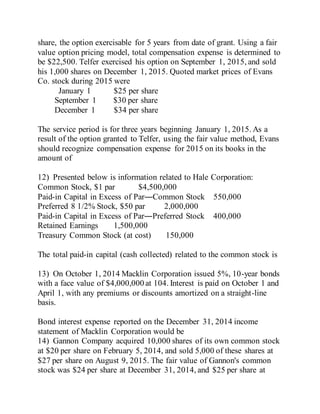

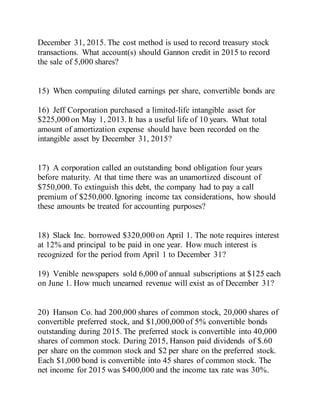

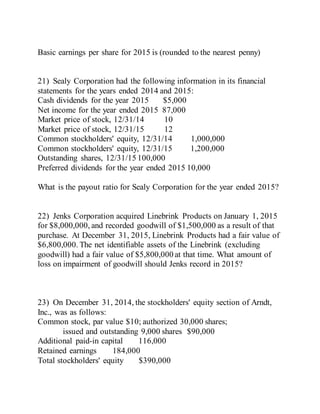

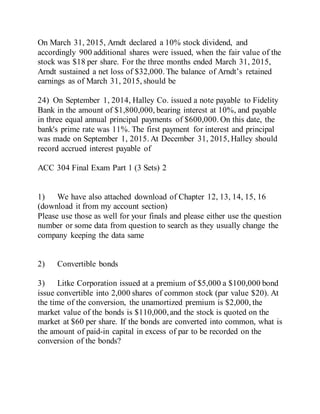

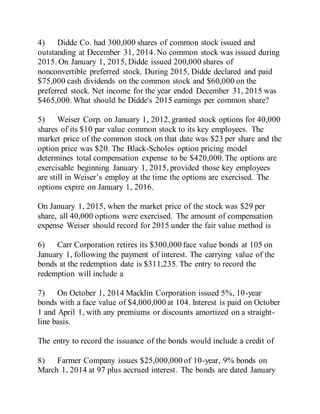

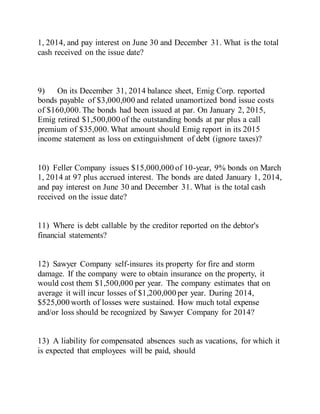

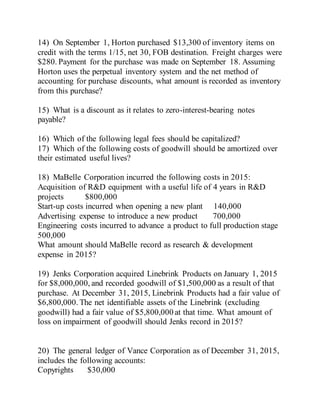

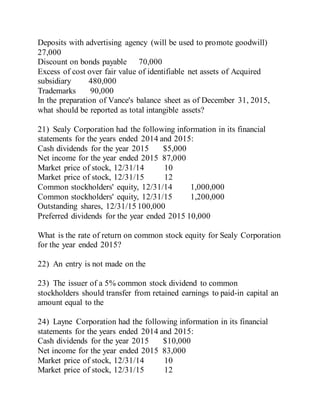

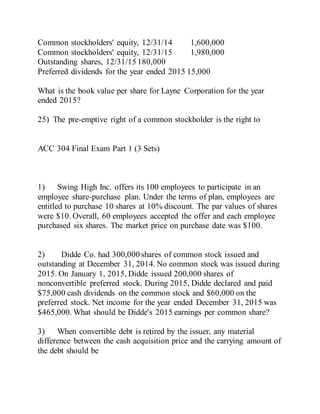

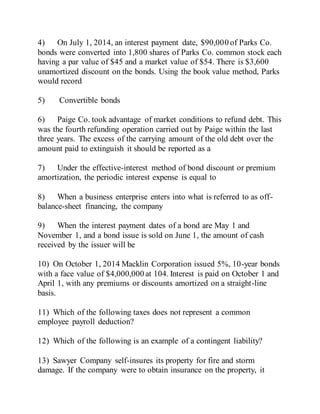

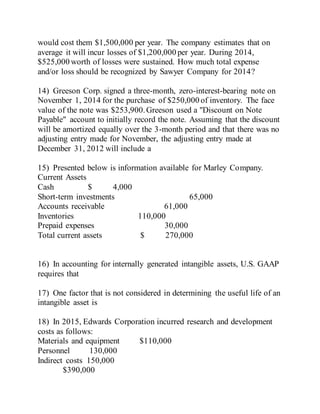

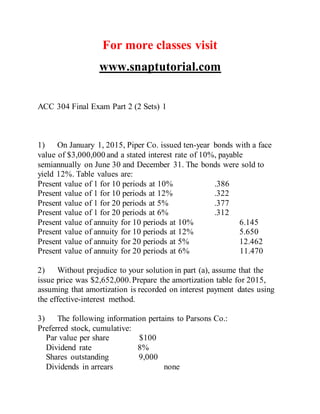

