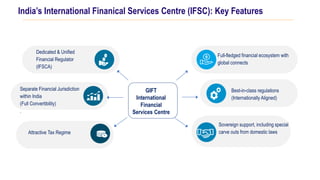

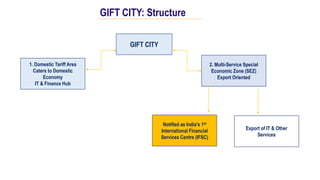

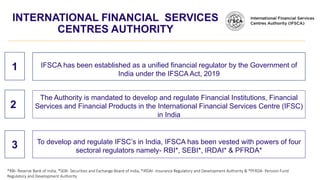

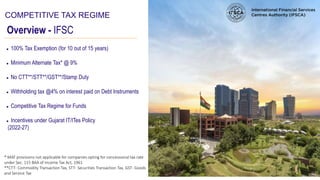

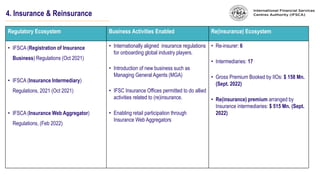

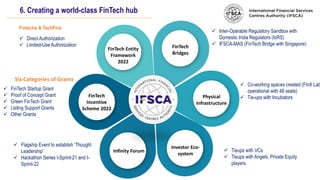

The GIFT International Financial Services Centre (IFSC) aims to develop as a global financial hub by providing attractive regulatory and tax incentives. Key features of GIFT IFSC include a dedicated financial regulator called IFSCA, a separate financial jurisdiction with full convertibility, and world-class regulations aligned with international standards. Major sectors being developed are banking, capital markets, funds, insurance, aircraft leasing, FinTech and professional services. Over time, GIFT IFSC has seen significant growth across sectors with increasing participation of global and domestic financial institutions and firms.