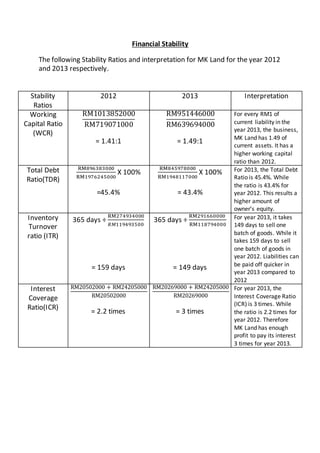

Group members analyzed financial ratios and stability ratios to evaluate MK Land Holding Bhd for investment recommendation. While some ratios improved from 2012-2013 like return on equity and inventory turnover, the group recommends against investing due to MK Land's share price consistently decreasing more than the KLCI index. The group also notes the interest coverage ratio could be higher.