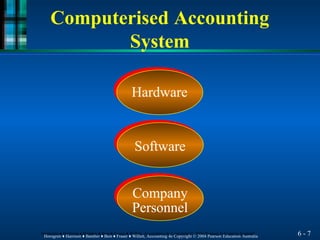

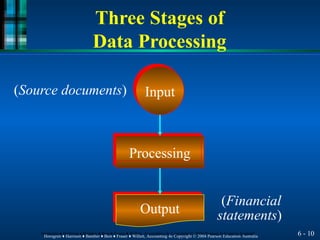

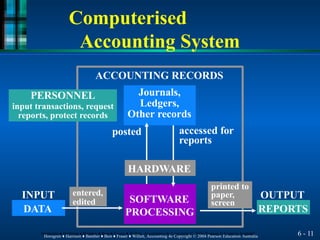

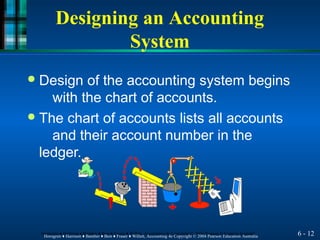

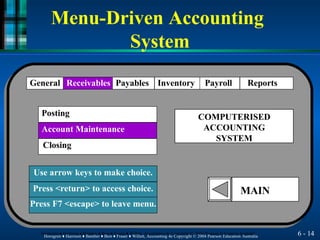

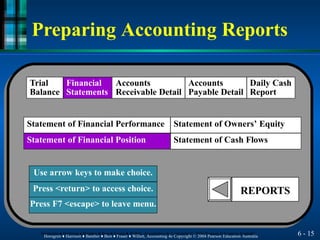

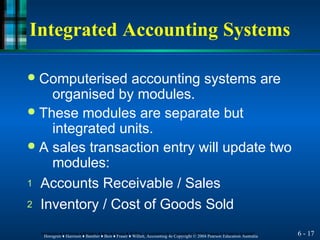

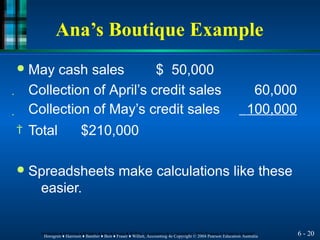

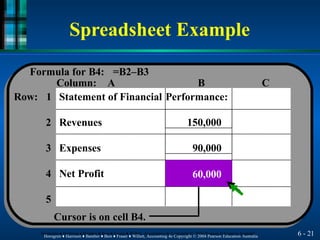

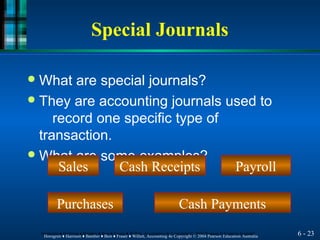

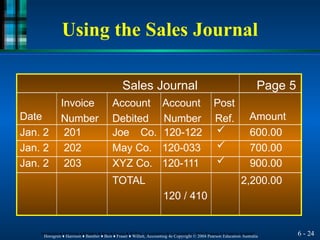

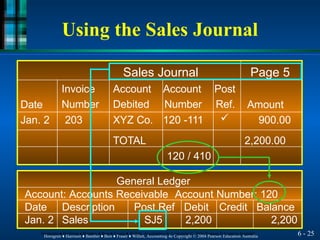

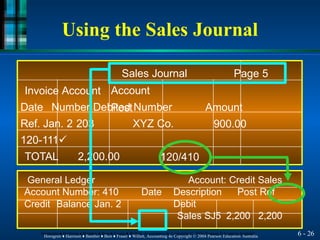

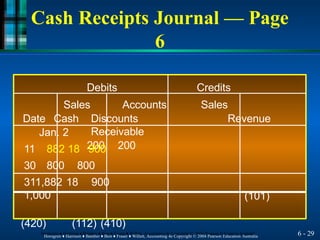

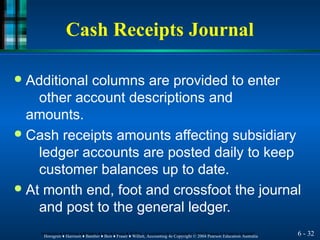

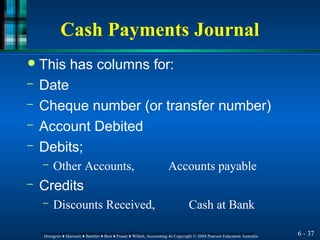

Chapter 6 of the accounting information systems discusses the features of an effective accounting information system, including internal controls, flexibility, and a favorable cost/benefit relationship. It explains both computerized and manual accounting systems, highlighting the use of journals and spreadsheets to manage financial transactions. Additionally, it provides insights on the design of accounting systems, the roles of various ledgers, and the processes for creating accurate financial reports.