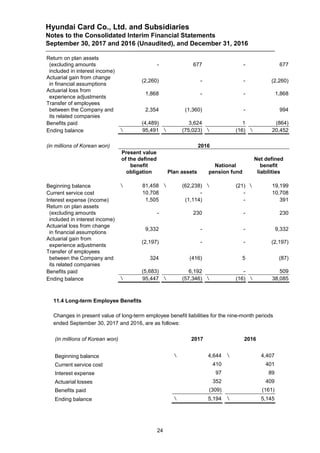

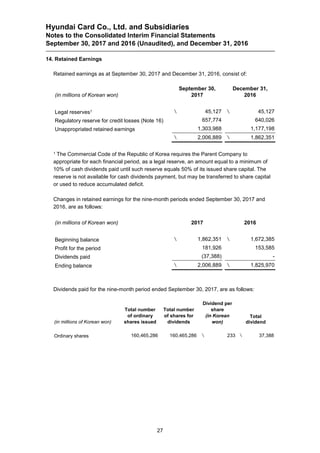

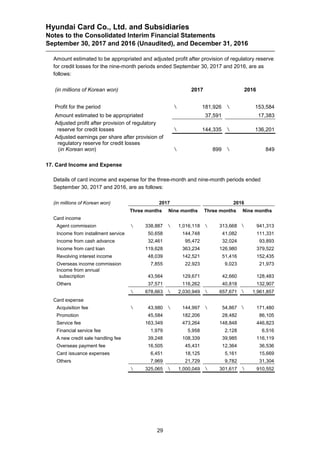

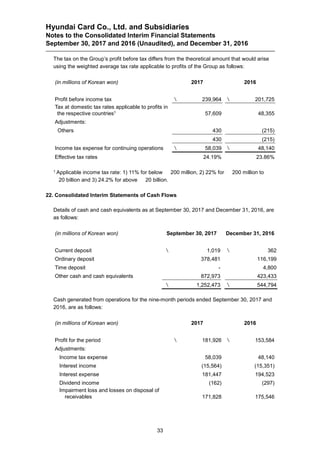

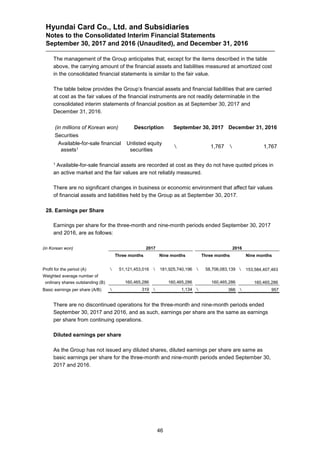

- The document is the consolidated interim financial statements of Hyundai Card Co., Ltd. and its subsidiaries for the period ending September 30, 2017.

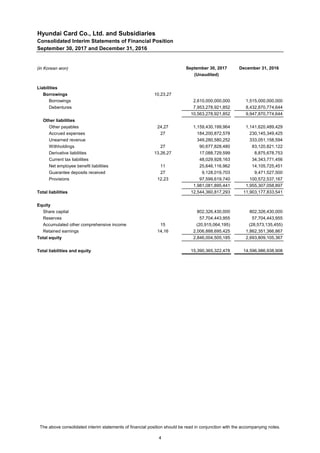

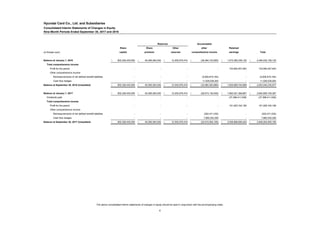

- It includes the consolidated statements of financial position, comprehensive income, changes in equity, and cash flows, as well as notes to the financial statements.

- The financial statements were reviewed by an external auditor, who concluded that the statements present fairly the financial position and performance of Hyundai Card for the interim period.