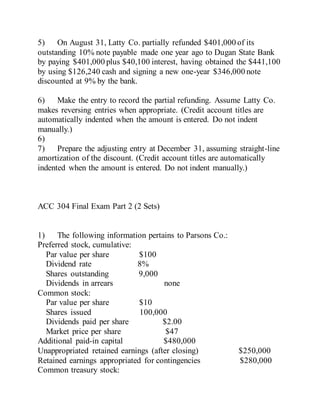

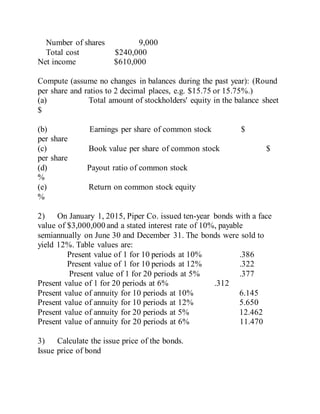

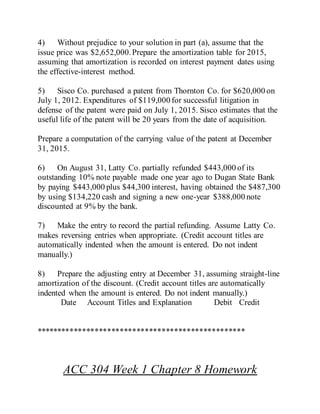

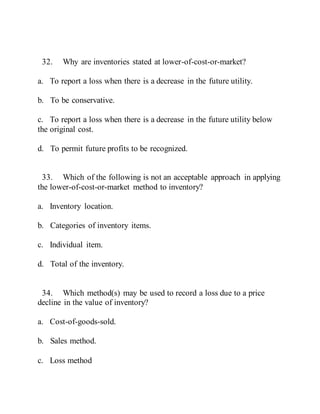

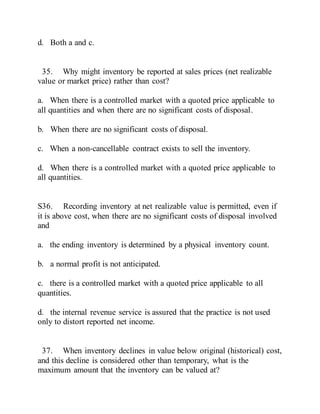

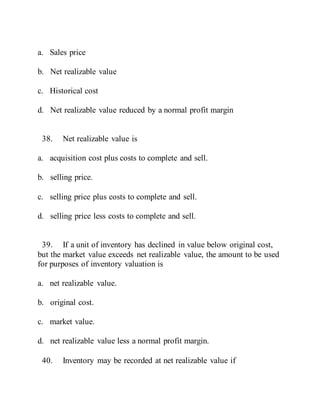

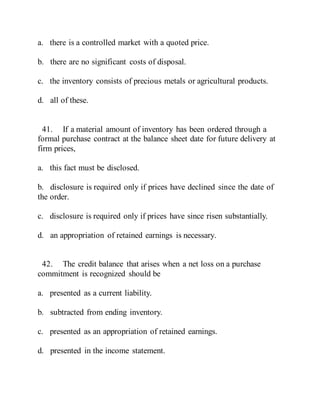

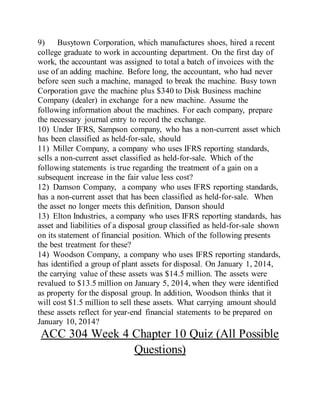

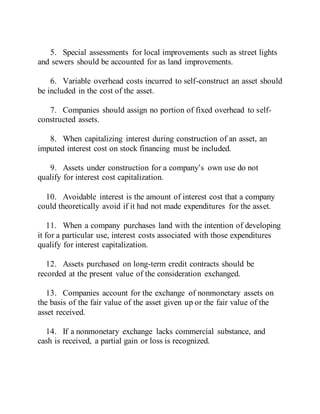

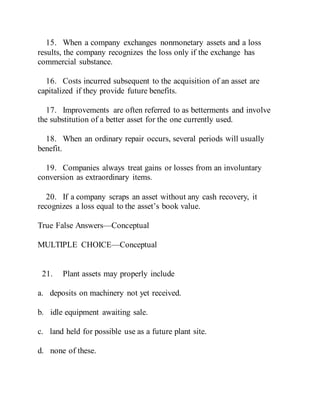

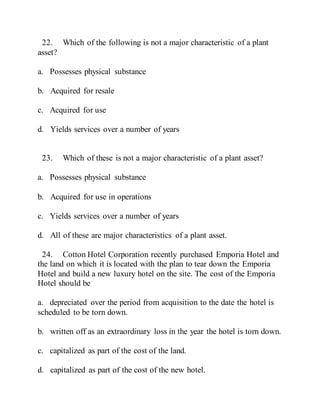

