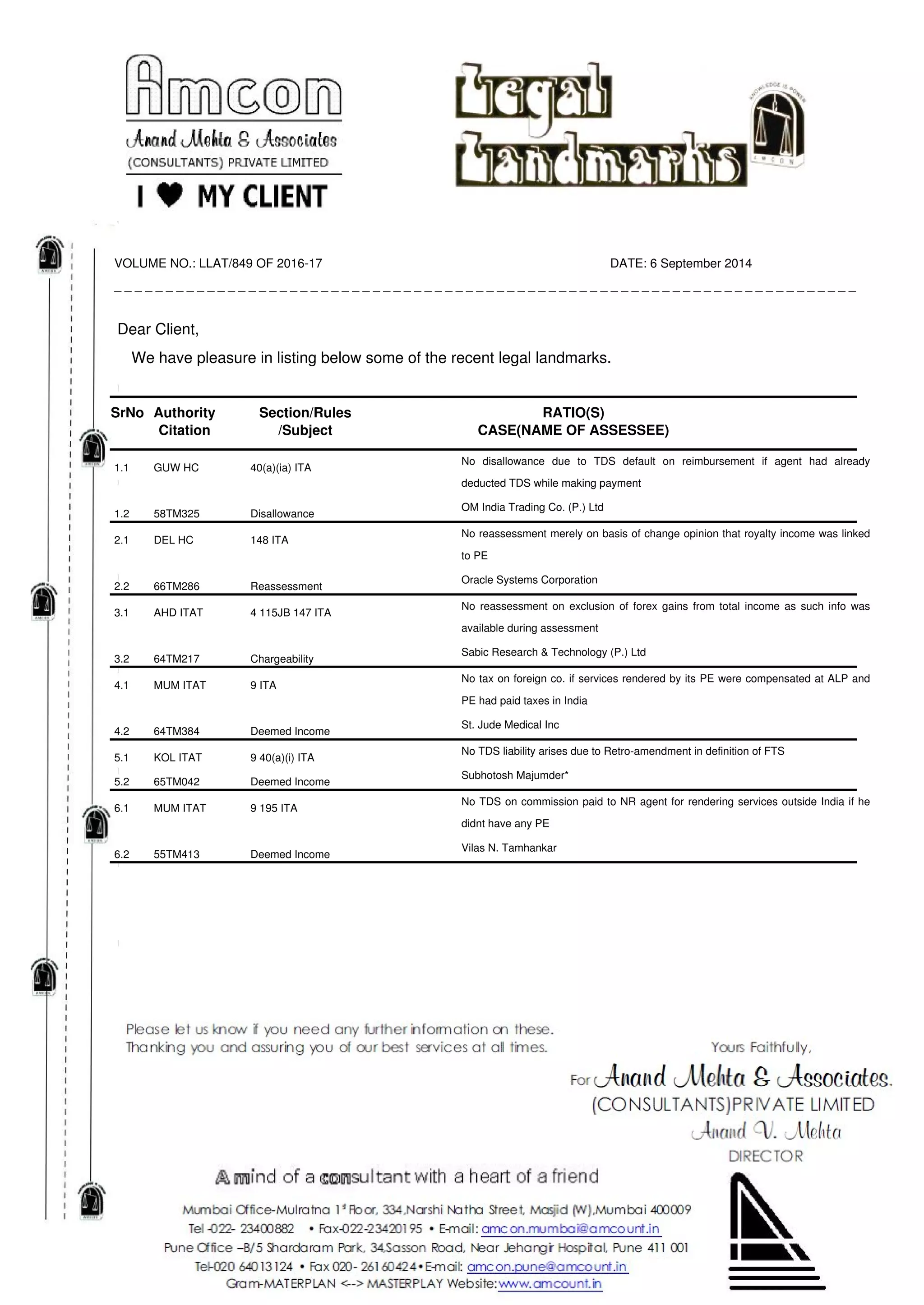

This document provides a summary of recent legal landmarks in Indian tax law. It lists 6 cases from various High Courts and the Income Tax Appellate Tribunal. The cases addressed issues such as disallowance of expenses due to TDS default, reassessment of income, tax chargeability, deemed income, and tax deductibility at source for payments made abroad. The document identifies the authority, section/rules of the Income Tax Act involved, key ratio of each case, and citation details.