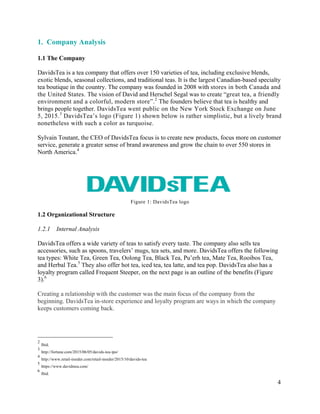

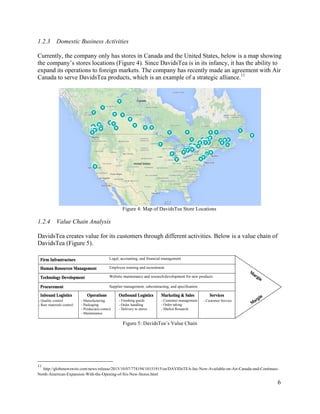

This document provides an international marketing plan for DavidsTea to expand into foreign markets. It begins with an analysis of DavidsTea as a company, including its products, financial information, operations, and value chain. It then discusses the tea industry and DavidsTea's main competitor, Teavana. The document selects potential countries for expansion based on criteria like tea consumption, income, population size, and ease of doing business. It analyzes the selected countries of UK, Japan, and Russia. Finally, it provides a marketing plan with recommendations on market entry mode, marketing mix, segmentation, targeting, positioning, and conclusion.