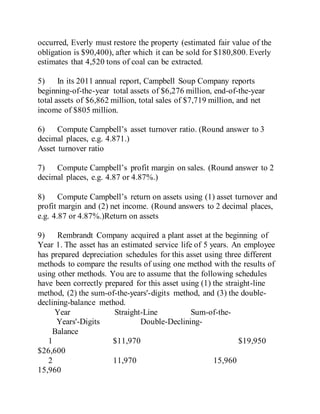

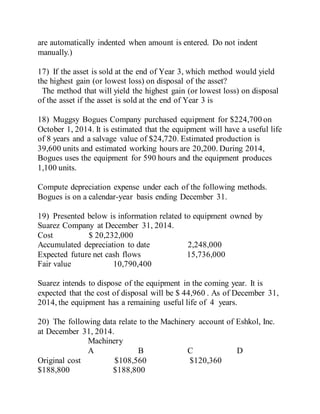

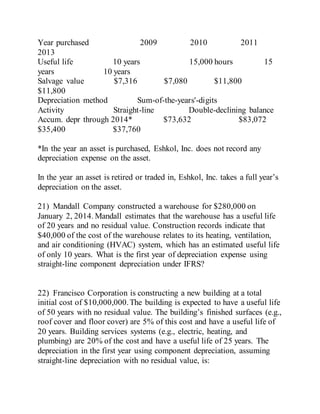

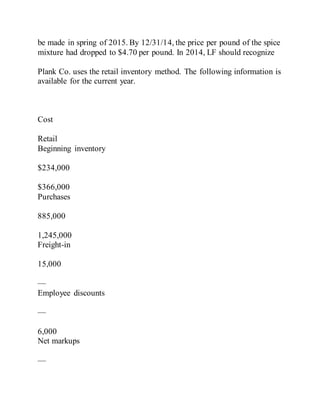

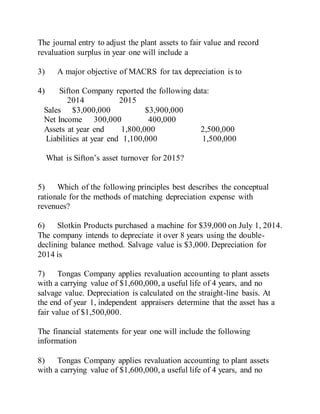

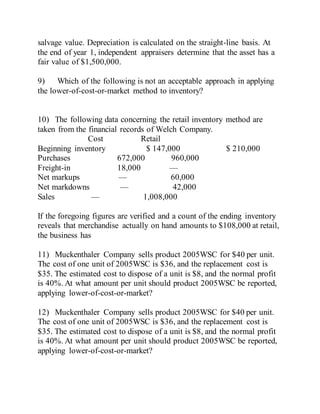

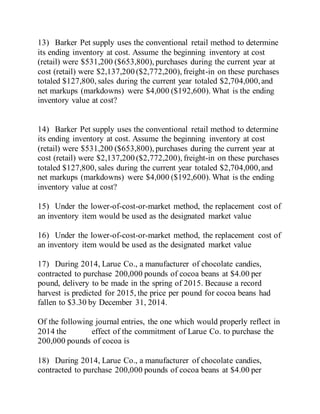

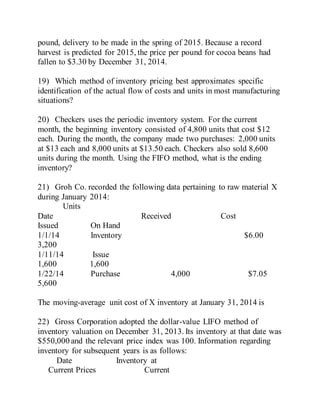

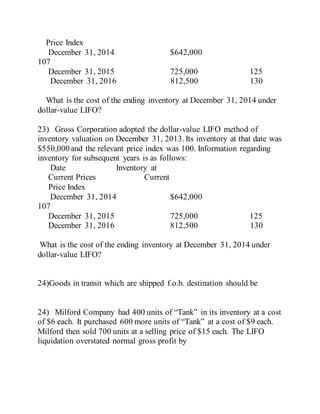

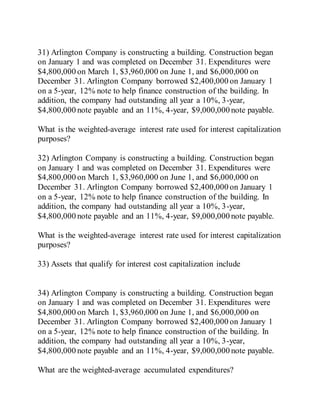

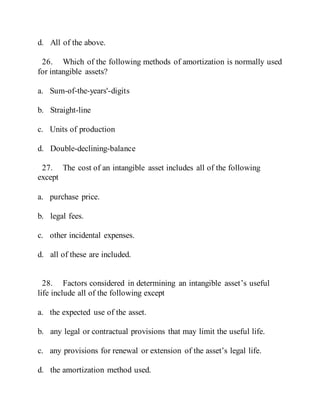

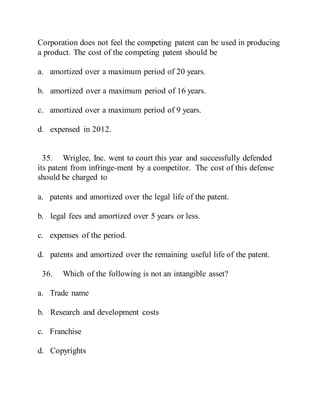

