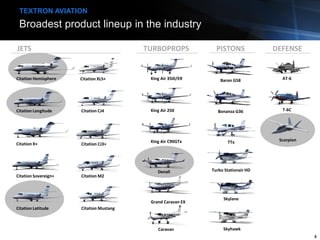

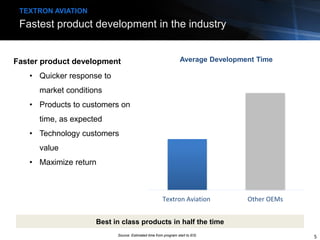

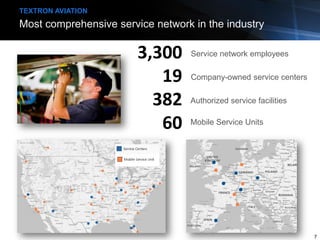

Scott Ernest presented at the 2016 Textron Aviation Analyst Meeting. Certain statements in the presentation were forward-looking and subject to risks and uncertainties outlined in SEC filings. The agenda covered an overview, accomplishments in 2016 including the first flight of the Citation Longitude and introduction of the Denali, the market outlook, product updates, defense programs, and operations. Textron Aviation is focusing investment on expanding into new aircraft segments like midsize and large jets with the Longitude and Hemisphere, and single engine turboprops with the Denali.