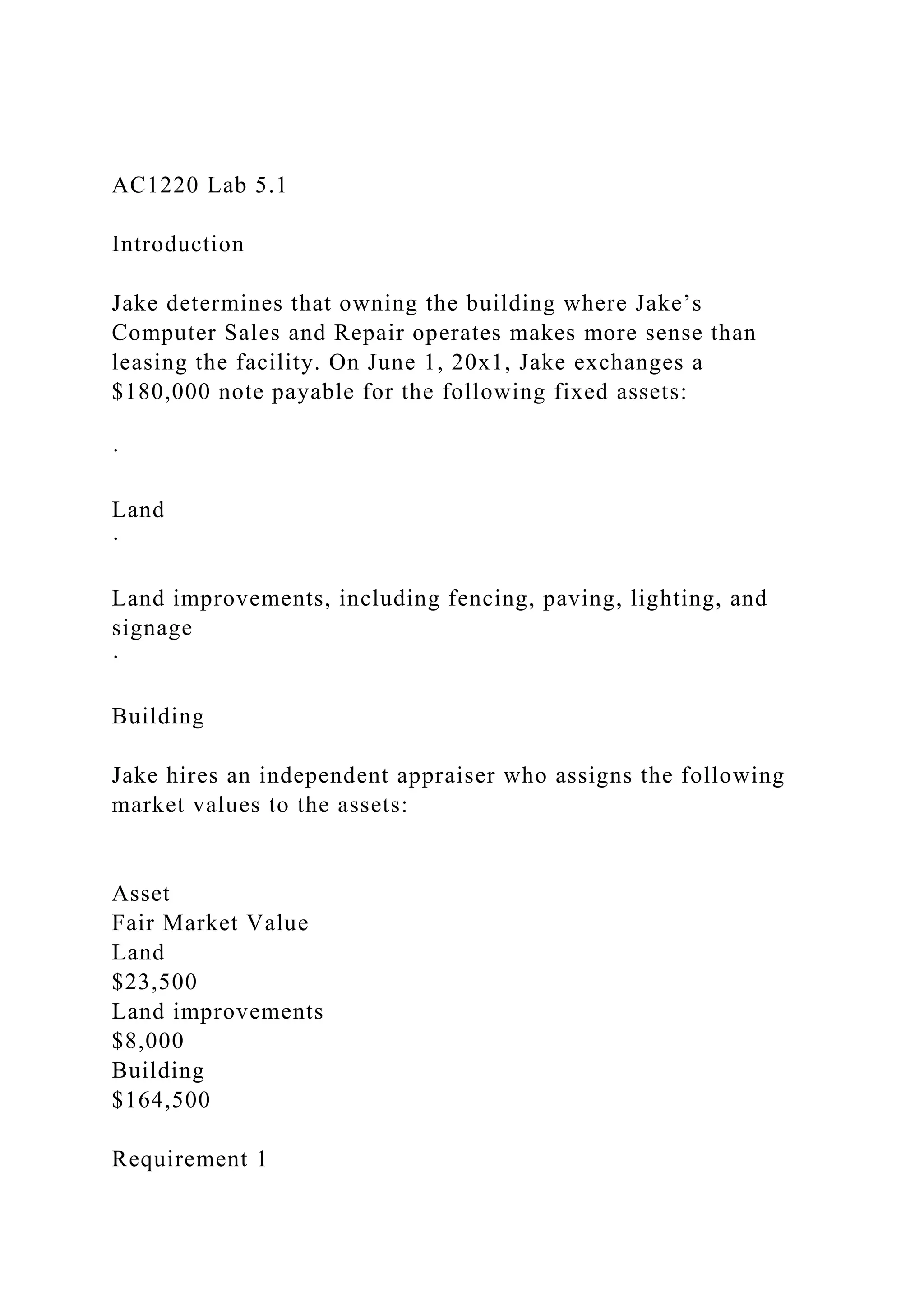

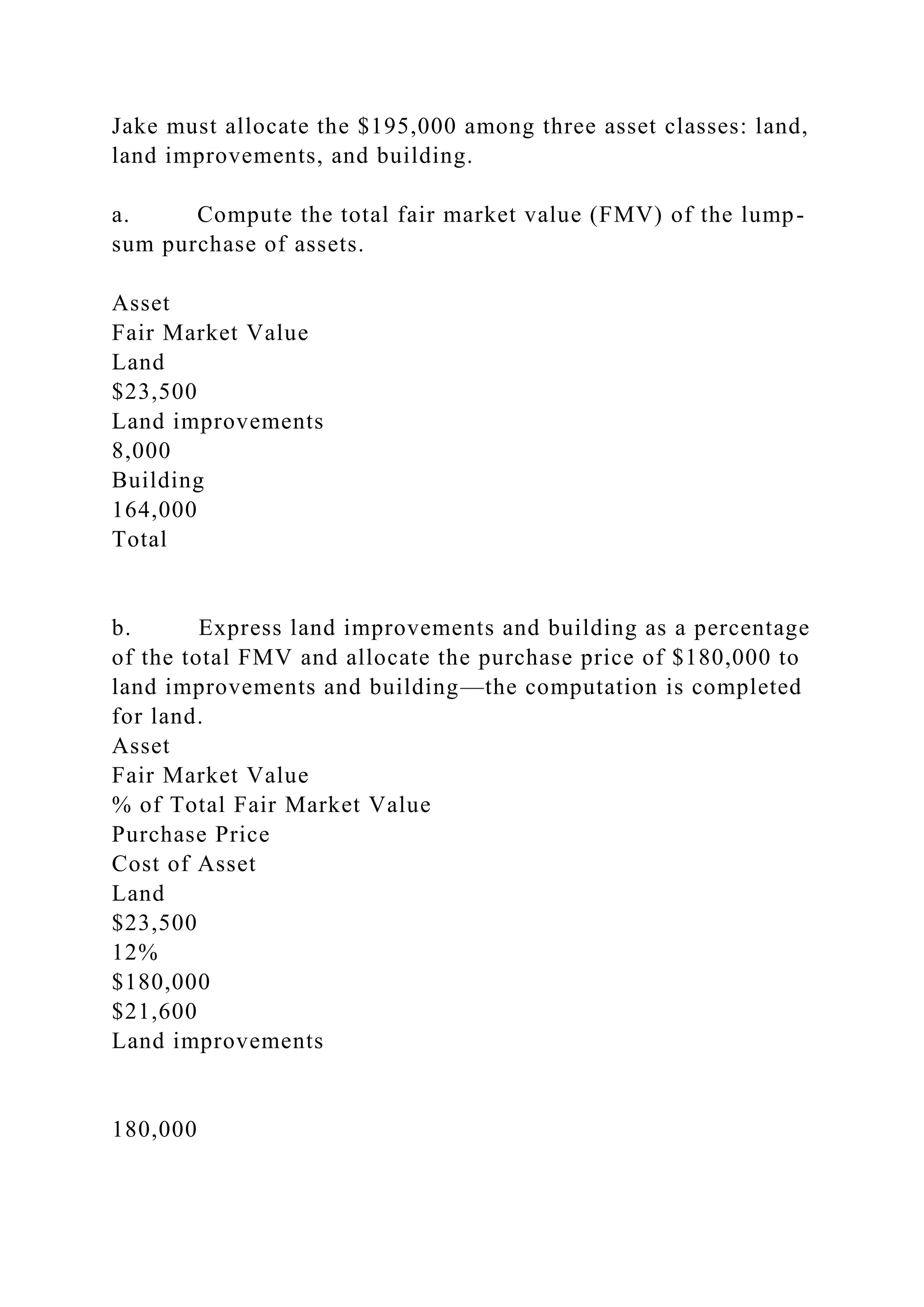

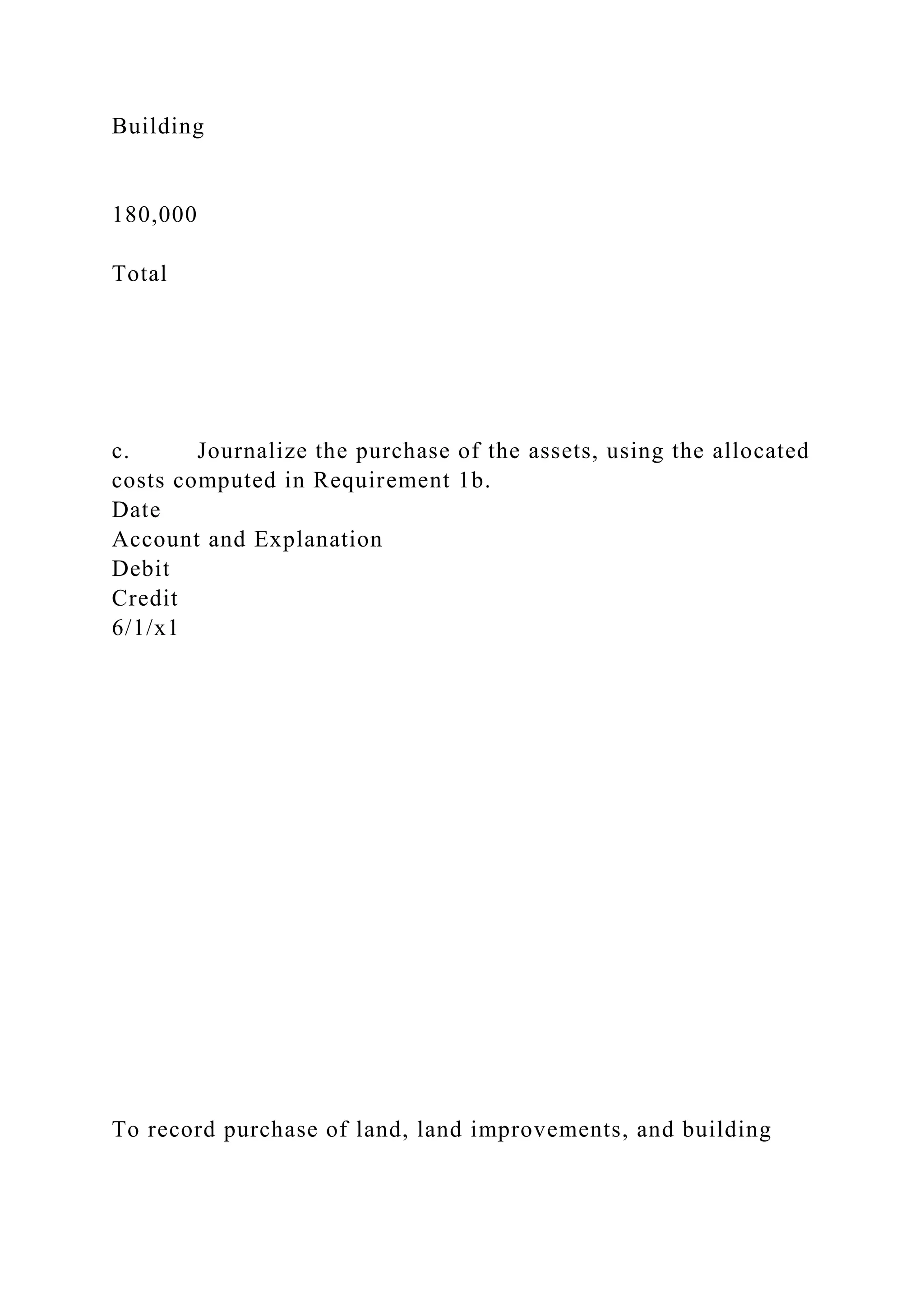

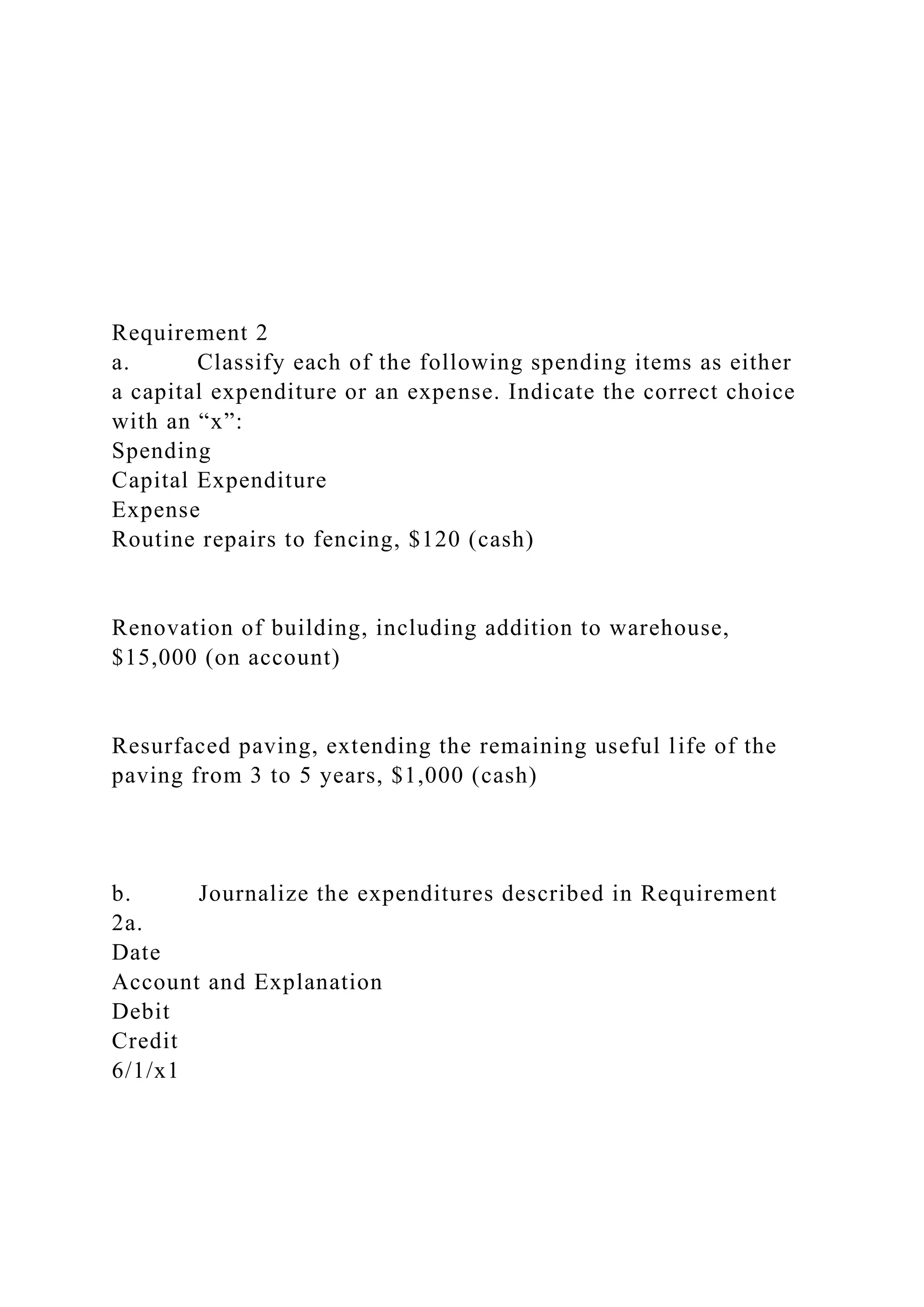

Jake decides to purchase a building and related fixed assets for his computer sales and repair business instead of leasing, exchanging a $180,000 note for land, improvements, and a building. The document details the asset valuations, allocation of purchase price, and calculation of depreciation using different methods, as well as the journal entries for these transactions. Additionally, it discusses the acquisition and amortization of an intangible asset, a license for selling a specific product.