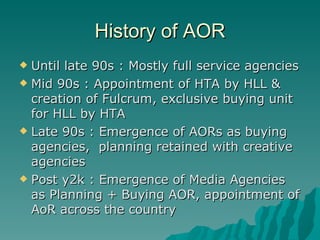

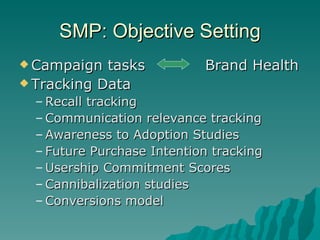

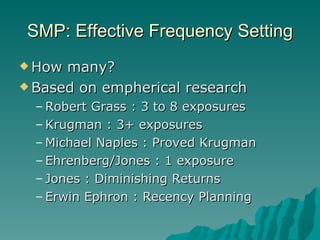

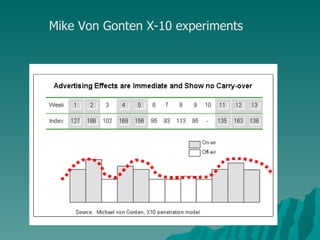

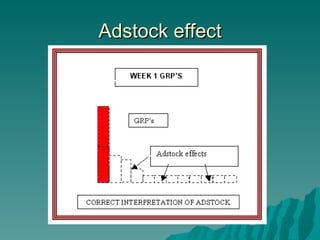

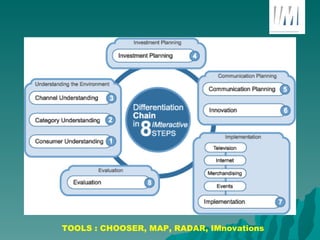

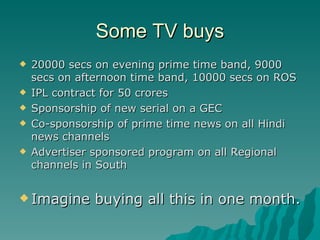

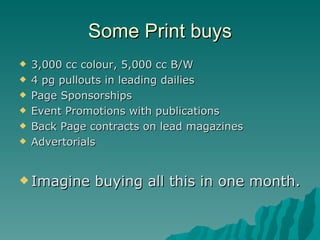

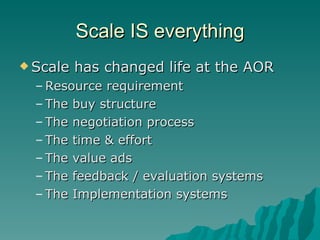

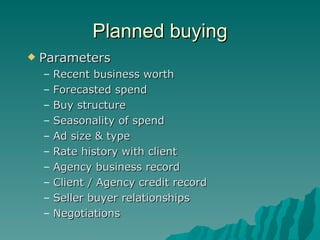

The document discusses the history and evolution of media agencies and appointment of advertising agencies of record (AORs) in India. It covers key aspects of strategic media planning conducted by AORs such as consumer insights, objective setting, effective frequency setting, and various tools and models used. The roles and challenges of AORs in large media planning and buys are also summarized.