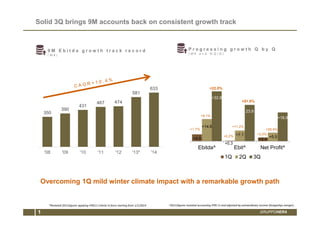

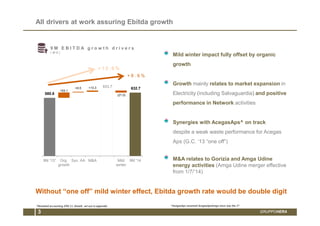

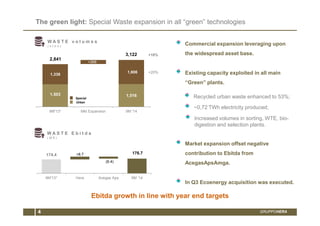

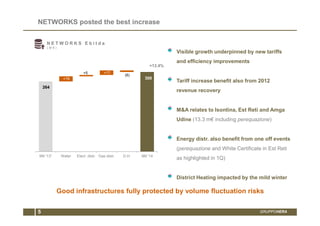

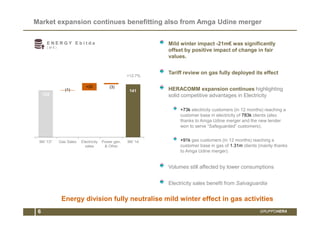

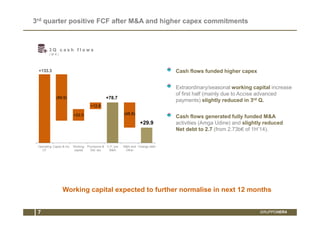

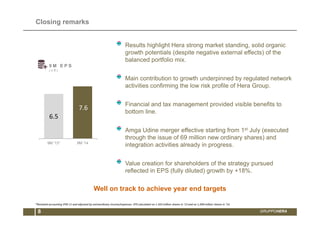

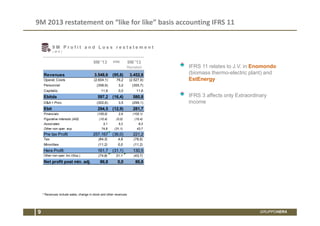

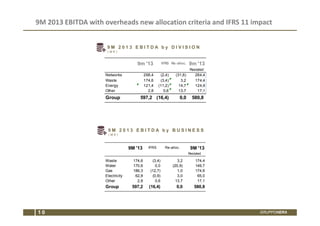

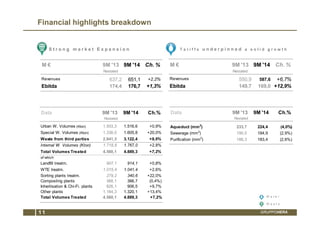

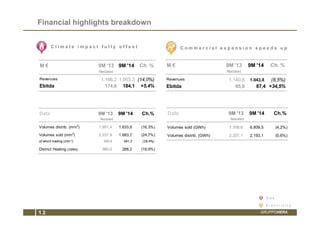

The document summarizes the 9-month financial results of Gruppo Hera. It reports that the company achieved outstanding results for the period, with EBITDA growth of 8.9% driven by organic growth, synergies from acquisitions, and market expansion offsetting the impact of mild winter weather. Net profit grew 31.1% despite the winter impact, with all business divisions contributing positively to results.