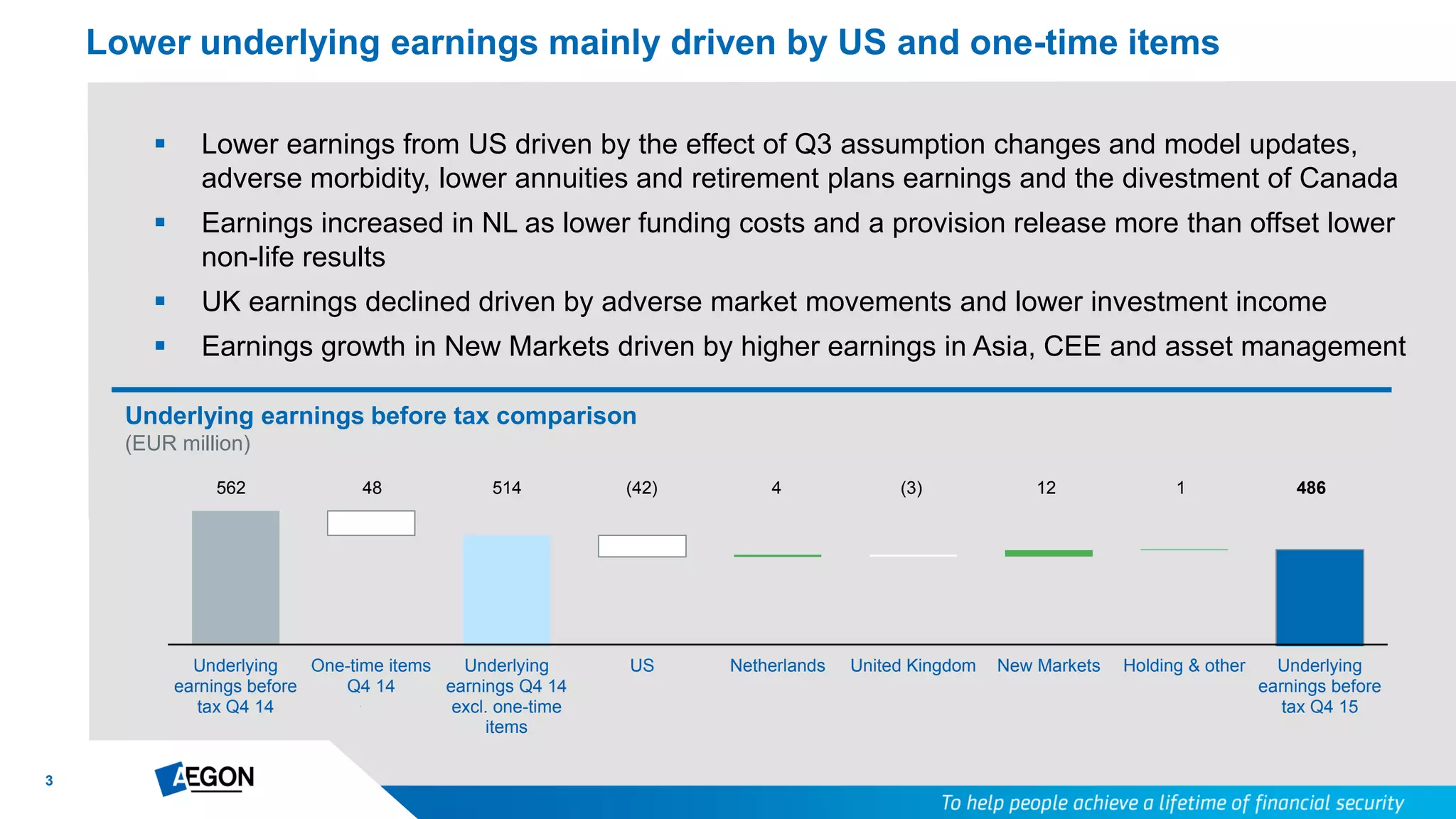

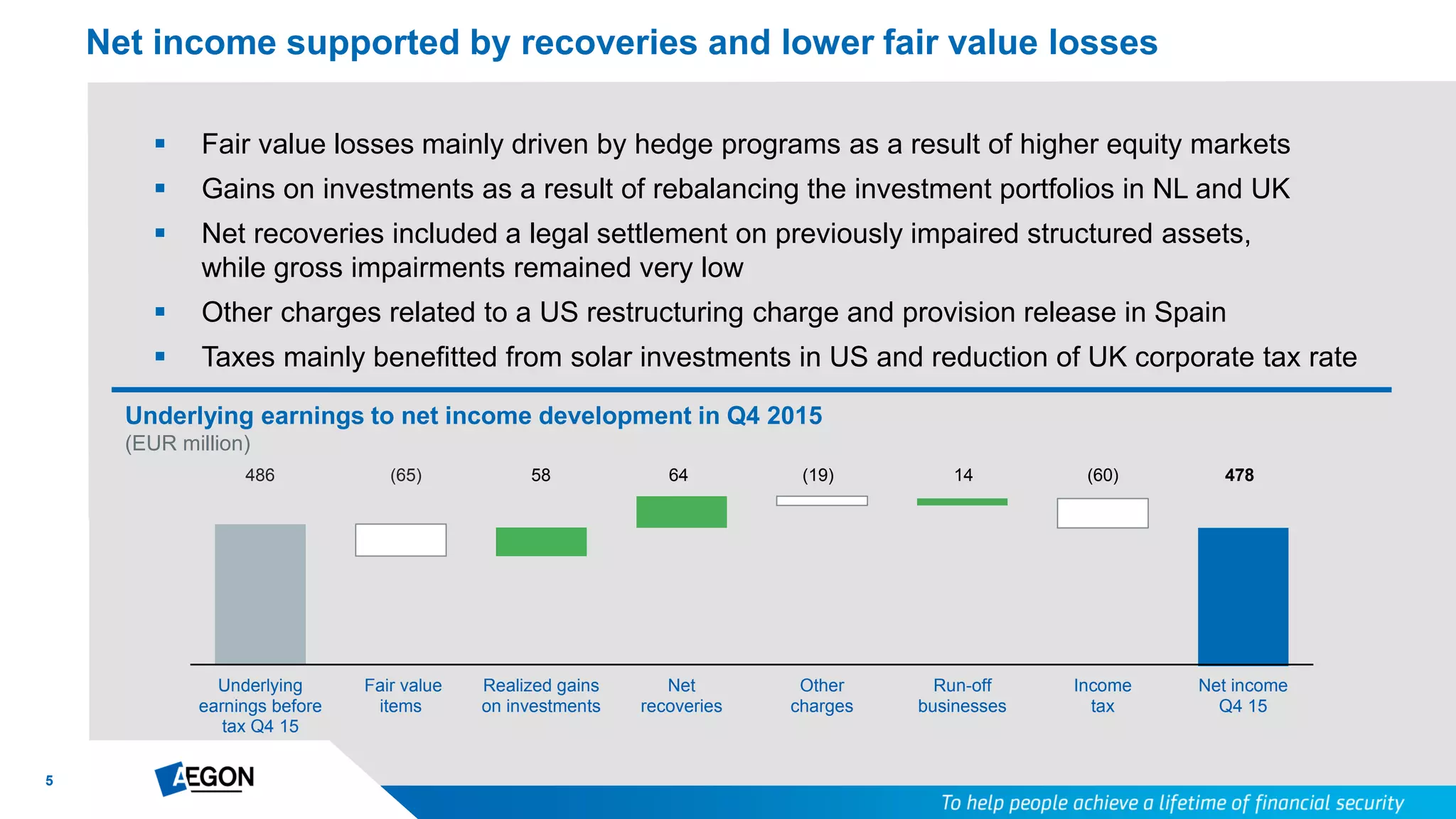

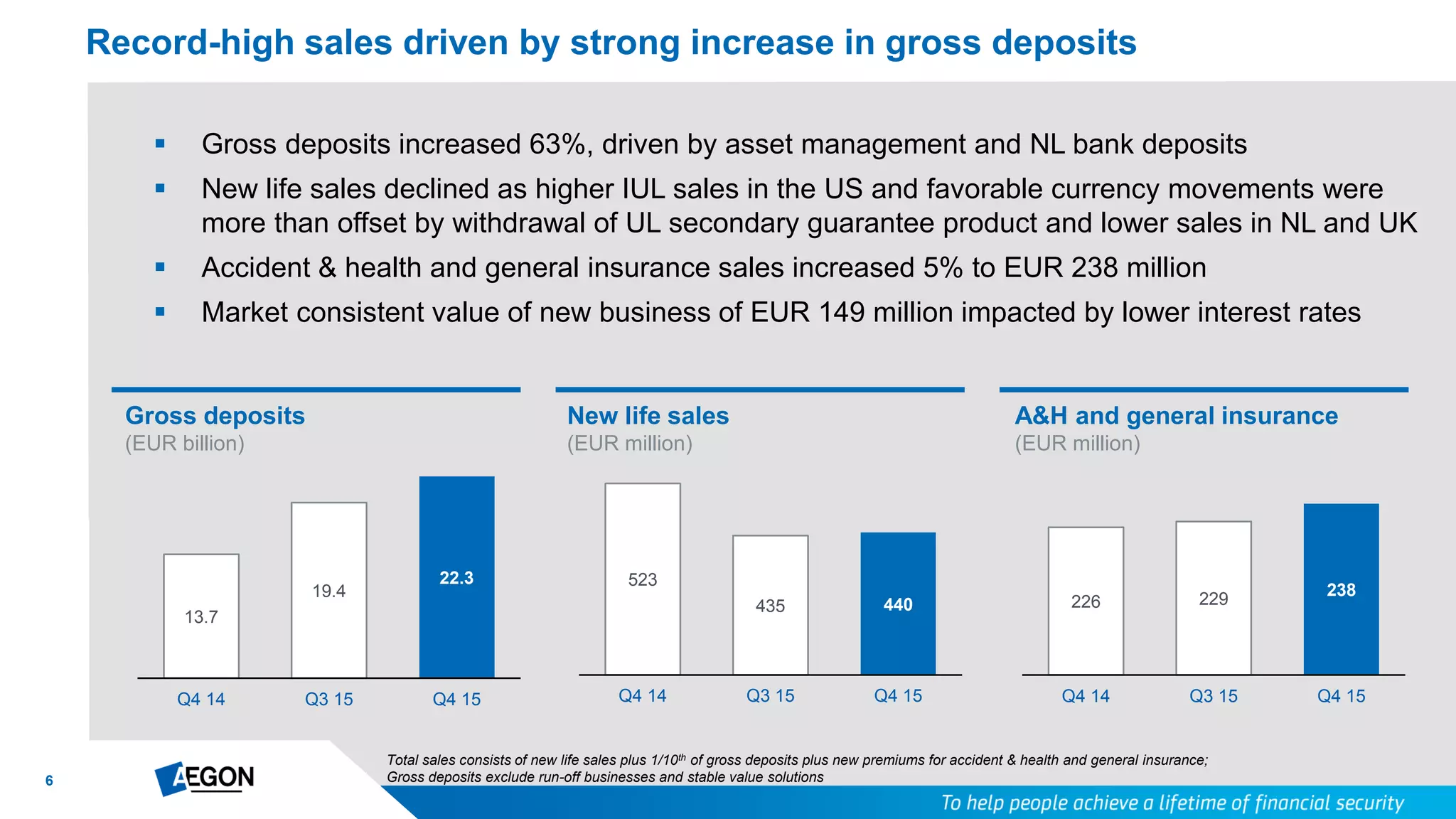

