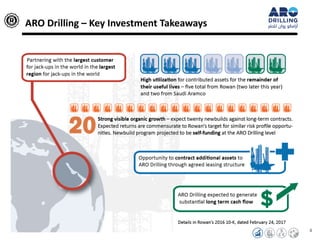

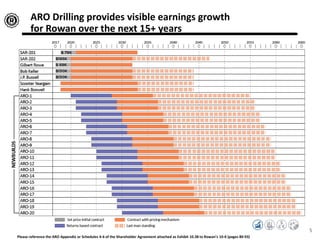

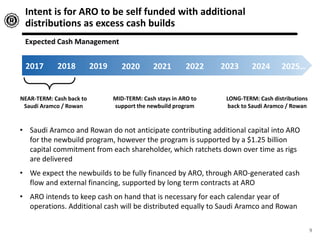

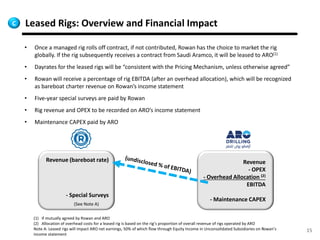

ARO Drilling is a 50/50 joint venture between Rowan Companies and Saudi Aramco that owns and operates jack-up drilling rigs in Saudi Arabia. Over the next decade, ARO is expected to construct 20 new rigs supported by long-term contracts. ARO operates independently with dedicated management and its financial results impact Rowan through equity income. The venture provides visible earnings growth for Rowan through contributions, management fees, leases, and construction of new rigs over 15+ years.

![18

In Summary: Rowan and ARO Financials

(1) KSA Shorebase costs previously borne by Rowan will now be paid by ARO

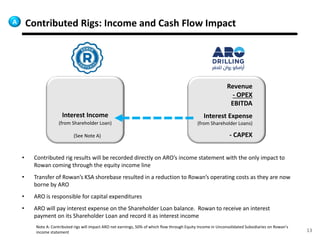

Revenue

▪ Managed Rigs

▪ Leased Rigs Bareboat Fee

▪ Transition Services Fee

▪ Contributed Rigs

▪ Management Fee

▪ Leased Rigs

▪ Newbuilds

OPEX

▪ Managed Rigs

▪ Management Fee

▪ [Interest Income on Shareholder Loan]

▪ Contributed Rigs

▪ Leased Rigs

▪ KSA Shorebase(1)

▪ Transition Services Fee

▪ Newbuilds

▪ Interest Expense on Shareholder Loan

50% of ARO net earnings flow through Equity Income in Unconsolidated Subsidiaries on Rowan’s income statement

CAPEX

▪ Managed Rigs

▪ Leased Rigs Special Survey

▪ Contributed Rigs

▪ Leased Rigs Maintenance Capex

▪ Newbuilds](https://image.slidesharecdn.com/arodrillingforwebsite-180409164401/85/Aro-drilling-for-website-18-320.jpg)