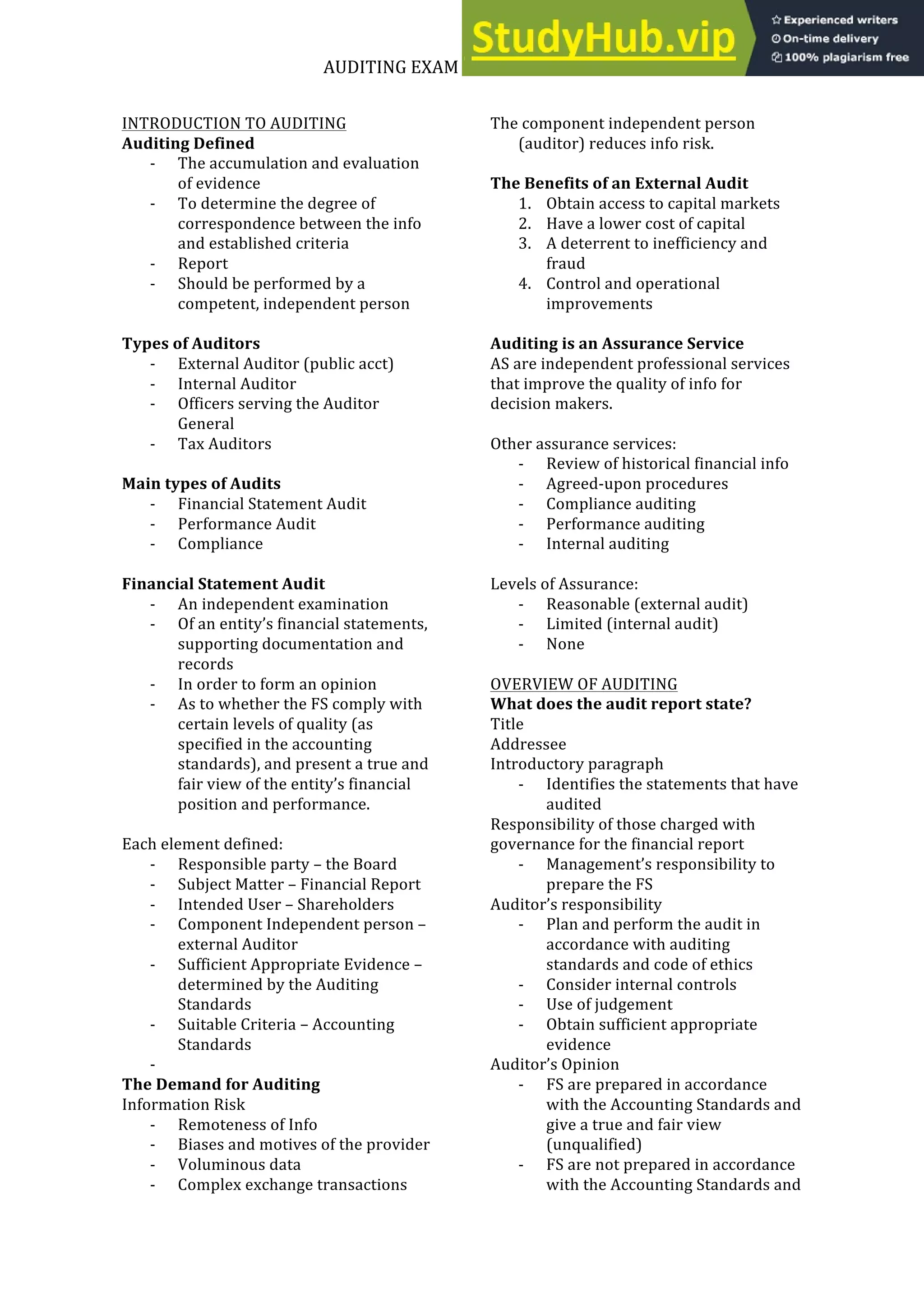

Auditing is defined as the accumulation and evaluation of evidence to determine the degree of correspondence between financial information and established criteria, and to report on the findings. The main types of audits are financial statement audits, performance audits, and compliance audits. A financial statement audit provides an independent examination of an entity's financial statements and records to determine if they comply with accounting standards and present a true and fair view. Auditing reduces information risk and provides benefits such as access to capital markets and deterrence of fraud. Audits require the auditor to exercise professional skepticism and make judgments based on sufficient evidence.