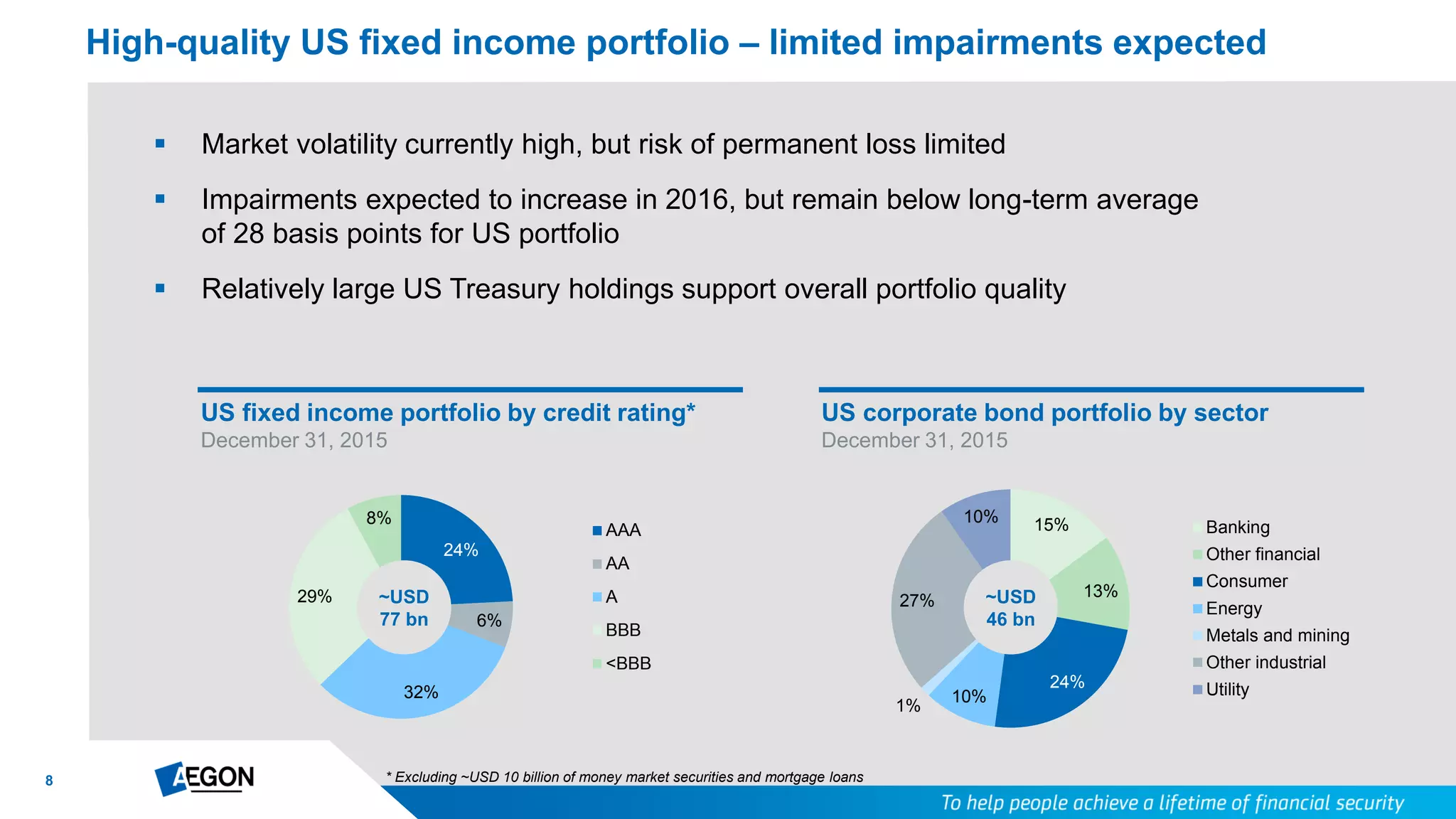

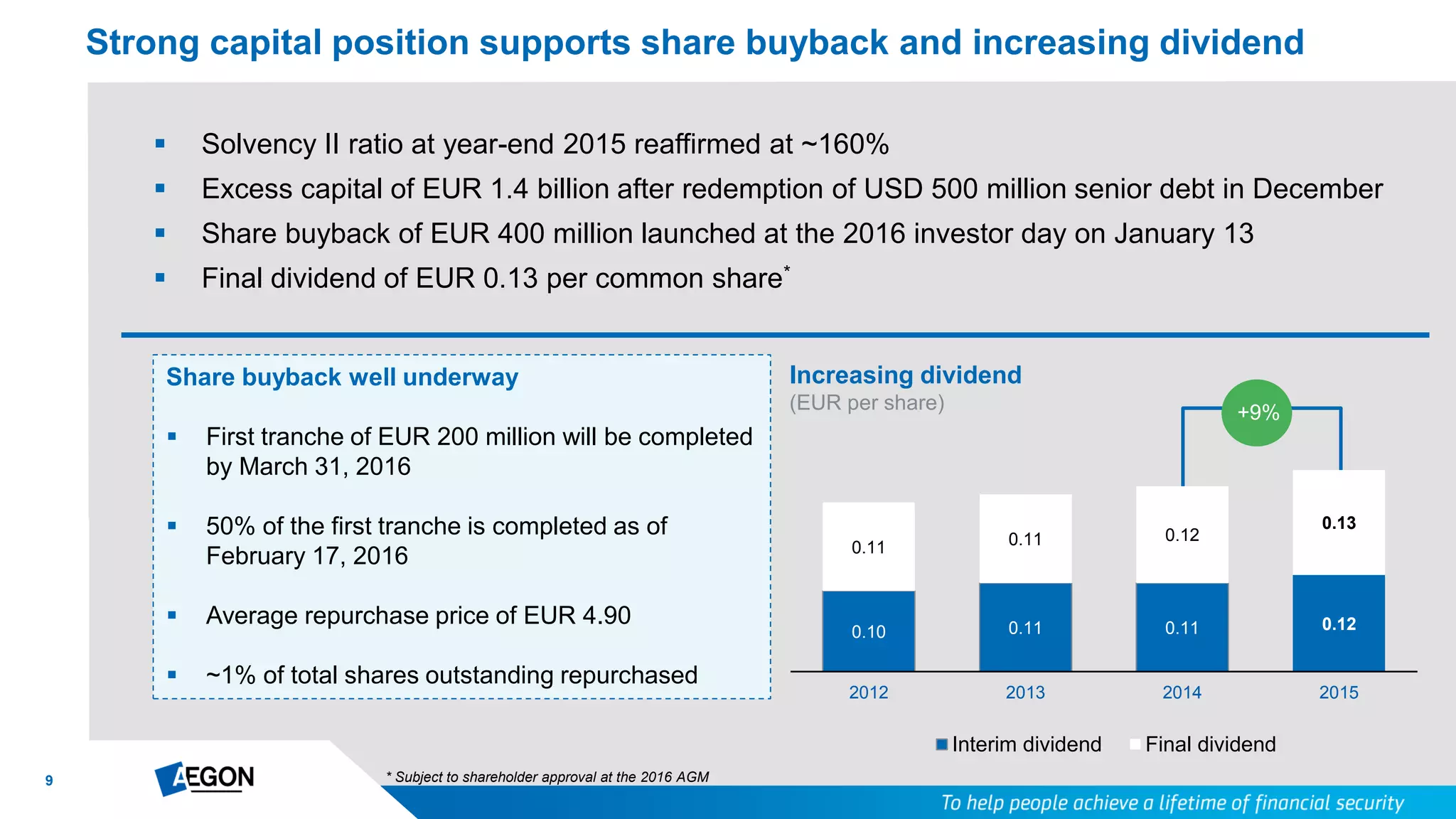

Aegon's Q4 2015 results showed a net income increase to €478 million, despite underlying earnings being affected by lower U.S. earnings and one-time items. The company reported record-high sales driven by strong growth in fee-based deposit businesses and reaffirmed a Solvency II ratio of about 160%. Additionally, a €400 million share buyback program is on track, and a final dividend of €0.13 per share has been declared.