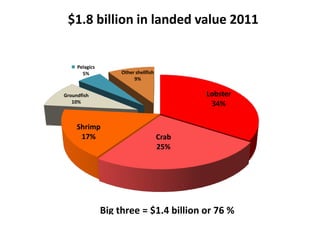

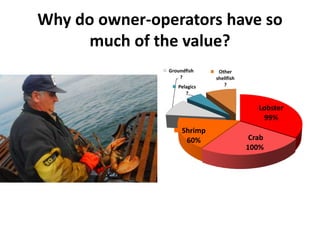

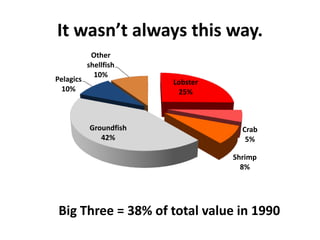

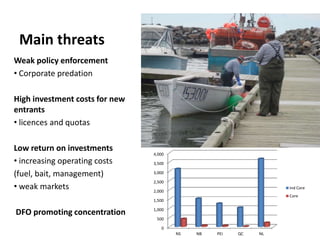

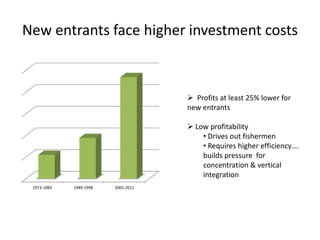

Canada's Atlantic fisheries represent a $1.8 billion industry dominated by three species - lobster, shrimp, and crab - which account for 76% of the total landed value. The industry is highly decentralized, with individual owner-operators representing 75% of the landed value. While corporate ownership has increased over time, owner-operators still control the vast majority of lobster, crab, and 60% of shrimp landings. The owner-operator model faces threats from high investment costs for new entrants, weak markets, and the potential for increased corporate consolidation and vertical integration. Alternatives being explored to support the owner-operator model include fleet buybacks, initiatives to facilitate intergenerational transfer of licences, and marketing/