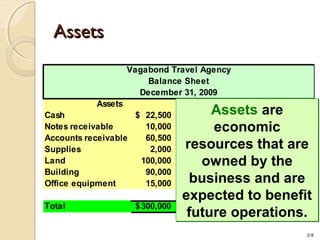

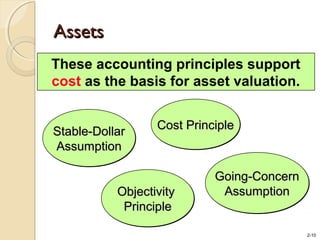

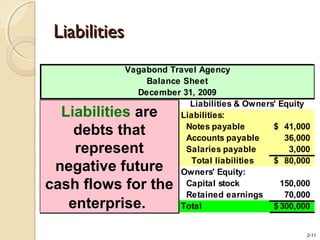

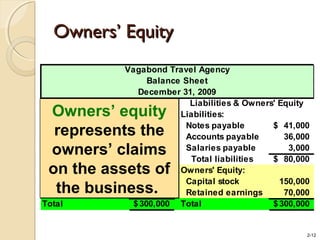

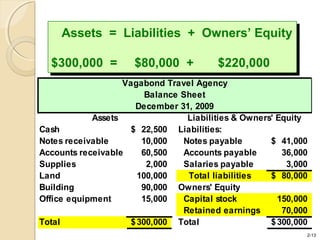

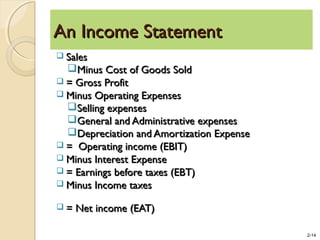

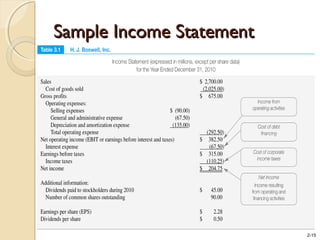

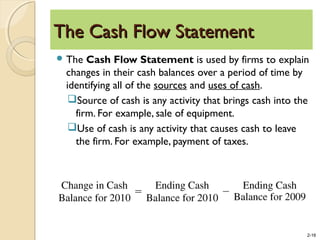

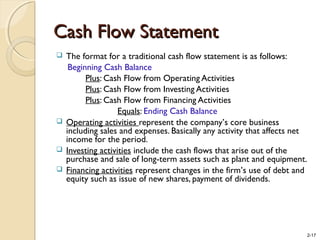

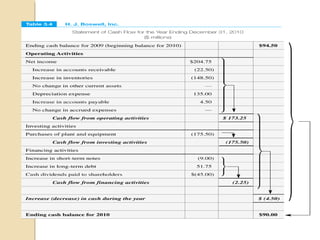

The document outlines the three primary financial statements: the income statement, balance sheet, and cash flow statement, explaining their purpose and how they depict financial data over specific time periods or at specific dates. It uses the example of the Vagabond Travel Agency to illustrate the elements of these statements, discussing assets, liabilities, and owners' equity, as well as the accounting equation. Additionally, it details the cash flow statement's structure, emphasizing the sources and uses of cash within a business.