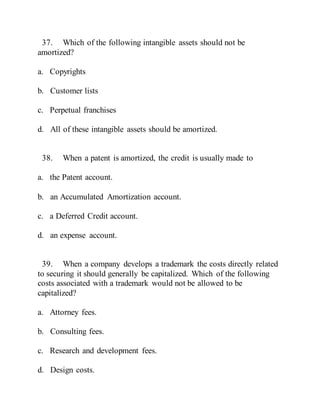

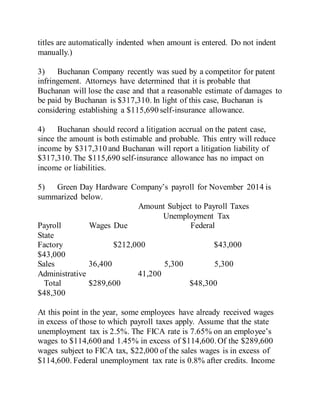

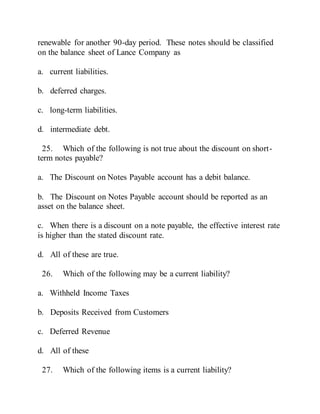

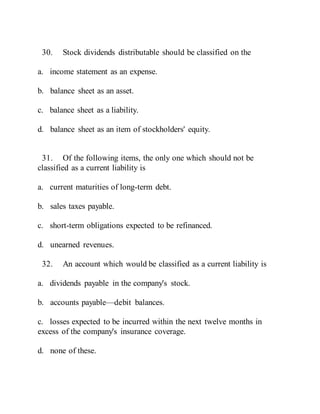

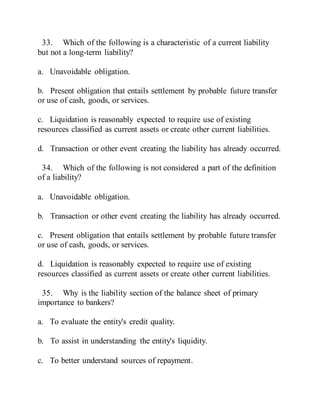

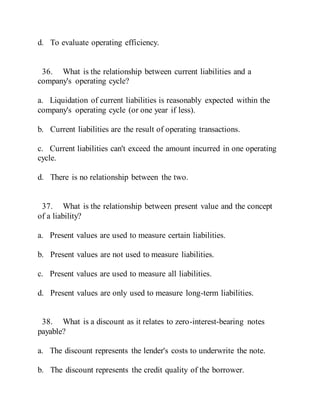

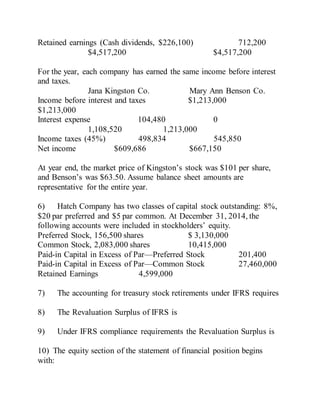

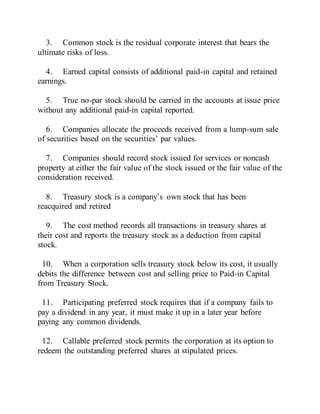

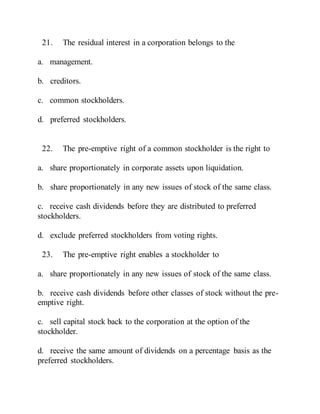

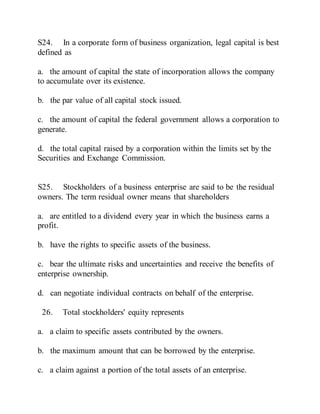

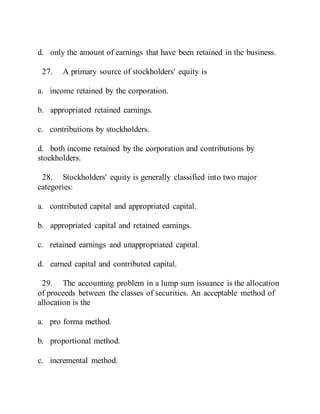

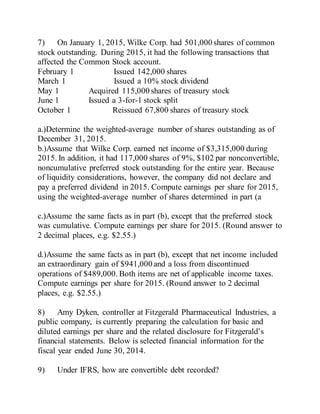

The document contains multiple sets of questions and problems related to accounting concepts, specifically covering employee compensation plans, bond issuance, payroll deductions, stock options, and financial statement analysis. Topics include amortization of intangible assets, equity transactions, convertible bonds, and calculations for earnings per share, among others. It appears to be a study guide or preparatory material for an accounting final exam.