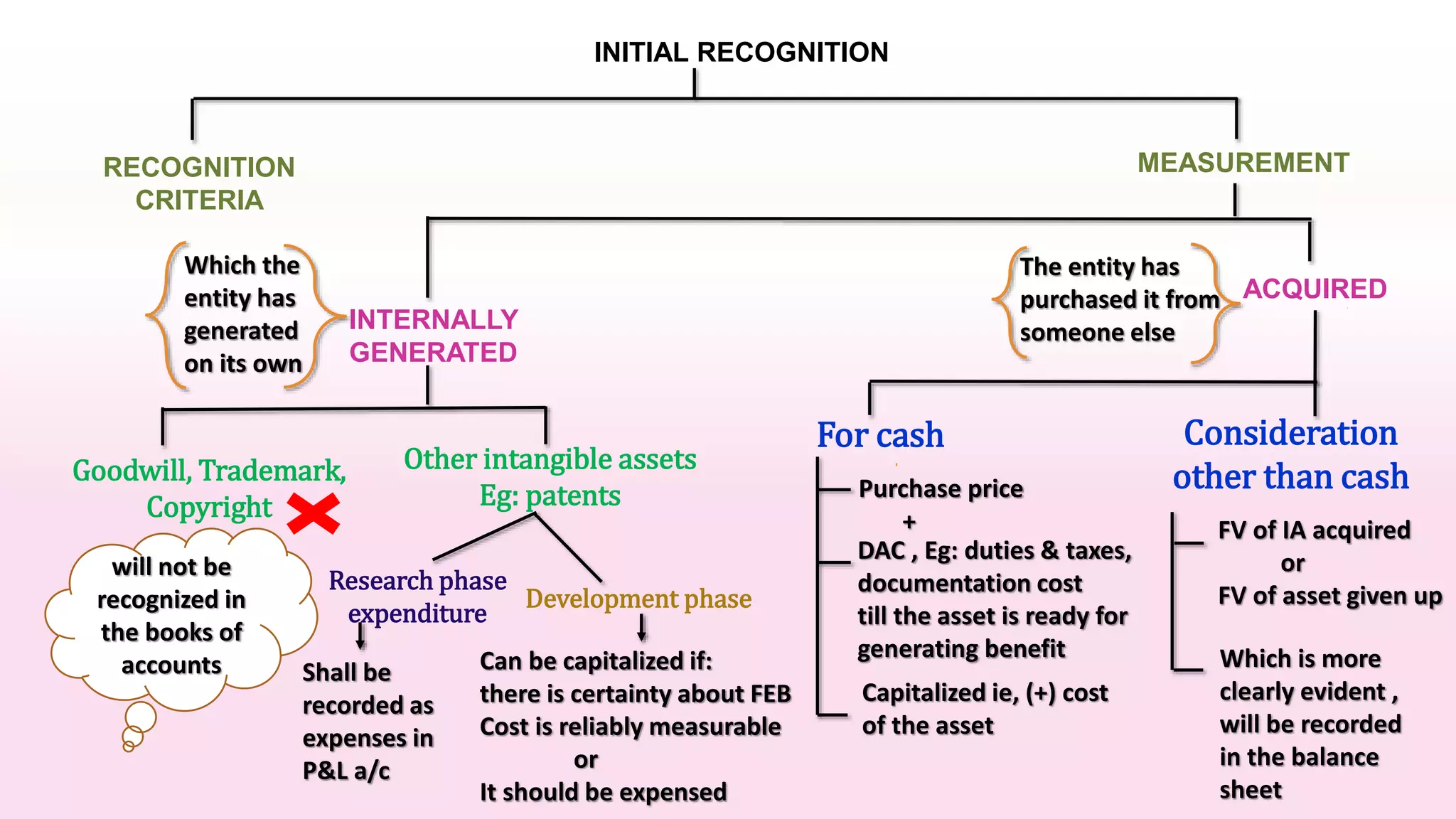

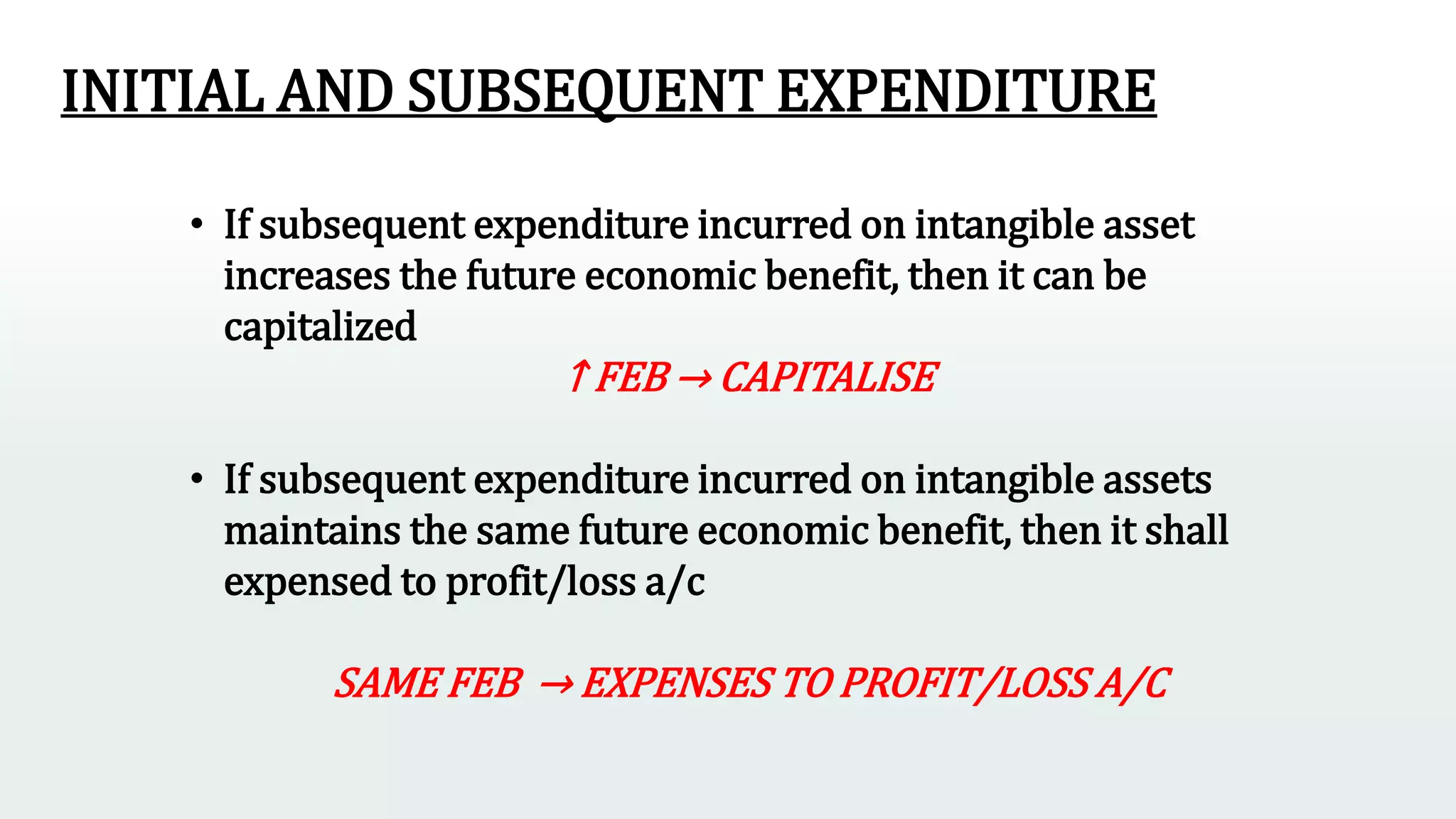

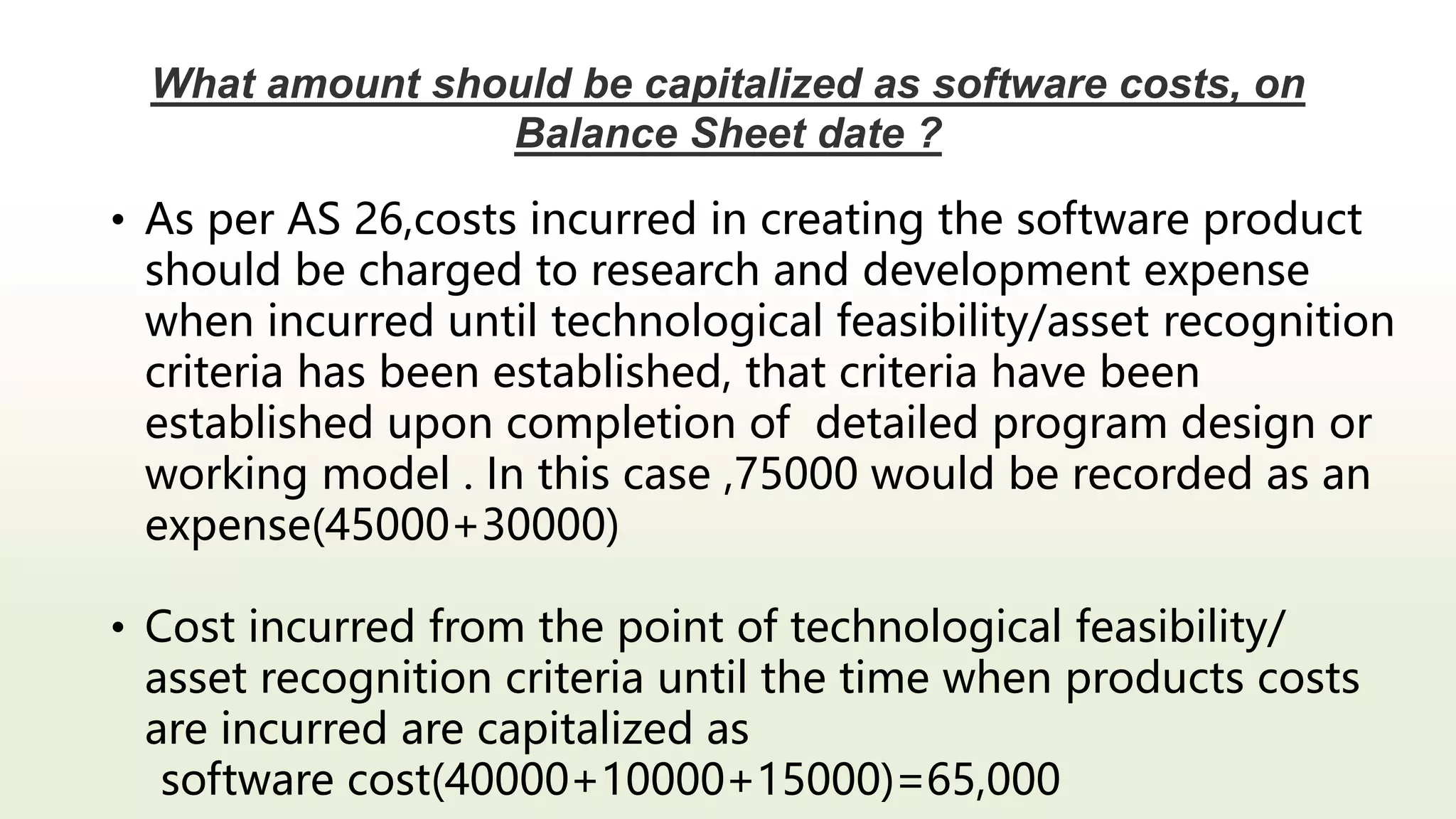

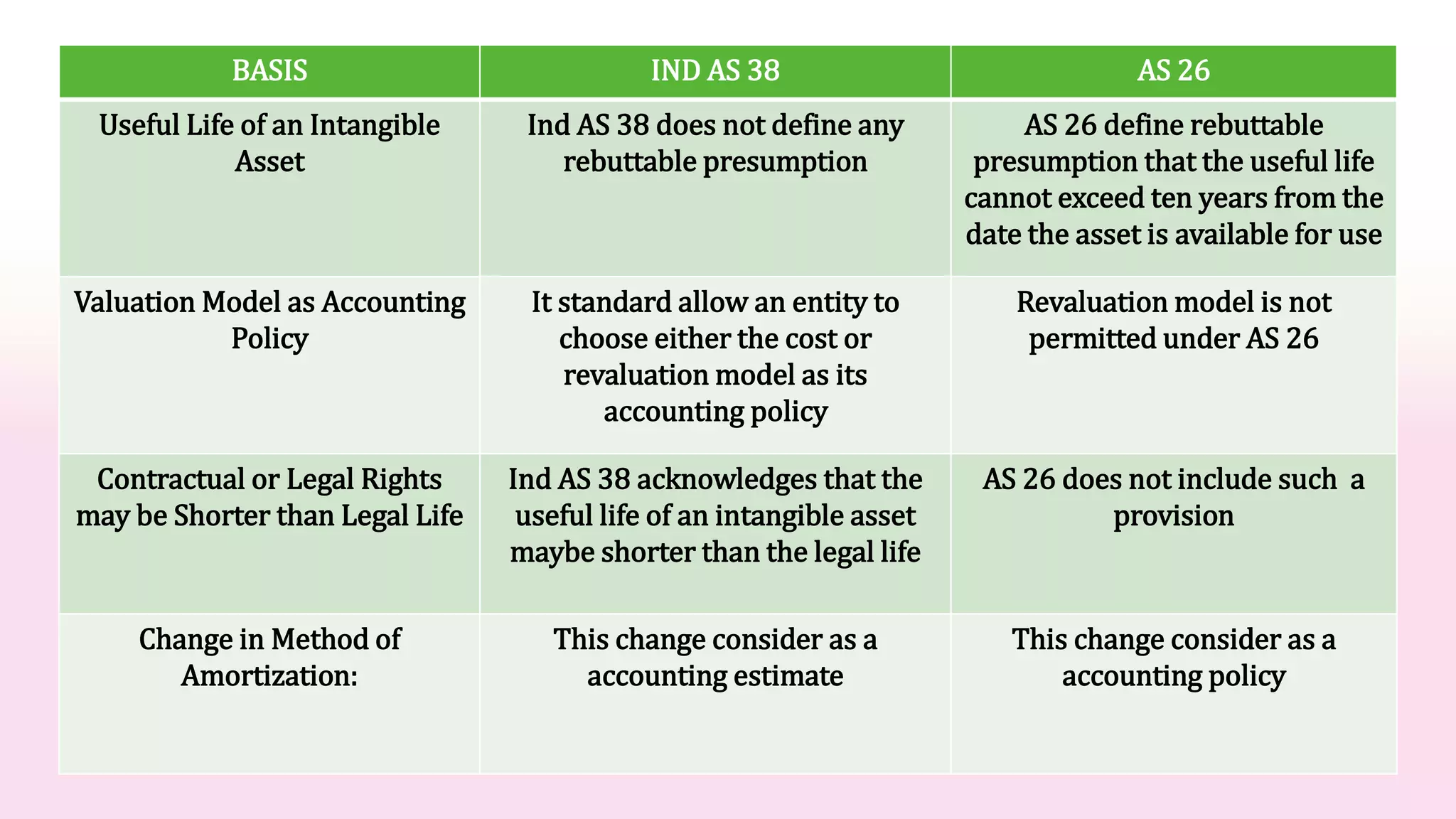

This document defines intangible assets and provides guidance on their recognition, measurement, amortization and disclosure. Key points include: intangible assets lack physical substance but provide future economic benefits; recognition criteria are future benefits are probable and cost reliably measured; measurement depends on whether asset is internally generated or acquired; amortization period generally does not exceed 10 years; expenditures that maintain asset value are expensed while those that increase benefits are capitalized. Significant differences between Ind AS 38 and AS 26 are also outlined.